- The ECB’s message is finely balanced between risks and confidence.

- EUR/USD buys this relative confidence, at least for now.

- The door is open to a dovish shift in March.

The European Central Bank left its policy and messages unchanged. The interest rate may still rise in September despite growing signs of a slowdown.

President Mario Draghi balanced between acknowledging the downturn but expressing optimism.

The dovish points initially weighed on the euro. They are:

- Growing protectionism and uncertainty about the trade.

- The slowdown in China.

- Issues with the German car industry.

- Brexit uncertainties.

- A recession in one country can spread.

- Lower inflation, especially core inflation.

On the other hand, Draghi was optimistic about other topics, and this sent the euro back up:

- The labor market is improving.

- Wages, especially collectively bargained ones, are on the rise.

- Financial conditions are favorable.

- Policymakers, such as in China, are taking measures.

- Falling energy prices leave more money in consumers’ pockets.

- Low chance of a recession.

What’s next?

Summing the situation:

Draghi summed it up with two approaches. On the one hand, there are reasons to believe that the slower momentum is temporary with potentially dissipating issues. On the other hand, the ongoing slowdown weighs on confidence.

So what’s next?

The Governing Council decided to “give itself more time” to assess if the confidence was hurt or not.

When will they know?

Maybe in March. They will then have new forecasts made by the Mario Draghi staff and see if the slowing momentum is waning or taking hold.

Kicking the can to March

If the data continue disappointing, there is a good reason to believe that Draghi and co. will find it hard to repeat this balancing act, and may have to say that downside risks have materialized, thus deciding to push back the guidance regarding rates.

So, if we do not see any improvement, Draghi can drag the euro down in March, but the common currency may react beforehand, responding to the data.

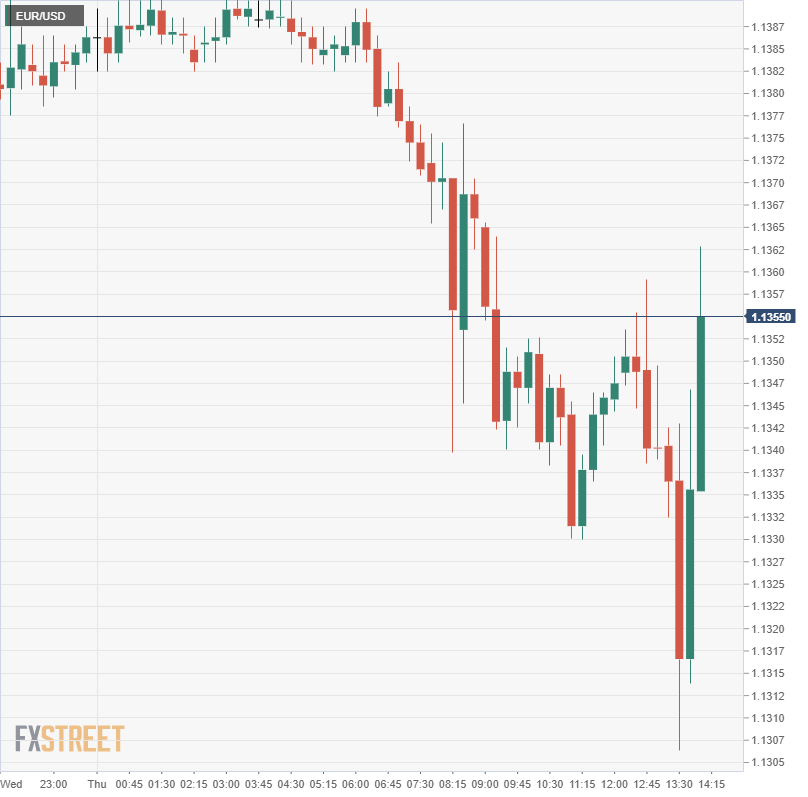

EUR/USD fall and rise:

Get the 5 most predictable currency pairs