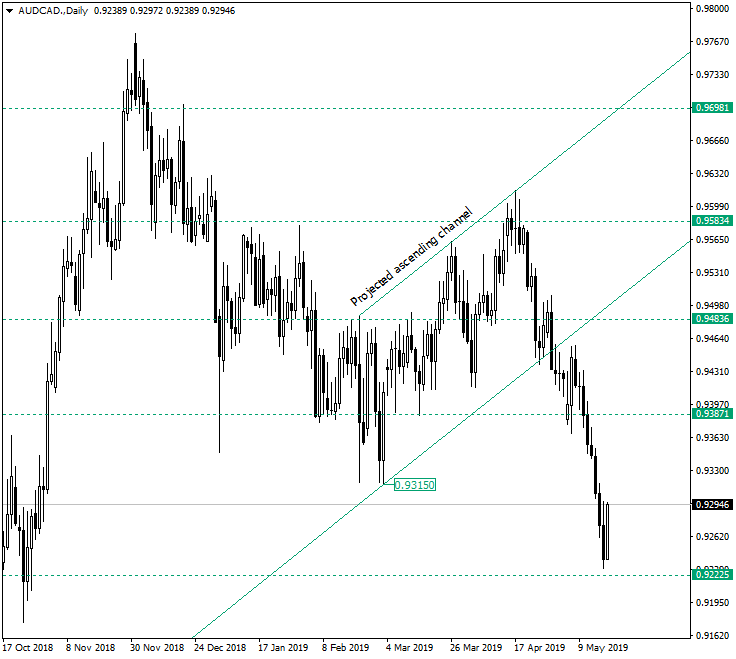

The Australian dollar versus the Canadian dollar currency pair declined sharply and the first signs of slowing down occurred only around the 0.9222 support level.

Long-term perspective

The price started an ascending move from the 0.9315 low on March 1, 2019, that was stalled by the resistance at 0.9583. From there the price descended and tried to confirm 0.9483 as support, but it did not manage to and pierced the support trendline of the ascending channel. One last stand was 0.9387, but this level also gave way allowing the drop that, for the time being, looks like is finding support at 0.9222.

Of course, this could only be a profit taking phase, with further decline still to take place. One thing to note is that 0.9222 is a very important support area, which can be observed by checking the weekly chart. In the light of this, the bulls could try a comeback from this area.

Today’s candle — May 20, 2019, looks like a bearish engulfing, but of course the candle is still open so such a pattern cannot be yet considered. But even if today’s candle does not close in a manner so that it would print a bullish engulfing, the fact that the bulls managed such a pull-back from an important area is a positive sign. In other words, the day could end with an inverted hammer, a pattern that also raises some questions regarding the bears conviction. So, as long as price is above 0.9222 and prints any reversal patterns rallies are possible, with a first target at 0.9387.

Shot-term perspective

The price is in a decline and got under 0.9315, an important short-term support level. As long as the price consolidates between 0.9315 and 0.9238, a continuation of the downwards move is possible. On the other hand, piercing and confirming 0.9315 as support would translate into an appreciation that targets 0.9399.

Levels to keep an eye on:

D1: 0.9222 0.9387

H4: 0.9238 0.9315 0.9399

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.