The Swiss franc was mixed today following the release of producer inflation data, which showed a bigger-than-expected decline. The general market sentiment was optimistic, weighing on safe currencies like the Swissie and the Japanese yen. The Federal Statistics Office reported that the Producer Price Index fell 0.6% in December from the previous month after falling 0.3% in November. Experts had predicted a much smaller decline by just 0.1%. Annual inflation was … “Swiss Franc Mixed After Bigger-than-Expected Decline of Producer Inflation”

Month: January 2019

Euro Stabilizes as Investors Revise Their Expectations of an ECB Rate Hike

The euro today traded in a stable rage against the US dollar as investors revised their expectations of a rate hike by the ECB. The single currency was not appealing to investors who have had to deal with weak data releases from the eurozone and a dovish European Central Bank. The EUR/USD currency pair today … “Euro Stabilizes as Investors Revise Their Expectations of an ECB Rate Hike”

Sterling Drops After Retail Sales Fall More than Expected

The Great Britain pound fell against other most-traded rivals, even the weak Japanese yen, after official data showed that retail sales declined last month. The Office for National Statistics reported that retail sales declined 0.9% in December compared with the previous month. Analysts had predicted a bit smaller decline by 0.8%. Furthermore, the November increase of 1.4% got a negative revision to 1.3%. Experts argued that the data … “Sterling Drops After Retail Sales Fall More than Expected”

Japanese Yen Weak on Risk Appetite, Disappointing CPI Release

The Japanese yen fell against majority of its most-traded peers today due to risk appetite prevailing on markets. Disappointing inflation report was not helping the currency either. Japan’s core Consumer Price Index, which excludes fresh food, rose 0.7% in December from a year ago. That is compared to the increase of 0.9% registered in November and 0.8% predicted by analysts. Excluding both fresh food and energy, the index rose just … “Japanese Yen Weak on Risk Appetite, Disappointing CPI Release”

Pound Trades Strongest After Theresa May Wins Confidence Vote

The Great Britain pound was the strongest major currency on the Forex market during Thursday’s trading after UK Prime Minister Theresa May won the confidence vote on Wednesday. The opposition Labor Party leader Jeremy Corbyn tabled a no-confidence motion after May suffered in resounding defeat in the voting for her Brexit plans. May’s government managed to win with 325 to 306 votes. After the victory, the Prime Minister offered members of the Parliament … “Pound Trades Strongest After Theresa May Wins Confidence Vote”

Japanese Yen Rises As BOJ Keeps Rosy Economic Picture

The Japanese yen is gaining against its major currency rivals on Thursday as reports suggest that the Bank of Japan (BOJ) will maintain a bright view of the national economy, despite a myriad of factors suggesting that Tokyo is expected to record disappointing data. According to Reuters, citing sources close to the situation, the Japanese central bank is expected to slash its inflation forecasts during next weekâs policy rate review. This … “Japanese Yen Rises As BOJ Keeps Rosy Economic Picture”

Euro Trades Sideways Despite In-Line Eurozone Inflation Data

The euro today traded in a tight range against the US dollar amid a market that was largely stable and lacked volatility. The release of upbeat data from the US docket in the early American session saw the EUR/USD currency pair come under intense selling pressure. The EUR/USD currency pair today traded in a range … “Euro Trades Sideways Despite In-Line Eurozone Inflation Data”

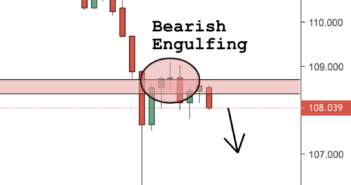

The Japanese yen is looking bearish

I am looking at the USDJPY pair. It looks like the bears are in control of price action again. After the flash crash from last week, there is some new selling enthusiasm that is developing. There are a few technical indications that tell me a continuation of the downtrend is imminent. There was a bearish … “The Japanese yen is looking bearish”

Sterling Range Bound on Mixed UK Data Before Leadership Vote

The Sterling pound today traded in a range as investors recovered from yesterday’s crazy swings following the historic Brexit vote. The GBP/USD currency pair was largely immune to most of the data released from the UK docket as investors remained cautious Noahead of a Parliamentary no-confidence vote against Theresa May. The GBP/USD currency pair today traded between a high of 1.2896 and a low of 1.2824 and was within this range at the time of writing. The cable was … “Sterling Range Bound on Mixed UK Data Before Leadership Vote”

Canadian Dollar Rises on Soft US Inflation, Crude Supply Contraction

The Canadian dollar is rising midweek after the US government reported soft inflation levels. The loonie is also getting a lift on market expectations that US crude oil inventories will record a contraction. This comes as market sentiment pertaining to the short-term health of the currency is split. On Tuesday, the producer price index (PPI) fell 0.2%, beating market projections of 0.1%. The wholesale costs of goods slipped 0.4%, driven by the steep … “Canadian Dollar Rises on Soft US Inflation, Crude Supply Contraction”