Under the 110.27 support area and still with an overall bullish bias, the US dollar versus the Japanese yen currency pair has what it takes for yet another upwards move.

Long-term perspective

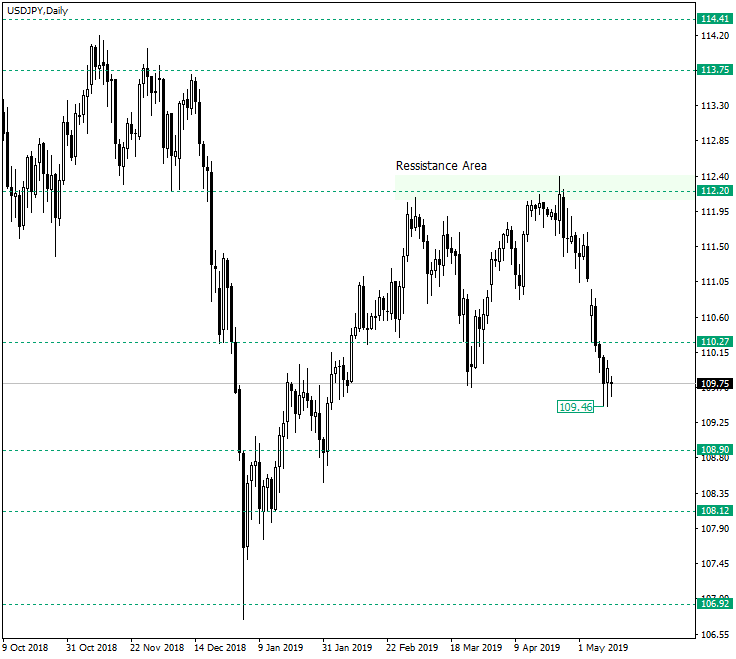

After the decline etched by the confirmation of 112.20 as resistance on April 24, 2019, the price pierced the first major support at 110.27 and made a new low — at least for the time being — at 109.46. Of course, one could say that after such a breach the continuation points towards south.

What needs to be taken into consideration are the following facts. First of all, this low — 109.46 — was materialized after a very sharp decline. This means that sooner or later the bears will park their profits and thus an appreciation is to be expected. The question is if this appreciation will bring the price back above 110.27 or not. If it does, then chances are that a rally towards 112.20 could very well be printed on the chart. On the other hand, if any appreciation is limited by 110.27, then a rectangle lined by 110.27 as resistance and 109.46 as support could be under way, opening the door to 108.90. The second fact, although not that evident on a first check, is that this pair tends to retrace drastically after strong declines.

Short-term perspective

Dropping from 112.15, the price confirmed as resistance the various levels found in its way, but the 109.74 ex-support looks like is posing some problems to the bearish advancement. Of course, the possibility of a continuation pattern — such as the rectangle — is real, but so is the formation of a bottoming one.

The bulls intend to show that they can repel any bearish activity around this 109.74 level, but they can only be convincing if they bring the price above 110.23.

Levels to keep an eye on:

D1: 110.27 108.90

H4: 109.74 109.12 110.23 110.88

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.