The Japanese yen has slipped to its lowest level against its major currency counterparts in 2019 on Tuesday. Because of soft economic data and the central bank maintaining an accommodative monetary policy, analysts feel that Tokyoâs economic growth could be threatened in 2019, sending the yen lower. The latest reports suggest that Japanese manufacturing and services reports contracted. Tertiary Industry Activity Index, a measurement of the value of services bought by companies, … “Japanese Yen Weakens to Lowest Level in 2019 on Poor Data”

Month: February 2019

Euro Recovers From Yearly Lows on Trade Optimism and US Politics

The euro today dropped to new 2019 lows against the US dollar in the early European session as the selling pressure on the single currency mounted. The pair reversed its losses later in the session as investor sentiment shifted and the US dollar gave up some of its earlier gains. The EUR/USD currency pair today … “Euro Recovers From Yearly Lows on Trade Optimism and US Politics”

Crypto confluences point to losses, at least in the short term

is After bottoming out, cryptocurrencies consolidated in range. They now seem to face significant resistance and may fall before resuming the rises. Here are the levels to watch according to the Confluence Detector, our proprietary tool. Ethereum led the rise of cryptocurrencies from the lows, Ripple enjoyed it as well, and Bitcoin also moved a … “Crypto confluences point to losses, at least in the short term”

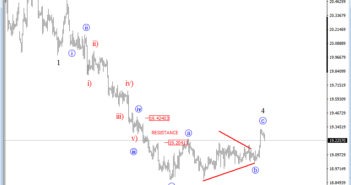

Elliott wave Analysis: USDMXN and CADJPY Update

USDMXN is still trading in a correction of wave 4 despite that bigger wave »c« recovery. The most important thing is that we have a triangle in wave »b« and we know that triangles cannot occur in wave 2, so it must be a correction! Anyhow, we remain bearish here for wave 5 towards new … “Elliott wave Analysis: USDMXN and CADJPY Update”

Global gloom: 5 worries and signs of relief to look for

Markets have stabilized but remain worried about quite a few issues going on in the world. Here is a quick update on the five things on investors’ minds and the signs of relief that could lift the gloom, the mood, and stocks. Trade talks China and the US are working to get a trade deal … “Global gloom: 5 worries and signs of relief to look for”

EUR/USD: where next after falling below 1.270? The levels to watch

EUR/USD lost the all-important triple-bottom around 1.1270. Economic divergence is behind the move. Here are the big levels to watch on the daily chart. Euro/dollar breached a level that supported it three times. 1.1270 was hit in November, then in December, and finally in February before the pair broke to lower ground. While the move … “EUR/USD: where next after falling below 1.270? The levels to watch”

Where EUR/GBP can go to in these five Brexit scenarios

With fewer than 50 days until Brexit Day, all the options are on the table. Brits living in the continent and Europeans in the UK are thinking what to do with their funds. There are five plausible scenarios with different outcomes for the euro/pound. Time is running out to reach a deal on Brexit, with … “Where EUR/GBP can go to in these five Brexit scenarios”

Chinese Yuan Weakens As Q1 GDP Expected to Slow to 6%

The Chinese yuan is weakening to kick off the trading week as a state-run newspaper anticipates economic growth to slump to a historically-low level in the first quarter. Investors are also combing through the latest forex exchange reserve data. According to Economic Information Daily, a newspaper run by the governmentâs Xinhua news agency, the Chinese economy is projected to grow just 6% in the January-to-March period, which would be the lowest on record. It is not … “Chinese Yuan Weakens As Q1 GDP Expected to Slow to 6%”

British Pound Declines on Weak UK Data as Brexit Jitters Persist

The British pound today dropped to new daily lows in the early European session following the release of weak UK manufacturing and GDP data at that time. The Sterling was further weighed down by the uncertainty surrounding the Brexit issue with only 46 days left before Brexit day. The GBP/USD currency pair today dropped from … “British Pound Declines on Weak UK Data as Brexit Jitters Persist”

Australian Dollar Trades Slightly Lower on Uneventful Monday

The Australian dollar traded slightly lower today, continuing feeling the pressure of Reserve Bank of Australia’s stance, which shifted from cautiously hawkish to neutral. Surprisingly, the Aussie performed better versus safer currencies despite investors’ mood being spoiled by worse-than-expected macroeconomic data in Great Britain. As for economic reports in Australia itself, today’s docket was empty. The rest of the week will be different, with home loans and the NAB business confidence … “Australian Dollar Trades Slightly Lower on Uneventful Monday”