- GBP/USD was remarkably stable amid Fed and Brexit turbulence.

- The BOE and quarterly GDP stand out in a busy week.

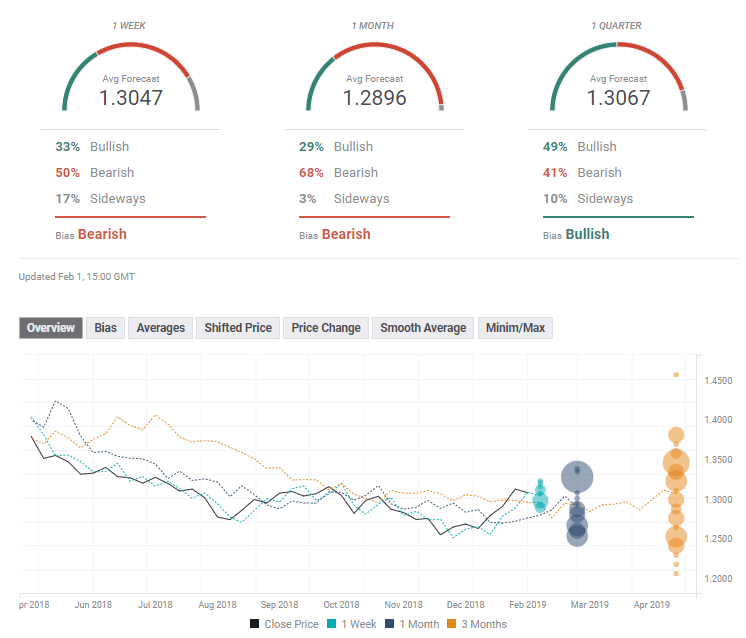

- The technical picture remains bullish for the pair. Experts are bearish in the short and medium terms.

This was the week: Trying to renegotiate Brexit and the Fed doves

The UK Parliament debated amendments to the meaningful vote on Brexit and eventually instructed the government to renegotiate the Irish Backstop. This “Brady amendment” and the “Malthouse compromise” that Conservative lawmakers worked so hard to achieve among themselves was instantly rejected by Brussels. European Union leaders offered only clarifications but no changes to the binding text.

The clock is running down towards Brexit Day, March 29th, with no extension in sight. The chances of a hard Brexit are rising. While House of Commons called to avoid a no-deal Brexit, they only approved the non-binding Spelman amendment and not the binding Cooper one.

UK PM Theresa May later reached out to Labour MPs representing constituencies that voted to leave the EU, offering funds to areas that were left behind. Labour Leader Jeremy Corbyn did not weigh in on the topic.

Markit’s forward-looking Manufacturing PMI fell to 52.8 points, below expectations, weighing on the pound as well.

GBP/USD stabilized thanks to a dovish Fed decision. The world’s most powerful central bank decided to pledge patience on interest rate rises. In addition, they opened the door to modifying the scheme to reduce the balance sheet and will work on setting a final target its size. The message soothed markets and sent the greenback lower.

US Non-Farm Payrolls came out above expectations with 304K jobs gained in January but a substantial downward revision to December’s figure and mixed wage numbers limited any gains for the greenback.

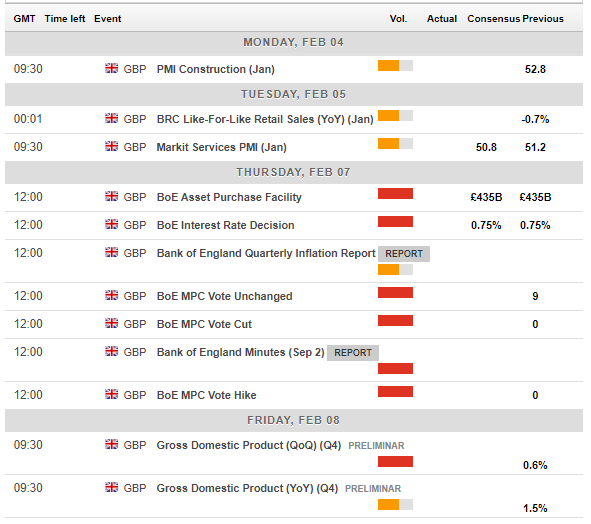

UK events: BOE Super Thursday and Brexit forever

The week kicks off with the Construction PMI, which is also projected to show moderate growth, with a score only slightly above 50 points. Services PMI on Tuesday carries significant weight. It is forecast to remain at growth territory, above 50, but only just. A contraction in the UK’s largest sector may weigh on Sterling.

