- USD/CAD fell sharply on US Dollar weakness and recovering oil prices.

- The jobs report stands out in the first full week of February.

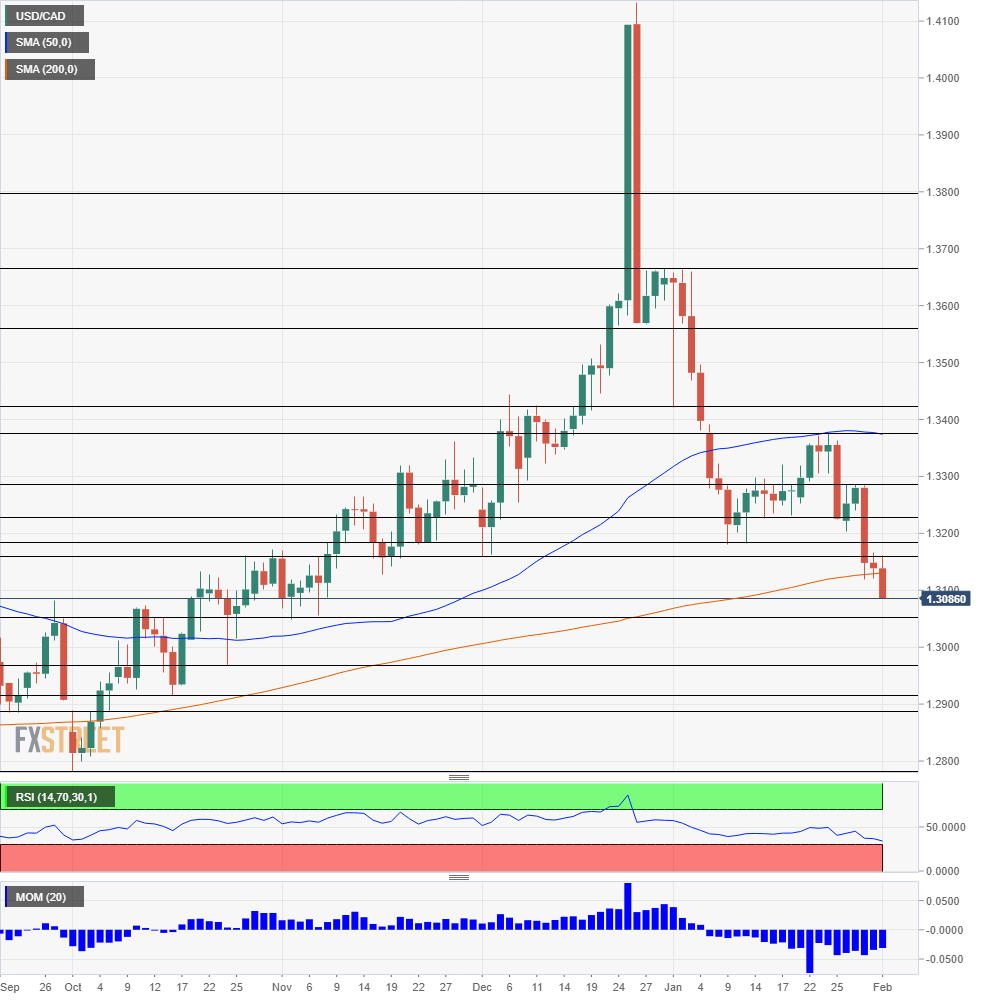

- The technical picture is bearish for the pair.

This was the week: Dovish Fed dominates

The US Federal Reserve made a dovish shift, saying it will be patient with raising rates. Also, the Fed is now ready to examine the program to reduce the balance sheet. Signs of a global slowdown and financial markets caused a change of heart and sent the US Dollar down.

Commodity currencies such as the Canadian Dollar took advantage of the move. Commodities rose as well. Canada’s critical export, crude oil, continued its gradual recovery, with WTI climbing above $54.

In Canada, BOC Deputy Governor Carolyn Wilkins was balanced in saying that low wage growth means the job market has room to run.

Canada’s GDP dropped by 0.1% in November, but this was expected by economists.

Late in the week, the US Non-Farm Payrolls report did not help. While the headline was another blockbuster figure of 304K, it came with downward revisions and mixed wage data. The US labor market is doing well, but nothing we did not know.

All in all, USD/CAD dropped mostly on USD weakness and not CAD strength.

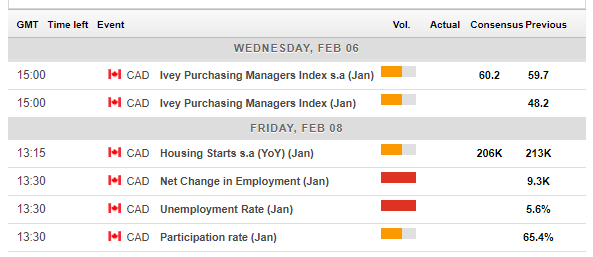

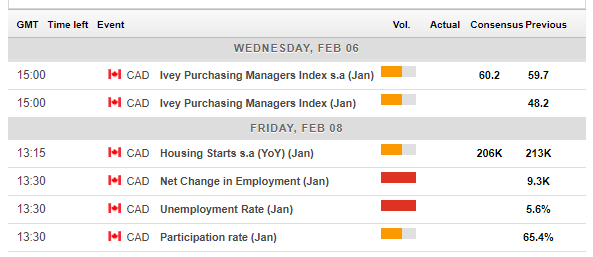

Canadian events: Jobs Friday

The Richard Ivey Business School’s forward-looking survey of Purchasing Managers kicks of the week. The number is quite volatile, but its upbeat levels of late have helped the loonie.

