The Japanese yen is mixed against a basket of currencies to start the trading week as traders try to make sense of the economy. It is a case of is Japan in a recession or is the economy already recovering? Policymakers cannot seem to determine what is going on in Tokyo, and the recent influx of data is not helping investors make a concrete bet on or against the worldâs third-largest economy. According to the Ministry of Finance, Japan recorded a 25.3% jump in its … “Japanese Yen Mixed As Markets Try to Make Sense of Economy”

Month: April 2019

3 scenarios for the critical EU Brexit Summit

EU Leaders convene in a special summit to decide on Brexit. There are three very different options on the table. European Council President Donald Tusk called an extraordinary leaders summit with only one topic on the agenda: Brexit. The ministers will convene on Wednesday, April 10th, from 16:00 GMT. They will meet two days before the … “3 scenarios for the critical EU Brexit Summit”

US Dollar Forecast for Week of April 8-12

The US dollar ended the past trading week relatively flat. What factors will drive the US dollar over the current week and what traders can expect from the greenback? One of the major events for the US currency during the week will be the release of monetary policy meeting minutes by the Federal Reserve. While the Fed did not change its monetary policy at the latest gathering, it shocked markets by dropping plans for hiking … “US Dollar Forecast for Week of April 8-12”

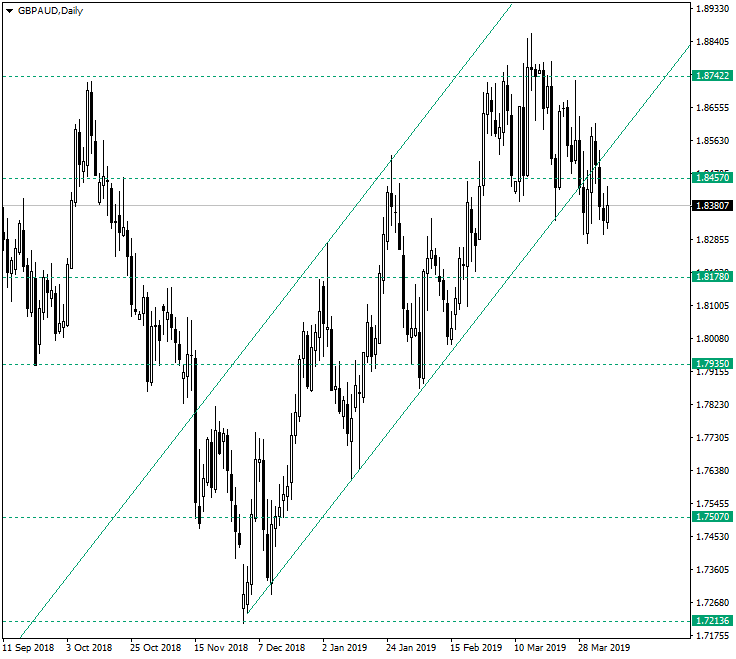

Hidden False Break on GBP/AUD

The recent break of the 1.8457 support area on the Great Britain pound vs. Australian dollar has the trails of an unsustainable move for the bears. Long-term perspective The ascending trend that began on the debut of 2019, from 1.7213, looks as if it is over. Such a conclusion can be easily drawn after acknowledging the break of two obvious support lines, the confluence of which consolidate an important support area. These two lines are the support … “Hidden False Break on GBP/AUD”

Aussie Ends Week Flat, Rebounding After Decline

The Australian dollar fell during the past trading week but bounced by the weekend to end week about flat. The currency got support from risk appetite on the Forex market as well as other positive fundamental factors. One of the major sources of the Aussie’s strength was the string of positive macroeconomic reports in China, Australia’s biggest trading partner. Australia’s retail sales were very supportive to the currency as well. Hopes for a positive outcome of the Sino-US trade … “Aussie Ends Week Flat, Rebounding After Decline”

Can the USD/JPY rally continue? The Fed has the keys

USD/JPY enjoyed a rally thanks to a calmer market mood. The FOMC minutes, inflation, and consumer sentiment stand out. The technical picture has become bullish for the pair but experts are bearish beyond the short term. This was the week: Lots of data, not pointing in one direction It was a busy week of US … “Can the USD/JPY rally continue? The Fed has the keys”

GBP/USD at the mercy of the EU Summit on Brexit

GBP/USD struggled on the neverending Brexit saga. The special EU Summit on Brexit is left, right, and center. The technical is marginally bearish. Experts are bullish on all timeframes. This was the week: Breaking the logjam It was another turbulent week in the Brexit saga. After Parliament failed to approve the Brexit deal for the … “GBP/USD at the mercy of the EU Summit on Brexit”

Canadian Dollar Falls on Weak Jobs Data Amid Mixed NFP Report

The Canadian dollar today fell against its US counterpart following the release of weak Canadian jobs data for March in the early American session. The USD/CAD currency pair rallied to new highs following the release of the weak jobs data from Canada as well as the upbeat US non-farm payrolls report. The USD/CAD currency pair … “Canadian Dollar Falls on Weak Jobs Data Amid Mixed NFP Report”

Mexican Peso Strengthens Amid Trumpâs Border Shutdown Threat

The Mexican peso is rising against several currencies at the end of the trading week. The pesoâs recent rally comes as President Donald Trump threatened to close the border, a move that many have estimated would cost both countries billions of dollars in lost commerce. On the domestic front, the federal government plans to curb spending amid slower economic growth and falling crude oil production, leaving financial analysts with the impression that the country … “Mexican Peso Strengthens Amid Trumpâs Border Shutdown Threat”

NFP is good enough for the dollar, not only for stocks

The US economy returned to normal job growth and lower wage growth. The “Goldilocks” report may be gold for the US Dollar. The US gained a net of 196K jobs in March. This is a return to normal levels after a dismal number in February (33K after an upwards revision) and superb numbers beforehand. The return … “NFP is good enough for the dollar, not only for stocks”