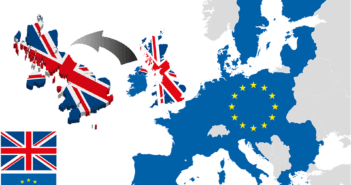

PM May is moving away from renegotiating the Irish Backstop. Her tactics may get the original deal over the line. GBP/USD may rise if a hard-Brexit is avoided, not only delayed. UK PM Theresa May moved away from totally renegotiating the controversial Irish Backstop. In a speech in Belfast, the PM insisted that there would … “GBP/USD Buying opportunity? May could get deal through”

Month: February 2019

Chinese Yuan Ignores Worries As Warnings Keep Piling On

The Chinese yuan is ignoring negative market sentiment on Tuesday, despite a myriad of warnings pertaining to the national economy. Beijing has experienced a significant slowdown in recent months, stemming mostly from the US-China trade war. Even though it looks like both sides are inching towards a new trade agreement, there is still growing pessimism regarding growth. As investors home in on a potential trade deal, there is another … “Chinese Yuan Ignores Worries As Warnings Keep Piling On”

Canadian Dollar Trades Flat vs. Most Rivals, Down vs. US Dollar

With no macroeconomic reports or other events scheduled in Canada for today, the Canadian dollar was trading mostly flat in the American trading session. Falling prices for crude oil and poor economic data in the United States drove the loonie lower versus its US counterpart. Underwhelming reports in the USA were detrimental to the Canadian currency because Canada has strong economic ties to its neighbor. Additionally, the disappointing indicators led to concerns about … “Canadian Dollar Trades Flat vs. Most Rivals, Down vs. US Dollar”

Euro Declines Against USD on Mixed Eurozone Data, Later Rallies

The euro today lost ground against the US dollar from the mid-Asian session into the European session as the greenback rallied driven by positive investor sentiment. The EUR/USD currency pair traded at daily lows after the release of mixed PMI prints from across the eurozone by IHS Markit even as the Brexit deadlock capped the pair’s … “Euro Declines Against USD on Mixed Eurozone Data, Later Rallies”

Oil: 3 ways Venezuela can impact prices

Venezuela is gripped in a deep political crisis that followed an economic one. The nation is a large oil exporter with the US importing a significant chunk of its oil. Here are three scenarios for the stand-off and the reaction in oil markets. Venezuela has the world’s largest proven oilreserves but mismanagement by the regime led … “Oil: 3 ways Venezuela can impact prices”

Pound Soft After Services PMI Falls Unexpectedly

The Great Britain pound was soft today after Britain’s services sector demonstrated surprisingly poor performance, expanding at the slowest rate in two-and-a-half years. Positive retail sales data was not able to offset the impact of the negative report. The seasonally adjusted IHS Markit/CIPS UK Services PMI dropped to 50.1 in January, down from 51.2 in December, while experts had predicted it to stay about unchanged. It was the lowest … “Pound Soft After Services PMI Falls Unexpectedly”

Aussie Rallies as RBA Statement Doesn’t Show Dovish Stance

The Australian dollar rallied today after the monetary policy statement of the Reserve Bank of Australia. While analysts had expected the central bank to demonstrate extremely dovish stance, the actual statement was considered to be either neutral or even slightly hawkish. The RBA maintained its main interest rate at 1.5%, as was widely expected. The central bank cut its economic forecasts. Now, the bank expects growth of 3% in 2019, down from … “Aussie Rallies as RBA Statement Doesn’t Show Dovish Stance”

Japanese Yen Trades Slightly Lower amid Mild Risk Appetite

The Japanese yen was flat-to-lower today as mild risk appetite on the Forex market made safe currencies less appealing to traders. The losses were limited, though, and the currency has trimmed most of them by now. As for today’s macroeconomic data in Japan, the Bank of Japan reported that monetary base expanded by 4.7% in January from a year ago. That was in line with market expectations of a 4.6% increase and the previous month’s growth of 4.8%. Being … “Japanese Yen Trades Slightly Lower amid Mild Risk Appetite”

Canadian Dollar Weakens on Sliding Crude Prices, Sluggish Growth

The Canadian dollar is losing ground against its major currency rivals to kick off the trading week. The loonie is falling on sliding crude oil prices, bearish economic data, and a dovish Bank of Canada (BOC) that is unlikely to raise interest rates for another few months. Oil retreated from last weekâs intraday high on Monday as concerns pertaining to the US and Chinese economies and sanctions slapped on Venezuela dominated the international … “Canadian Dollar Weakens on Sliding Crude Prices, Sluggish Growth”

Euro Mixed After Poor Macroeconomic Reports

The euro was trading mixed today, falling against some majors, including the US dollar and the Great Britain pound, but rising versus safe haven currencies. Macroeconomic data in the eurozone was mostly poor and put downward pressure on the currency. The Sentix Investor Confidence dropped from -1.5 in January to -3.7 in February, while analysts had expected an improvement to -1.1. The report commented about the result: Even in February, the bad news for the economy … “Euro Mixed After Poor Macroeconomic Reports”