The primary event of the week is on Thursday. The Bank of England not only makes its rate decision and publishes the meeting minutes, but also releases the Quarterly Inflation Report (QIR).

The Bank of England is blinded by Brexit, like everybody else. On one hand, the economy is doing OK, with a bustling job market and rising real wages that imply higher inflation down the road. Prices are still rising above the 2% target and the “Old Lady” would like to raise rates.

But then there’s Brexit.

The high level of uncertainty holds the BOE back. So far, Governor Mark Carney stressed that the Bank is assuming a smooth exit from the EU. Will he change that assumption now? If so, the pound could fall. Carney will hold a press conference half an hour after the data is out.

No change is expected in interest rates, the QE size, or any other measure. The vote will likely be unanimous with all nine members of the MPC voting in favor of leaving the policy unchanged. A surprise vote to cut rates due to Brexit or raise rates due to rising wages could move the pound. Otherwise, it’s all about Carney’s words about Brexit.

Here are the events lined up in the UK on the forex calendar:

Brexit uncertainty

On the Brexit front, there is no specific event scheduled, but May may travel to Brussels or other capitals for talks. So far, the EU has been united in rejecting fresh negotiations. It will also be interesting to see if the PM can convince enough Labour members to support her, thus weakening the hand of hard-line Brexiteers.

A Norway-style agreement as some pro-Remain MPs from both parties want remains on the table. A general election or a second referendum cannot be discounted either. The most probable scenario is an extension of Article 50, delaying Brexit. No. 10 is opposed to such a move, but they have rejected other things in the past that eventually came to fruition.

The only certain thing is that uncertainty is higher after the votes in Parliament.

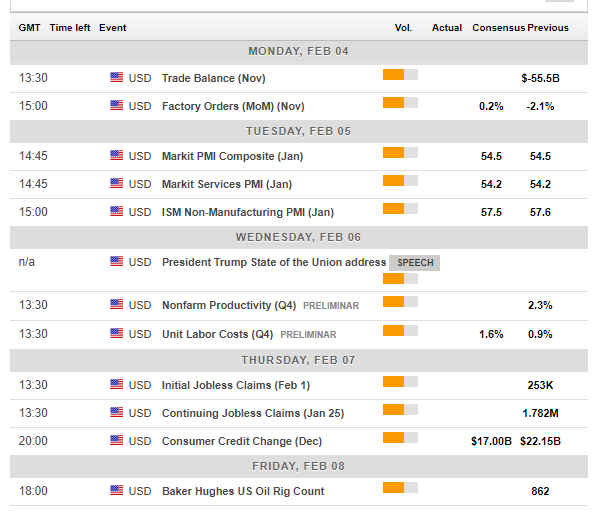

US events: Data slowly coming back after the shutdown

Markets will continue digesting the dovish Fed decision and the mixed Non-Farm Payrolls numbers at the wake of the new week. Trade data will be of interest given the ongoing US-Chinese talks.

The primary economic indicator is the ISM Non-Manufacturing PMI which will likely point to lower growth. The release, after the NFP, gives its own spot in the sunshine.

President Trump’s State of the Union address may move markets if he offers further tax cuts or infrastructure spending. Any signs of avoiding another shutdown on February 15th will also carry weight.

Weekly Unemployment Claims jumped last week and that was probably a one-off, but markets will want a confirmation.

Apart from these publications, a few more may be added. US agencies are running through a long backlog of data that has been released due to the shutdown.

Trade talks continue at a low level after the intense talks in Washington. A meeting between Chinese President Xi Jinping and Trump may be announced.

