GBP/USD is looking relatively stable for a change, just like Prime Minister Theresa May that does not suffer a broad rebellion just yet. However, the currency pair faces more upside resistance than support.

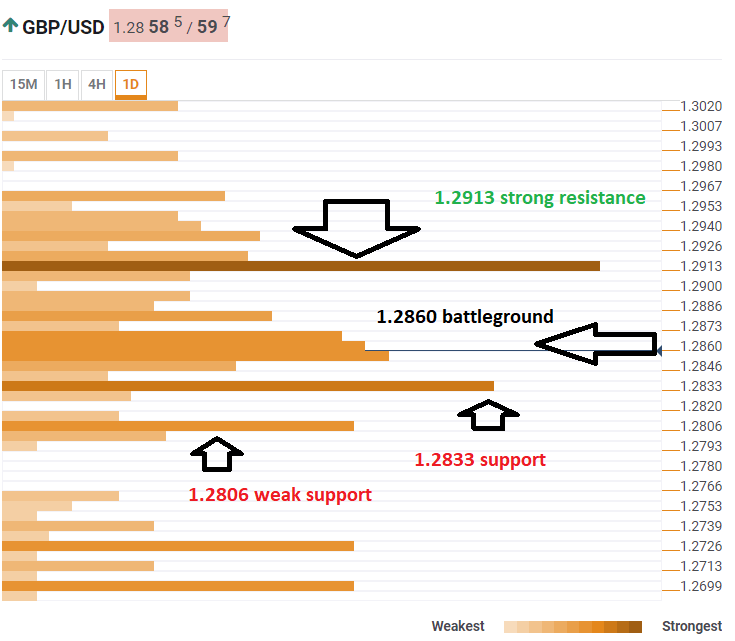

The Technical Confluences Indicator is currently struggling with a dense cluster of technical lines around 1.2860. This includes the Simple Moving average 100-15m, the SMA 10-15m, the SMA 10-1h, the Bollinger Band 15m-Middle, the Fibonacci 38.2% one-week, the Fibonacci 23.6% one-day, the Bollinger Band 15m-Upper, the SMA 5-4h, the Fibonacci 38.2% one-day, and the SMA 5-15m.

If cable emerges from this area, the next resistance line is quite close. At 1.2913 we see the Fibonacci 38.2% one-month, the Bollinger Band one-day-Middle, and the SMA 50-4h converge.

Looking down, 1.2833 is the meeting point of the Fibonacci 61.8% one-day, the Fibonacci 23.6% one-month, and the BB 1h-Lower.

The next support line is close, but weaker: at 1.2806 we note the Pivot Point one-day S1, and the Fibonacci 23.6% one-week.

All in all, the path of least resistance is to the downside.

This is how it looks on the tool:

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. This means that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Learn more about Technical Confluence

Get the 5 most predictable currency pairs