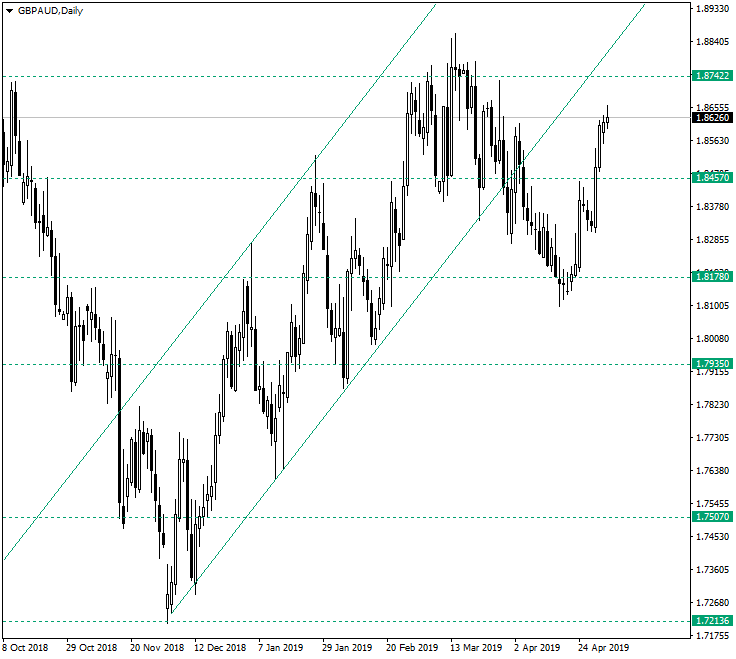

Last month, the Great Britain pound vs. the Australian dollar looked as if it was poised for a drop, but now it seems that the bulls are the ones who manage things.

Long-term perspective

After piercing the support of the trend that started at 1.7213 and the 1.8457 support level (an important confluence area), the price began on April 4, 2019, a decline that could make anyone think that the bears took control. But there were two issues with this break: the next two candles that followed the March 29, 2019, were very bullish and managed to get the price back above the confluence area; the drop that followed the piercing decelerated and eventually confirmed 1.8178 as support.

Because the false break was stopped by a key level, namely 1.8178, there was a lot of optimism on the bullish side, optimism that made it possible for them to drive the price back above 1.8457.

As long as the price remains above 1.8457, confirms it as a support or falsely pierces it the bullish profile remains intact and 1.8742 is the next target. On the other hand, a break of 1.8457 would target 1.8178.

Short-term perspective

Price consolidates around the 1.8598 level. In the event of a decline, 1.8420 should limit the move.

From the current consolidation phase the price should target 1.8732. Once that level is reached, in the light of the bullish daily optimism, the price could continue to rally and 1.8900 would be a fit destination for such a development.

Levels to keep an eye on

D1: 1.8457 1.8742 1.8178

H4: 1.8598 1.8420 1.8731

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.