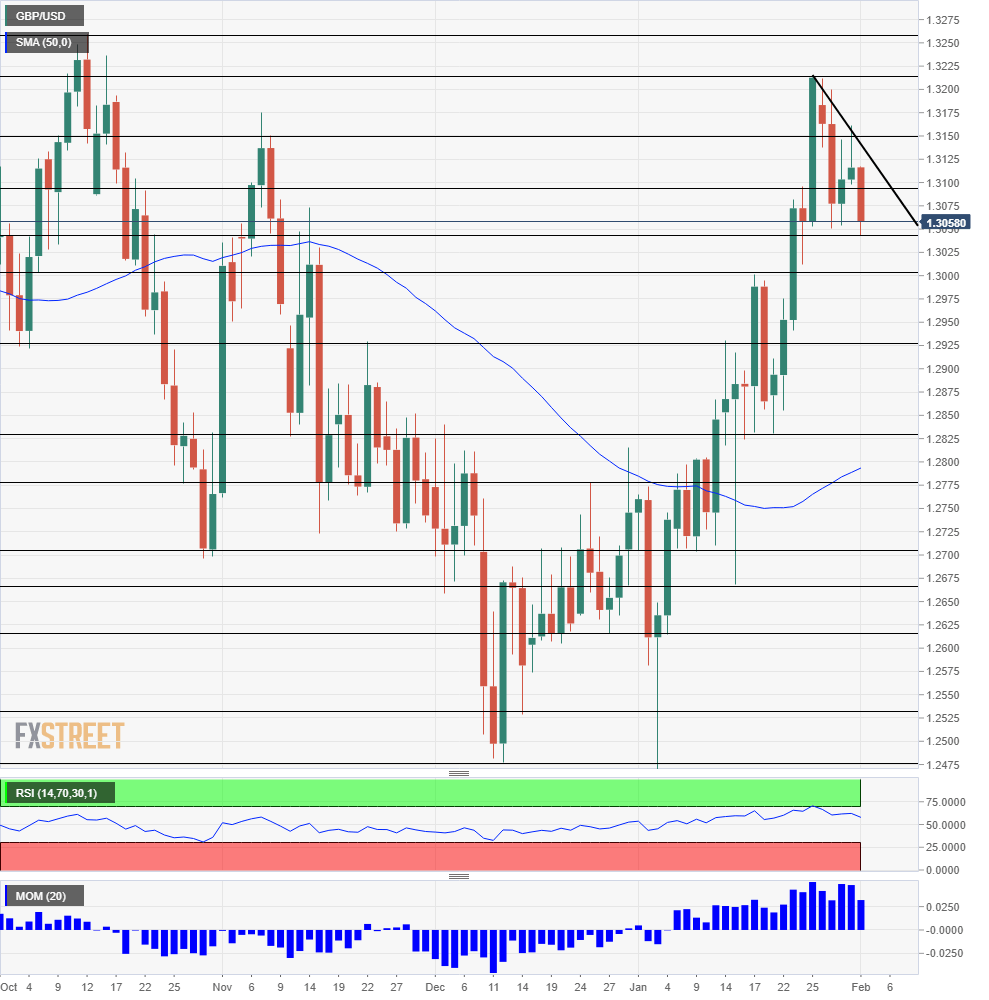

GBP/USD Technical Analysis

GBP/USD is trading continues enjoying upside Momentum, which has not diminished with the recent slide. Moreover, the Relative Strength Index is outside the overbought territory, below 70, implying more gains are possible.

Cable is trading below a downtrend resistance line that accompanies it in the past few days but most indicators are positive.

1.3095 worked as a line in both directions in recent days. More importantly, 1.3150 prevented the pair from extending its gains after the Fed. 1.3220 is the cycle high. Further above, 1.3275 and 1.3300 date back to the autumn.

1.3040 is the fresh low and also capped cable in November. 1.3000 is a critical round number and also served as resistance in the middle of the month. 1.2925 was a temporary high on the way up and 1.2830 provided support during the climb in mid-January.

GBP/USD Sentiment

Sterling’s recent ascent came on top of hopes for a softer Brexit, but the clock is ticking and the UK is not headed in that direction. Despite upbeat technicals, markets may have a “panic attack” around a hard Brexit, especially if Carney ramps up talk of contingency plans. All in all, there is room to the downside.

The FXStreet Poll shows a mixed picture: a bearish outlook in the short and medium terms and a bullish trend in the longer term. The targets have been slightly donwgraded in the past week.

Related Forecasts

- GBP/USD Forecast 2019: Imprisoned by Brexit darkness Sterling is set to chart a check mark

- USD/JPY Forecast: Fed dovishness and the global slowdown prove toxic, trade and the ISM awaited

Get the 5 most predictable currency pairs