Here are the factors, followed by the levels:

1) Forward guidance: The ECB moved its pledge regarding low interest rates from “through the summer,” aka September, to the end of the year. This was expected to happen at some point, but not now.

2) Cheap money to banks: Like the previous decision, a move to provide additional cheap money to banks via the TLTRO program was on the cards, but not so soon. The early move caused some analysts to paint the decision as a “panic move.”

3) GDP forecast slashed: The reasoning for the dovish shift came from the new ECB staff forecasts. Forecasts for inflation were cut for 2019, 2020, and 2021. The same goes for GDP growth forecasts, and the downgrade that stood out was for 2019 growth: from a mediocre 1.7% to a meager 1.1%. This reflects the pessimism.

4) Risks are firmly to the downside: Draghi revealed that some members wanted a longer pushback to March 2020 from the end of this year. While this suggestion was not accepted, he reiterated that risks are firm to the downside. A pushback to March next year or beyond is undoubtedly possible.

5) Unanimous decision: The decision was unanimous, including hawks such as Bundesbank President Jens Weidmann. The head of the German central bank is not competing for the top job anymore and may have been more hawkish now that he does not have to please anyone. Nevertheless, he went with the flow.

EUR/USD big levels to watch

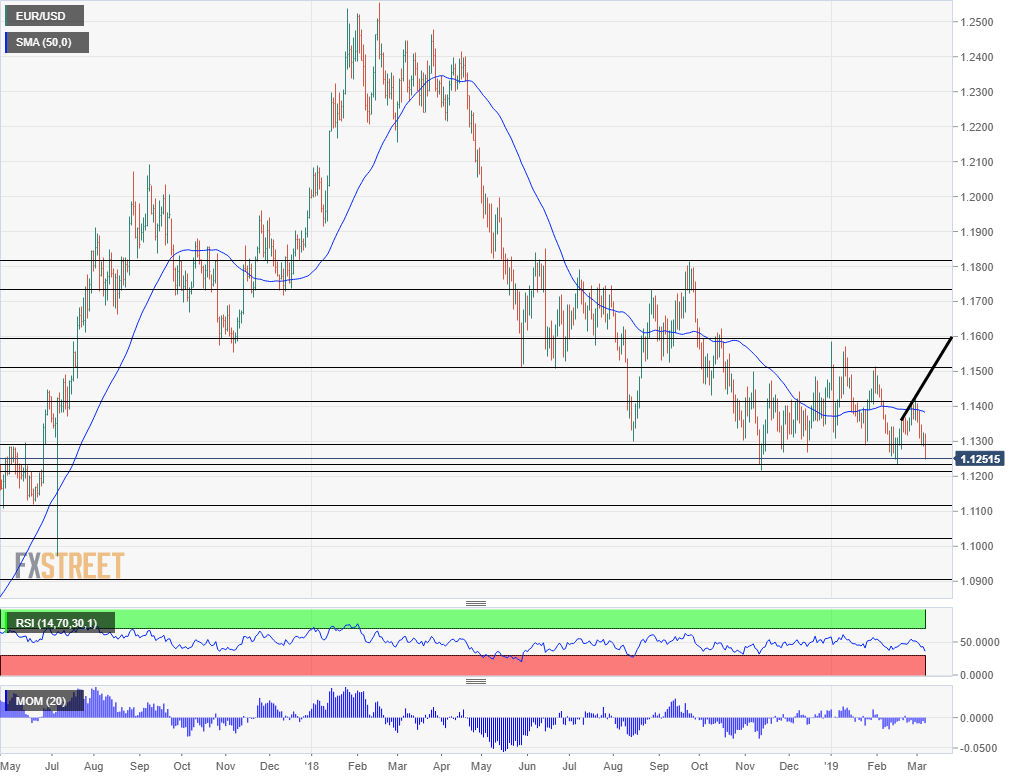

The apparent downside target is the 2019 low seen on February 15th which was 1.1234. Further down, 1.1215 was the 2018 trough recorded in mid-November.

Further down, we are back to levels last seen in 2017. 1.1110 was a considerable cushion in June 2017. 1.1025 capped euro/dollar in May that year. The round number of 1.0900 was a high point in March 2017 and the last line, for now, is 1.0810 that was a gap line in the spring of 2017.

Looking up, familiar levels could cap the recovery: 1.1290, 1.1420 and 1.1515 all stand out on the chart.

Get the 5 most predictable currency pairs

EUR/USD levels to watch after Draghi’s 5 downers