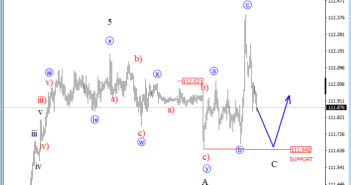

Good morning traders, Stocks are coming down a little, but not much, so we see the SP500 in sub-wave four which may see support at the recent swing high, so ideally there is going to be another push higher up to 2960. Only a decline below 2900 May suggests that a temporary top is already … “Elliott wave Analysis: S&P500 and USDJPY Intra-day View”

Month: April 2019

Euro Falls on Rising US-German Yield Spread and Weak German IFO

The euro today fell for the second straight session against the US dollar as the German business climate deteriorated more than expected. The EUR/USD currency pair’s decline was further accelerated by the risk-off market sentiment triggered by falling equity indices earlier today. The EUR/USD currency pair today fell from a session high of 1.1224 to hit a low of 1.1180 in the early … “Euro Falls on Rising US-German Yield Spread and Weak German IFO”

Canadian Dollar Plunges As BOC Abandons Bias for Future Rate Hikes

The Canadian dollar is sliding midweek after the central bank removed its bias about future increases to interest rates as the economic slowdown intensifies. This has left the market betting that there will not be a rate hike until at least sometime next year. While it did pledge to adapt monetary policy to incoming data, it does not anticipate substantial growth anytime soon. On Wednesday, Bank … “Canadian Dollar Plunges As BOC Abandons Bias for Future Rate Hikes”

NZ Dollar Follows Australian Dollar in Decline

The New Zealand dollar dropped today, following the Australian dollar in decline. While today there were no events specific for the currency of New Zealand, market analysts pointed out that moves of the Aussie and the kiwi usually correlate, and this can explain why the New Zealand dollar behaved similarly to its Australian counterpart during the current trading session. Of course, the kiwi has its own negative factor in the form of the outlook for an interest … “NZ Dollar Follows Australian Dollar in Decline”

Aussie Sinks After Inflation Misses Expectations

The Australian dollar sank today after inflation data missed market expectations, fueling speculations about a potential interest rate cut from the Reserve Bank of Australia. The RBA reported that the Consumer Price Index was unchanged in the March quarter of this year after rising 0.5% in the December quarter of the previous year. Market participants were hoping for at least a 0.2% increase. The trimmed mean CPI rose 0.3%, while economists were … “Aussie Sinks After Inflation Misses Expectations”

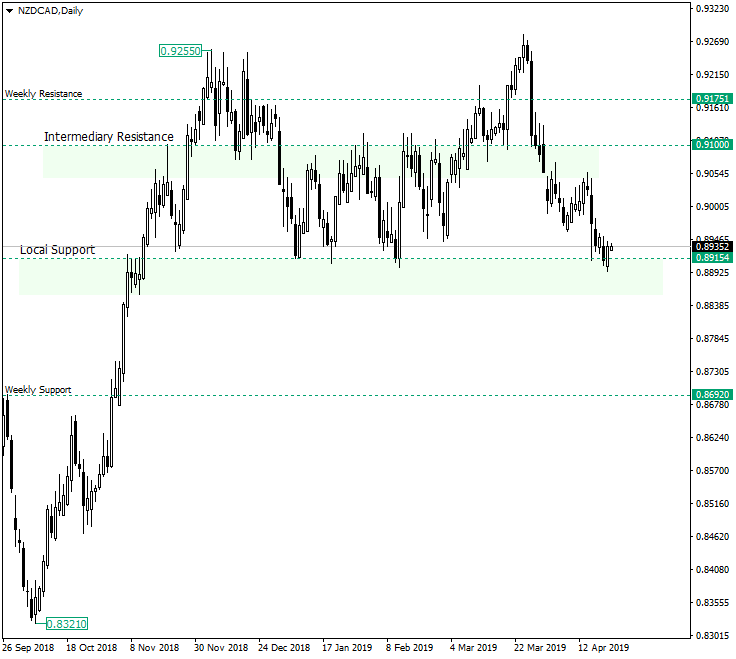

Consolidations on NZD/CAD

The New Zealand dollar versus the Canadian dollar is sitting in a very interesting spot. Long-term perspective The current phase is a consolidation that started at 0.9255, marking at least a pause of the rally etched at 0.8321. It is important to take note of the landmarks that the price projected during this upwards move. These can be categorized into two important levels and two intermediary levels. The important ones are represented by 0.8692 … “Consolidations on NZD/CAD”

Canadian Dollar Slumps to Four-Week Low Ahead of BOC Rate Decision

The Canadian dollar weakened to a four-week low on Tuesday ahead of the Bank of Canada (BOC)âs decision on interest rates. The market is anticipating a prolonged pause to rate hikes, which suggests that officials are not confident that the economy can withstand a move to normalize monetary policy. Investors also traded the loonie on rallying energy prices, as well as data that showed nearly half of Canadians are on the brink of insolvency. On Wednesday, the central bank … “Canadian Dollar Slumps to Four-Week Low Ahead of BOC Rate Decision”

Pound Trades at 2-Month Lows Against Resurgent US Dollar

The Sterling pound today traded at 2-month lows against the US dollar as European markets reopened following the long Easter weekend. The GBP/USD currency pair today fell to new lows as the greenback rallied higher in the American session amid a lack of releases from the UK docket. The GBP/USD currency pair today fell from … “Pound Trades at 2-Month Lows Against Resurgent US Dollar”

5 scenarios for Spain’s elections

Spaniards go to the polls on Sunday and polls show a divided country. The various political scenarios may take time to materialize. EUR/USD may enjoy the results, but it will take time. Citizens of the fourth-largest economy in the euro-zone vote in general elections on Sunday, April 28th. Voting ends at 18:00 GMT. Exit polls … “5 scenarios for Spain’s elections”

USD/JPY has room to fall on a paralyzed BOJ

The BOJ is set to leave its policy unchanged at the sixth anniversary of its QQE program. There is little maneuvering space for the central bank. The Japanese yen could strength on the inability to act. The Bank of Japan announces its rate decision and releases its Outlook for Economic Activity and Prices in the … “USD/JPY has room to fall on a paralyzed BOJ”