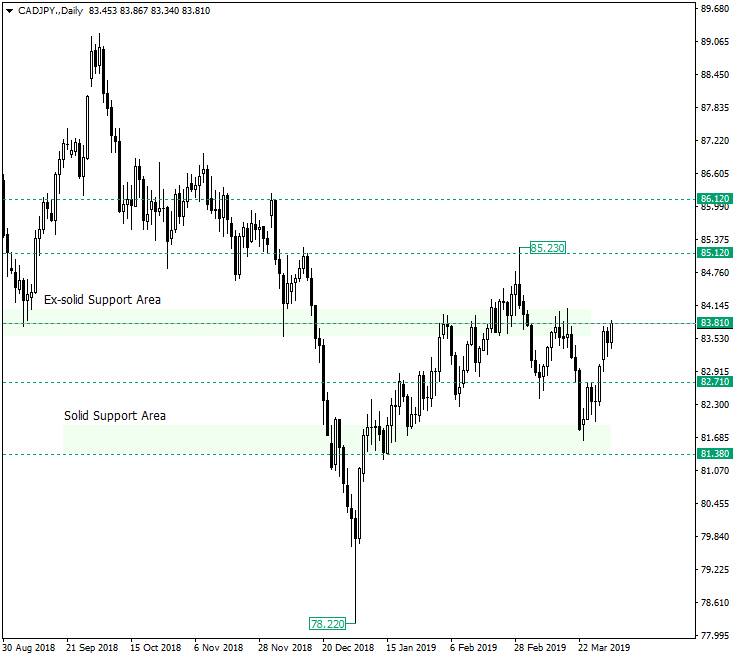

On CAD/JPY, the price managed to rally to an area which not only served as a solid support in the second half of 2018, but also primed as an important boundary since the earliest times of the pair.

Long-term perspective

After the retracement from 78.22 at the beginning of 2019, the price prevailed in reconquering, in two months, two important support areas: 81.38 and 83.81, respectively. Because of this achievement, the profit-taking phase which followed caused a drop from 85.23 that drove the price under 83.81 and favored its confirmation as a resistance, then made a crucial confirmation by bouncing from the solid support area at 81.38. Now, the price tries to regain 83.81. A closure above this level or a piercing followed by the reconfirmation as a support represents an open path to the previous high, at 83.23. On the other hand, a false break or a confirmation as resistance of the same 83.81 ex-solid support area would expose 82.71 and possibly 81.38.

Short-term perspective

The descending move that started at 85.19 ended after the price crossed the resistance line, fueled by negative domestic data from Japan. Contained above an ascending trendline, the price faces the 84.00 psychological level. Bearish price-action from here should not rise any concerns, as this area is guarded by sellers, and any descent, even though will precipitate the break of the trendline, does not pose any menace to the bullish profile as long as it does not conclude to a relocation of the price under the area etched by the descending trendline and 82.94.

Levels to keep an eye on

D1: 86.12 85.12 83.81 82.71 81.38

H4: 85.19 84.49 84.00 82.94 82.43

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.