- GBP/USD has fallen sharply but may extend its falls according to experts.

- Things may substantially improve afterward.

- The FXStreet Forecast Poll provides in-depth sentiment for selected financial assets.

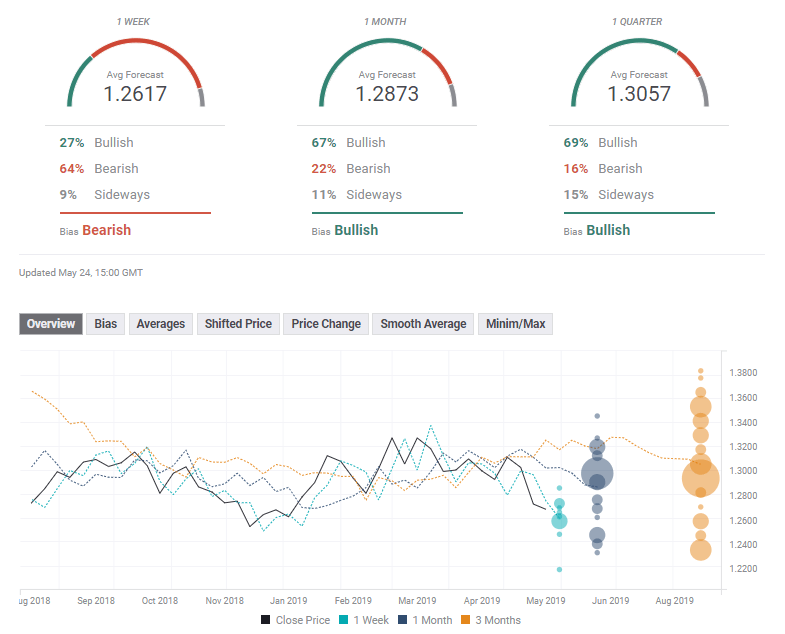

GBP/USD may find a bottom sooner rather later. The FXStreet Forecast Poll shows that experts have responded to the recent downfall in pound/dollar by cutting their short-term target to 1.2617. However, they only made a token downgrade of the one-month forecast, which stands at 1.2873.

To top it off, experts have expressed confidence in the long-term prospects for GBP/USD. The average target is 1.3057 in the next three month, over 400 pips from current trading levels.

Here are the latest developments in the forecasts:

What is behind these projections?

Analysts may be thinking that the pound has already paid the price for the growing political uncertainty and that it has room to rise – even if Brexit-supporting Boris Johnson becomes PM.

Others may be looking at the charts, observing oversold conditions after the deep losses seen in May and also beforehand.

Dmitry Lukashov touches on these key topics:

The British pound has weakened three weeks in a row. The movement of the pound will depend on who will be May’s successor. Тhe “No-Brexit” would be best for pound and Britain’s economy

Not everybody is line with the average forecast. The Dukascopy Team sees deeper falls to 1.2500 within one month and a meager recovery afterward. They are more pessimistic:

Fundamental events still dictate the moves on the GBP/USD. The quitting of Theresa May is just the start of another chapter in the Brexit disaster.

Another potential speculation may be related to the USD side of the equation. The greenback gained substantial ground and may be nearing its peak.

If the collective wisdom of experts is correct, GBP/USD may soon turn around, staging a rally and reach substantially higher levels during the summer, when a new PM will enter 10 Downing Street.

Get the 5 most predictable currency pairs