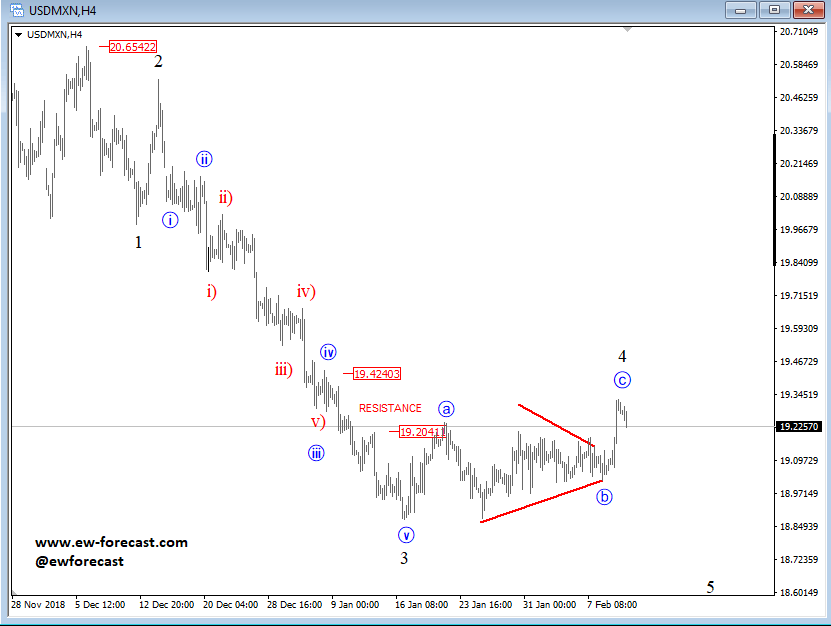

USDMXN is still trading in a correction of wave 4 despite that bigger wave »c« recovery. The most important thing is that we have a triangle in wave »b« and we know that triangles cannot occur in wave 2, so it must be a correction! Anyhow, we remain bearish here for wave 5 towards new lows, but if we are surprised by an impulsive continuation higher towards 20, then our count would be invalidated.

USDMXN, 4h

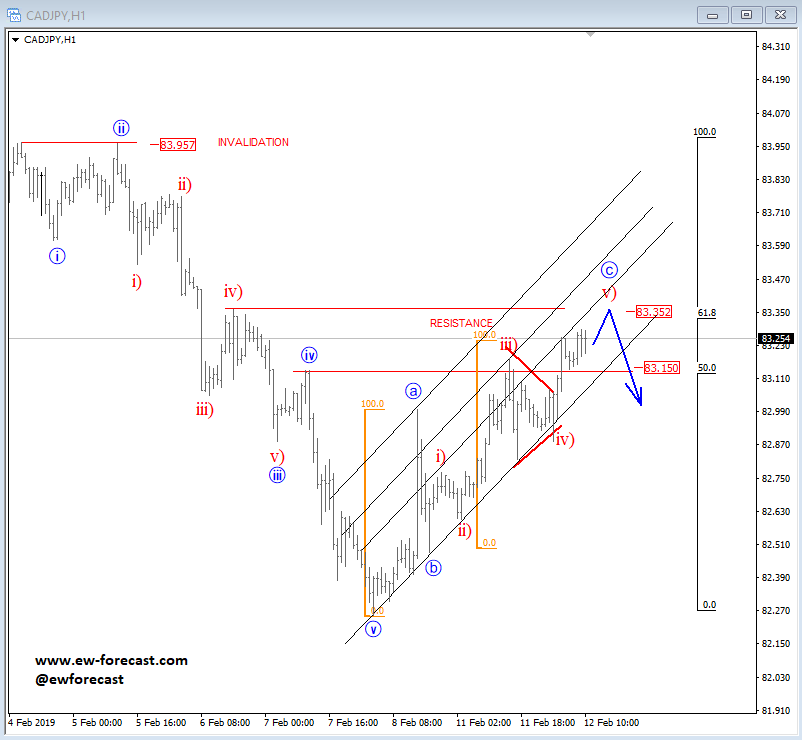

CADJPY has a pretty clear bearish setup after that impulsive five-wave decline from the highs and a current slow three-wave a-b-c corrective structure. So, watch out for a bearish turn here around ideal 61,8% Fibo. retracement and 83.35 resistance level, but only while price is trading below 83.95 invalidation area.

CADJPY, 1h

Get the 5 most predictable currency pairs

Elliott wave Analysis: USDMXN and CADJPY Update