The US dollar is surging against some currencies and sliding against others at the end of the trading week as tariff hikes on Chinese imports went into effect. With inflation meeting market expectations, investors are focused more on another hiccup in the US-China trade war deliberation, which may linger into the summer and cause market strife. On Friday, US tariffs on $200 billion in Chinese goods rose from 10% to 25% after … “US Dollar Mixed As Tariffs on Chinese Goods Go Into Effect”

Month: May 2019

Is it time to buy the dollar? The post-inflation fall does not seem warranted

April’s inflation numbers show core inflation accelerated to 2.1% as expected That should enough for the Fed to sit on its hands and refrain from rate cuts. The greenback may recover from and even extend its gains after the light drop. US core consumer prices are accelerating once again. They have edged up from 2% … “Is it time to buy the dollar? The post-inflation fall does not seem warranted”

British Pound Trades Sideways Despite Upbeat UK GDP Data

The British pound today traded sideways against the US dollar despite the release of upbeat UK GDP data in the early London session. The GBP/USD currency pair kept trading in a tight range for the second straight session despite the release of multiple upbeat UK macro prints. The GBP/USD currency pair today traded in a … “British Pound Trades Sideways Despite Upbeat UK GDP Data”

South African Rand Jumps as ANC Heads to Victory in Election

The South Africa rand jumped against the US dollar today on the positive outcome of the national election. While not all votes were counted yet, it seems very likely that the governing African National Congress will retain majority in the parliament. Investors welcomed the news as they are hoping that this allows President Cyril Ramaphosa to implement reforms necessary to boost the nation’s economy. USD/ZAR slumped from 14.3354 to 14.1835 … “South African Rand Jumps as ANC Heads to Victory in Election”

Aussie Fails to Hold Unto Gains, RBA Downgrades Growth Forecast

The Australian dollar attempted to rally today on the back of cautious optimism about the US-China trade talks but has almost lost its gains by now. The Reserve Bank of Australia released the Statement on the Monetary Policy, in which it downgraded growth forecast for this year. The RBA cut its forecast for Australia’s economic growth in 2019 significantly, to 2% from 2.75% in the previous estimate. The outlook for 2020 remained unchanged at 2.75%, though. US tariffs … “Aussie Fails to Hold Unto Gains, RBA Downgrades Growth Forecast”

Japanese Yen Soft Despite US Tariffs, BoJ Outlook

The Japanese yen was soft today as the market sentiment was stable despite the United States implementing additional tariffs on Chinese imports. News from Japan itself was good for the most part. The Bank of Japan released today the Summary of Opinions at its April monetary policy meeting. The central bank signaled that it is planning to preserve its current extra loose monetary policy in the near future: It is necessary … “Japanese Yen Soft Despite US Tariffs, BoJ Outlook”

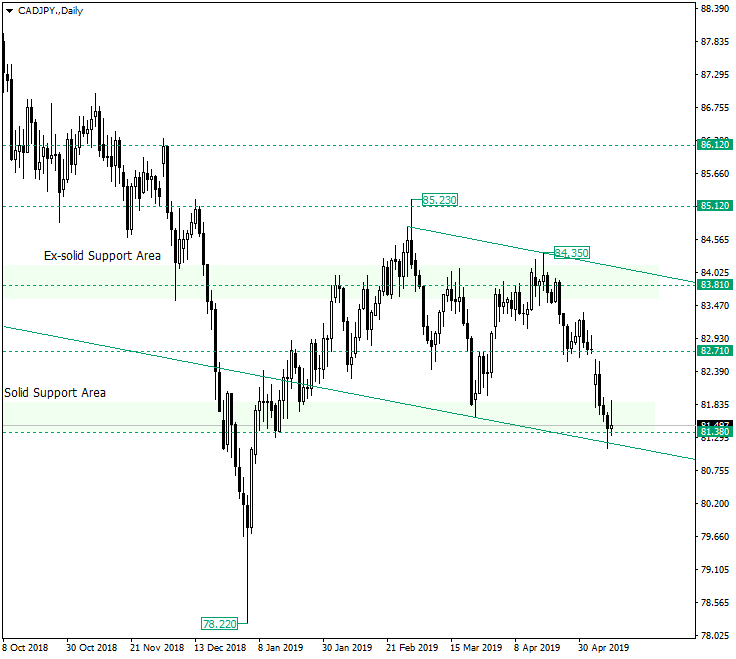

CAD/JPY May Be Different Than It Looks

The Canadian dollar versus the Japanese yen currency pair is now at the important support level of 81.38, an area which could have already given sings of weakness, but it could also turn out to still be the support everyone is expecting it to be. Long-term perspective After the appreciation from 78.22, the price formed what could turn out to be a bullish angled rectangle, with the highs at 85.23 and 84.35 … “CAD/JPY May Be Different Than It Looks”

Canadian Dollar Slides on Mixed Data

The Canadian dollar is trading lower against a basket of currencies on Thursday as an influx of mixed data is driving the loonie’s short-term performance towards the end of the trading week. The slumping economy is not giving consumers a ton of confidence, suggesting that they may not be as adamant to consume. According to Statistics Canada, exports surged 3.2% to $49 billion in March, driven by energy products, automobiles, mining, and aerospace technology. Imports to Canada … “Canadian Dollar Slides on Mixed Data”

Euro Rallies on US Dollar Selloff Ignoring Trade Jitters, Later Drops

The euro today spiked to new weekly highs against the US dollar in the early American session as the greenback dropped significantly against its peers. The EUR/USD currency pair later retraced some of its gains, but remained in positive territory as high-level US-China trade talks resumed. The EUR/USD currency pair today rallied from a low … “Euro Rallies on US Dollar Selloff Ignoring Trade Jitters, Later Drops”

GBP/USD has room to rise on weak GDP expectations

The UK is projected to announce an unimpressive growth rate of 0.2% in Q1. The low expectations are based on Brexit uncertainty. A minor surprise could provide the spark for a GBP/USD recovery. How hard has Brexit uncertainty hit the UK economy? Economists believe that it had a substantial adverse impact on growth, and this explains … “GBP/USD has room to rise on weak GDP expectations”