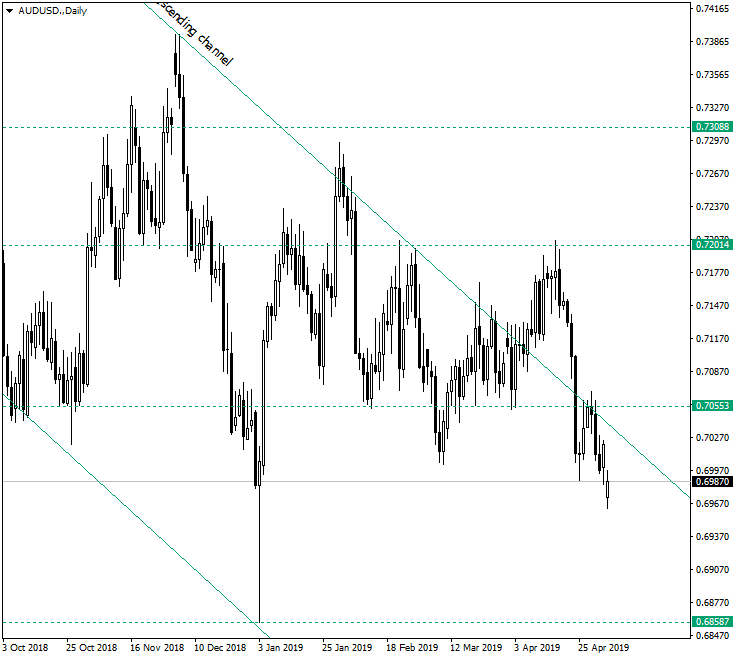

The failure of the Australian dollar versus the US dollar currency pair to gain more ground after the rally to 0.7200 resulted in a drop that sent the price back into the descending channel. But still, the bulls could be more motivated than ever.

Long-term perspective

The resistance line of the descending channel that can be drawn by uniting the highs of January 31, 2018, and December 4, 2018, was finally pierced on April 8, 2019, after two previous stranded attempts. But the appreciation that followed decided to consolidate in a very critical spot: just under 0.7201, which is a very obvious level and which also served as a confluence resistance zone on February 27, 2019, alongside the trendline of the descending trend. This was interpreted by the bears as a stagnation and, after the bearish engulfing on April 18, 2019, as an impossibility of the bulls to advance, leading the strong decline that followed.

As long as the price is contained in the deadening channel — and of course also under the 0.7053 resistance level — the depreciation towards 0.6858 is just a matter of time. What is vital to note is that the price now oscillates around the body of the candle printed on January 1, 2019, and this may drive the bulls to a one last effort to push the price above the confluence zone. In this case, crossing 0.7201 would not pose an issue anymore.

Short-term perspective

The price consolidates under 0.7003. As long as this level holds or is falsely breached, new lows are possible and 0.6935 would be a prime target.

If the price manages to confirm 0.7003 as support, then sideways trading between this support and the 0.7047 resistance is a possible development.

Levels to keep an eye on

D1: 0.7055 0.6858 0.7201

H4: 0.6935 0.7003 0.7047 0.7097

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.