The central event of the week is on Friday. Canada’s jobs report is published on its own, separately from the US one. This means that USD/CAD will move solely on this event. After a leap of over 90K in November, Canada continued gaining jobs in December: 9.3K. This time, we may see some kind of moderation. The unemployment rate remains low at 5.6%.

A drop in jobs will not be a disaster after November’s excellent report which still supports the C$.

Oil remains of importance. If the black gold remains at current levels or rises, it will continue lending a helping hand to the loonie.

Here is the Canadian calendar for this week:

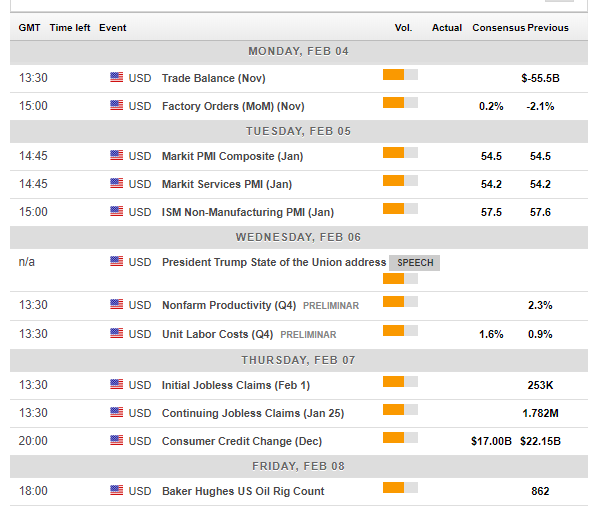

US events: Service sector data, trade

After a busy week with the Fed and the NFP, the upcoming week is lighter. Trade data and factory orders serve as a warm-up on Monday. The most significant publication is on Tuesday, with the ISM Non-Manufacturing PMI. After the falls, the parallel manufacturing PMI beat expectations. It will be interesting to see if the services sector is stabilizing as well.

Trump’s State of the Union speech on Wednesday may move markets if he talks about taxes or infrastructure in front of a divided Congress. Jobless claims will be watched after a disappointing increase last week.

Trade talks between the US and China continue at low levels, and an announcement about a meeting between Trump and China’s Xi Jinping will be seen as a sign of an upcoming deal. The Canadian dollar is set to enjoy an accord between the US and China.

Here are the critical American events from the  :

:

USD/CAD Technical Analysis

USD/CAD is bearish after breaking below the 200-day Simple Moving Average. Also, the Relative Strength Index remains above 30, thus not indicating oversold conditions. Momentum continues to the downside.

Support awaits at 1.3055 which provided support back in early November. The next support line is at 1.2970 which was a low point in late October. 1.2915 was a low point in mid-October, and it is closely followed by 1.2880 that was a double-bottom in mid-2018.

Immediate resistance is at 1.3160 which was a trough in late November. 1.3185 was a low point early in January. 1.3230 provided support in mid-January and switches to resistance. 1.3280 held the pair down in late January.

USD/CAD Sentiment

Even though technicals are not showing oversold conditions, Dollar/CAD may have gone too far. The global slowdown is not good news for Canada.

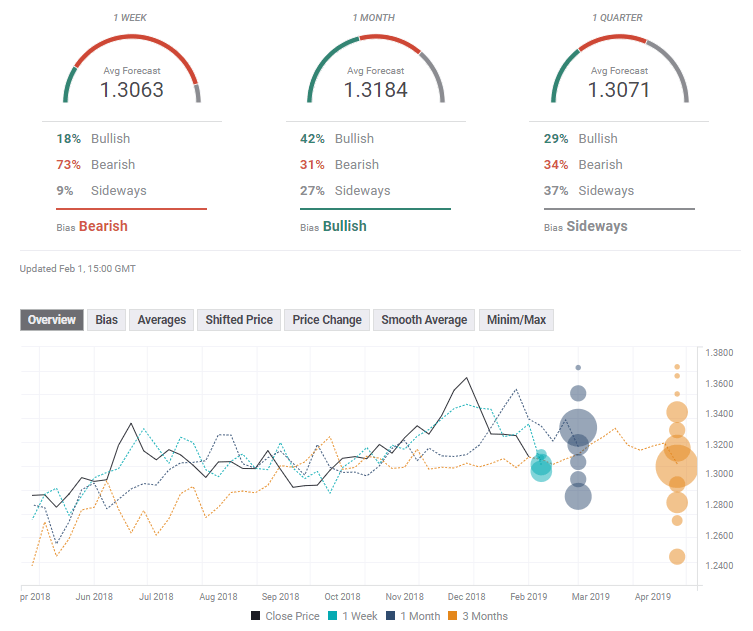

The FXStreet forex poll of experts shows a bearish outlook for the short-term, a bullish one afterward and sideways in the long-term. Targets are quite close to each other. Goals have been downgraded for the short and medium terms while remaining stable in the long run.

Related Forecasts

- USD/CAD Forecast 2019: CAD comeback on the cards

- GBP/USD Forecast: Can the pound hold its ground amid this Brexit-blindness?

- USD/JPY Forecast: Fed dovishness and the global slowdown prove toxic, trade and the ISM awaited

Get the 5 most predictable currency pairs