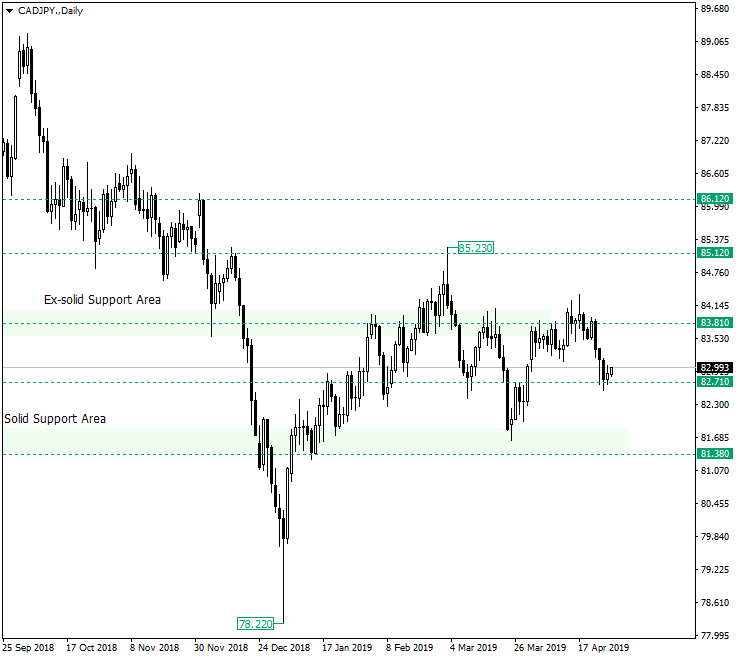

The Canadian dollar versus the Japanese yen dropped from 83.81 after a failed attempt to confirm the level as a support.

Long-term perspective

Unfortunately for the advancement that began at the solid support area of 81.38, there were at least two signs that the bears would drive the price lower: the hanging-man on April 14, 2019, and the bearish engulfing on April 23, 2019. The price now paused its decline just above the intermediary level 82.71, this area being a good spot to book the profits made by shorting 83.81.

Being an intermediary level, 82.71 does not posses the necessary strength to hold the decline for too much time, a normal continuation being the extension of the current decline to 81.38. Only a false piercing of 82.71 would offer the bulls confidence to try a new rally towards 83.81.

Short-term perspective

The price is in a consolidative phase that discretely pinched the 82.94 resistance. To this adds the long upper shadows of two of the candles that make up this phase.

After the price retraces under 82.94 the bears would be much more determined to drive the prices towards 82.43, a move which on the higher timeframes translates to the extension to 81.38 with the purpose of confirming it as a support.

Levels to keep an eye on:

D1: 82.71 81.38 83.81

H1: 82.94 83.22 82.43

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.