Cryptocurrencies suffered a mini “flash crash” early in the week. The move sent BTC/USD to a low point of $3,433 but the granddaddy of digital coins bounced back to range quite quickly. Similar moves were seen in Ethereum and in Ripple. It seems that stop-loss orders were flushed and weak hands were gotten rid of.

The rest of the week was stable, which is surprising amid the negativity. JP Morgan analysts said that cryptos’ value is “unproven” and that BTC/USD could go as low as $1,260. They favor other assets even in case of a deep financial crisis. Gold and the US Dollar are more liquid and easier to access and to transact.

The global bank has made investments into the blockchain technology but its boss Jamie Dimon has been outspoken against Bitcoin.

Another downbeat development comes from the high profile Bitcoin Exchange Trade Fund (ETF) request by the CBOE in collaboration with VanEck and SolidX. They withdrew the requested rule change that has been delayed over and over again.

The move is due to the government shutdown which paralyzes the Securities and Exchange Commission (SEC). While they may reapply, yet another delay in bringing cryptos to the masses has weighed on prices in the past.

This time, markets are shrugging it off and this is a sign of resilience. The ongoing shutdown means that the topic is off the agenda for quite a while.

What will be the next driver of Bitcoin? More adoption is the answer. The new year may bring innovation in this field.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

BTC/USD Technical Analysis

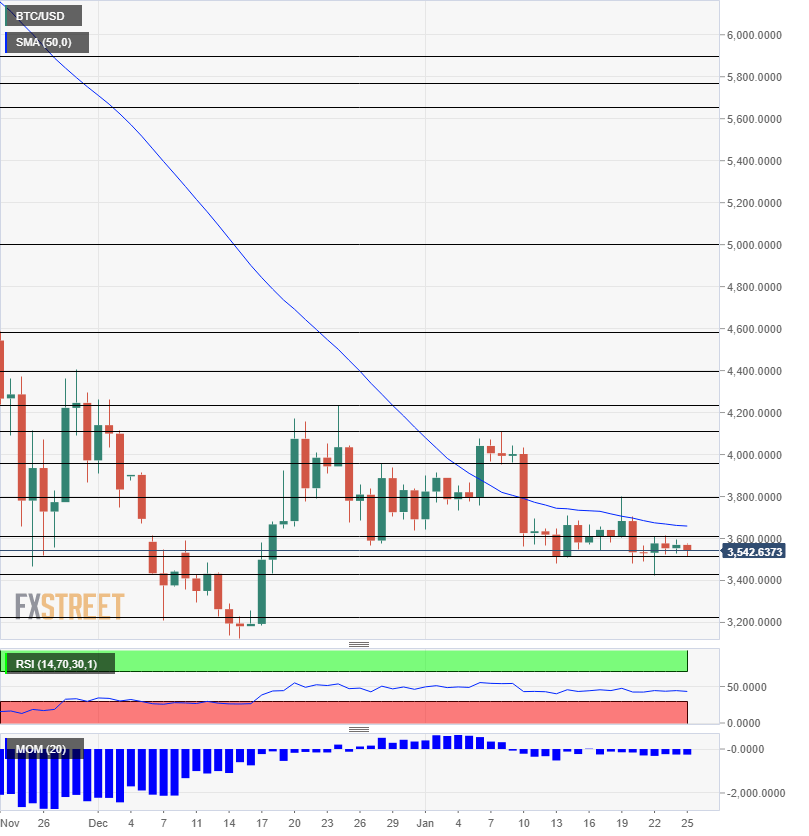

Bitcoin is trading in a narrow range capped by $3,620 and supported by $3,510. Both lines have been tested in recent days. Momentum and the RSI are not going anywhere fast.

The 50-day Simple Moving Average awaits at $3,660 and is the initial upside target out of this range. The swing high of $3,800 recorded in mid-January. $3,980 provided support to BTC/USD when it was trading on the higher ground early in the new year. $4,100 was the high point of 2019 so far.

Support below $3,510 is at $3,433, the mini-flash crash point. Further down, $3,210 was a swing low in early December. $3,125 is the cycle low recorded in mid-December.

The Forecast Poll of experts provides intriguing insights.

Get the 5 most predictable currency pairs