After a loss in jobs in March, minimal changes are projected for April. Wage growth may steal the show but also here, Canada may have hit its limits. The Canadian dollar is already under pressure, and it could intensify now. Has rapid job growth come to an end in Canada? Loonie traders will get an … “C$ may struggle with the jobs report”

Month: May 2019

Elliott wave Analysis: USDJPY is Targeting 109.70 Level In Sharp Fashion

On USDJPY we are tracking a bigger triangle correction which can be fully visible on the weekly chart but maybe still incomplete. If that’s the case then current leg up on the daily time frame is wave D in three legs which can be headed much higher after current blue sub-wave B is completed, which … “Elliott wave Analysis: USDJPY is Targeting 109.70 Level In Sharp Fashion”

Chinese Yuan Weakens Amid Tariffs, Trade Data

The Chinese yuan is weakening against a basket of currencies midweek as global markets are still reeling from the incoming US tariff hikes on billions in Chinese imports. Beijing has promised it will retaliate, despite reportedly being closer to a new trade agreement. Investors are also combing through new trade data that surprised market forecasts. President Donald Trump shocked global markets this week when … “Chinese Yuan Weakens Amid Tariffs, Trade Data”

Euro Gains Limited on Trade Tensions Despite Draghiâs Optimism

The euro today traded in a sideways range against the US dollar despite attempting to break higher driven by positive German releases and the upbeat speech from Mario Draghi. The EUR/USD currency pair’s gains remained capped by the trade tensions between the US and China, which made investors cautious about buying risky assets such as … “Euro Gains Limited on Trade Tensions Despite Draghiâs Optimism”

NZ Dollar Licks Wounds After RBNZ Cuts Interest Rates

The New Zealand dollar sank today after the Reserve Bank of New Zealand cut interest rates. By now, the currency managed to erase a big chunk of losses, though it is still trading below the opening level. Ahead of the central bank’s decision, analysts were divided whether it would cut rates at this meeting or later. It turned out that the RBNZ decided to act now, slashing its main interest … “NZ Dollar Licks Wounds After RBNZ Cuts Interest Rates”

How these 5 currencies can react to the trade showdown

The US has announced new tariffs on China on Friday unless talks succeed. China’s delegation will try to resolve the situation on Thursday. Some currencies are set to win if the situation escalates, and others if things are resolved. The trade wars are flaring up once again and the situation is deteriorating rapidly. The US has … “How these 5 currencies can react to the trade showdown”

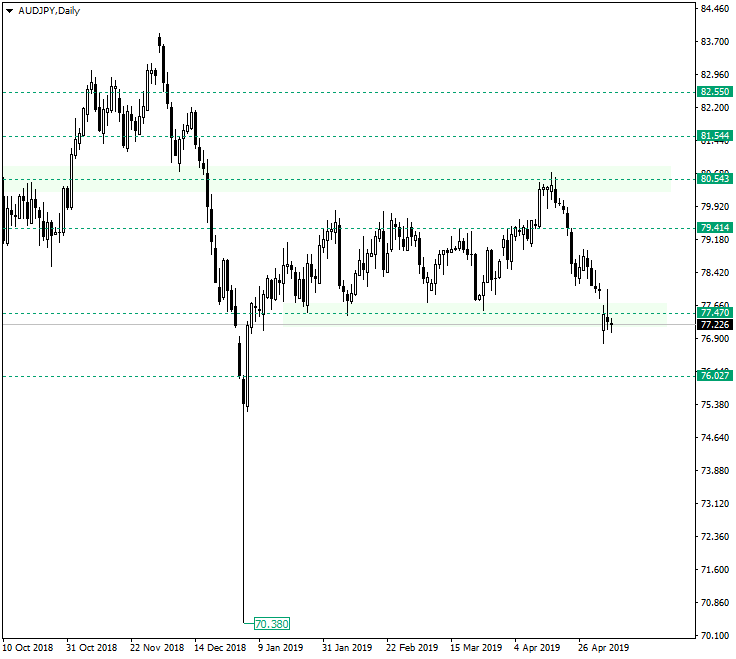

AUD/JPY and the Decision Moment at 77.47

The Australian dollar versus the Japanese yen currency pair followed its course after confirming the 80.54 resistance and dropped to the 77.47 support, an area from which it has to decide where to go next. Long-term perspective After retracing from the 70.38 low on the start of 2019, the pair oscillated between the 79.41 resistance and the 77.47 major support. The resistance looked like is keeping the bulls in check, turning down every attempt that … “AUD/JPY and the Decision Moment at 77.47”

EW Update: USDZAR and EURNZD Into A Retracement, then Up

USDZAR made a clear five-wave rally, so pair remains bullish, but before a bullish continuation, we may see a deeper three-wave a-b-c setback, where ideal support would be around the previous wave »iv« and 14.25 level. USDZAR, 1h EURNZD can be already trading in an a-b-c correction, but wave »c« is still missing, so the … “EW Update: USDZAR and EURNZD Into A Retracement, then Up”

Australian Dollar Gains on RBA Surprise, Trims Gains Later

The Australian dollar jumped today after the nation’s central bank surprised markets, keeping interest rates unchanged. The currency has trimmed its gains by now, though, losing them against the Japanese yen completely. The Reserve Bank of Australia left its main interest rate unchanged at 1.5% during today’s monetary policy meeting. That surprised market participants who were counting on a cut to 1.25%. Yet the statement sounded rather … “Australian Dollar Gains on RBA Surprise, Trims Gains Later”

Euro Drops on Market Sentiment and Weak German Factory Data

The euro today fell against the US dollar as market risk sentiment remained subdued due to the uncertainty associated with the Sino-US trade negotiations. The EUR/USD currency pair also fell due to weak German factory data, which painted a gloomy picture of the eurozone’s largest economy, and the euro area at large. The EUR/USD currency … “Euro Drops on Market Sentiment and Weak German Factory Data”