- Cryptocurrencies have suffered a blow with Bitcoin dropping temporarily below $500.

- All top three digital coins need to cling onto support lines in order to consolidate and resume the rally.

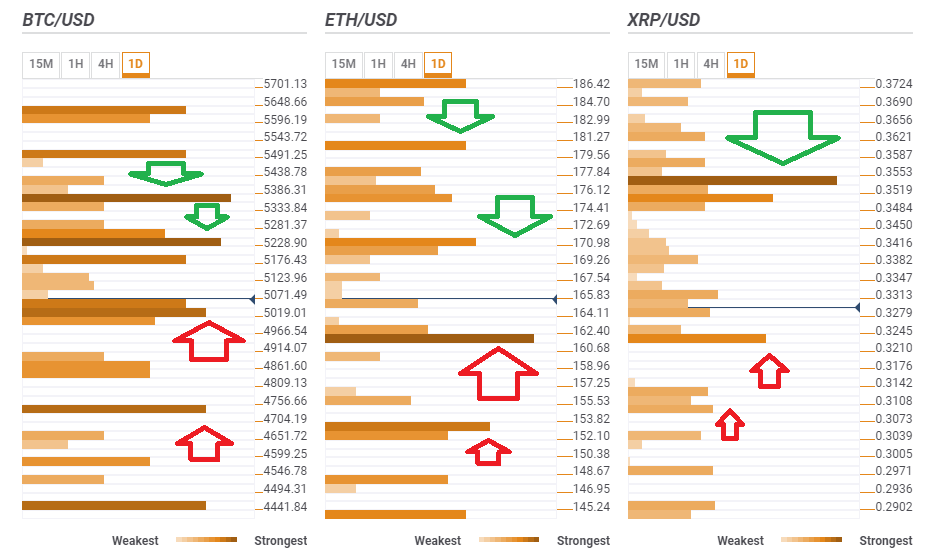

- Here are the levels to watch according to the Confluence Detector.

After finding at least seven reasons for the surge, cryptocurrencies consolidated on higher ground and recently suffered a blow. Is this a continuation of the correction or perhaps a worrying change of course?

This looks more like a correction, but to convince the skeptics, digital assets need to hold onto critical support lines, until the next

This is what the Crypto Confluence Detectorshows in its latest update:

BTC/USD needs to hold onto $5,019

Bitcoin, the grandaddy of cryptocurrencies, has managed to bounce back above $5,000 quite quickly and needs to hold onto $5,019 where we see the convergence of the Simple Moving Average 10-1d, the Pivot Point one-day Support 2, the previous 1h-low, the Bollinger Band 15min-Lower, the Fibonacci 161.8% one-day, the Fibonacci 23.6% one-week, the SMA 10-15m, and others.

Further down, additional support awaits at $4,861 where we see the Fibonacci 38.2% one-week and the PP one-day Support 3. The next target is $4,730 where the PP one-month R3 awaits.

BTC/USD has its first upside target at $5,228where the confluence of the following levels awaits: the SMA 5-1d, the SMA 100-1h, the BB 15min-Upper, the BB 4h-Middle, and the SMA 10-4h.

Further up, the next upside target is $5,355which is the meeting point of the previous weekly high and the Fibonacci 38.2% one-day.

ETH/USD must hold onto $161

Ethereum has a very clear support line at $161where the previous 4h-low, the PP one-month low, the PP one-day S2, and the BB 1h-Lower converge.

Vitalik Buterin’s brainchild’s next support is $153which is a juncture including the SMA 200-1d, the PP one-day, the BB one-day Middle, and the PP one-month Resistance 1.

ETH/USD has an initial upside target at $171which is the confluence of the BB 15min-Upper, the Fibonacci 23.6% one-week, the SMA 50-4h, the PP 1d-S1, the previous daily low, and the SMA 50-15m.

The next upside target is at $180 where the Fibonacci 38.2% one-day and the previous weekly high converge.

XRP/USD is somewhat weaker, as usual

Ripple enjoys support, albeit not that strong, at $0.3220 where we see the confluence of the SMA 50-1d, the PP 1w-S1, and the SMA 100-1d.

The next support line is even weaker, around $0.3108 which is where the previous weekly low and the Fibonacci 161.8% one-month.

Resistance is far but is quite substantial. At $0.3530 we see the convergence of the BB 4h-Middle, the Fibonacci 161.8% one-month, the Fibonacci 61.8% one-day, the Fibonacci 38.2% one-week, and the SMA 504h.

Get the 5 most predictable currency pairs