The ascending trend on the Great Britain pound versus the Australian dollar currency pair ended, but the bulls still guard their gains.

Long-term perspective

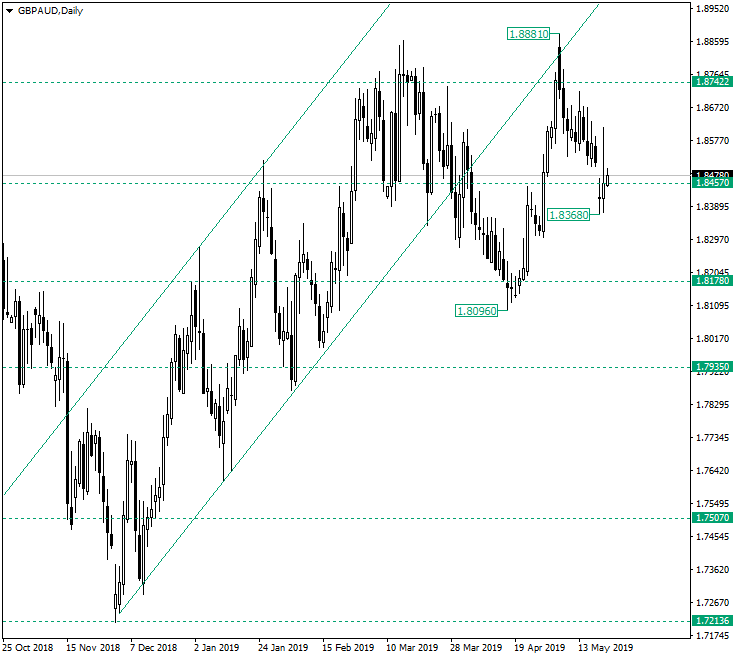

At the beginning of December 2019, the pair started an ascending trend that was halted by 1.8742. The apparent correction that started from this level managed to extend beyond the double support made up by the trendline of the ascending trend and 1.8757, reaching 1.8178. But 1.8178 served the bulls by facilitating them with a support from where to start their new rally, a rally that reached the 1.8881 high and also confirmed the double resistance founded by 1.8742 and the support trendline of the previous ascending trend.

Such a retracement from 1.8881 can be seen as a bearish victory, but the reality is that the bulls are only preparing a major comeback. As long as the price sits above 1.8457, a new move towards the upside is to be expected. Such a move could consolidate a new ascending wave as part of a bullish triangle limited by 1.8742 as resistance and the line that joins the 1.8096 and 1.8368 lows as support.

Shot-term perspective

The price is contained in a flat lined by 1.8598 and 1.8420. As long as the support holds, the piercing and confirmation as support of 1.8598 is possible, with an afterwards extension to 1.8732. On the other hand, if the overall downwards move continues, a revisit of 1.8264 could happen.

Levels to keep an eye on:

D1: 1.8457 1.8742 1.8178

H4: 1.8420 1.8598 1.8264 1.8732

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.