The Japanese yen is roaring against several of its major currency rivals on Tuesday, buoyed by positive manufacturing numbers. But the gains were slightly capped on concerns over the intensifying trade war between the worldâs two largest economies and what their fallout might mean for Tokyo. Last month, Japanese manufacturing activity expanded for the first time since January as businesses hired more workers amid growing optimism pertaining to the economy, … “Japanese Yen Surges As Manufacturing Returns to Expansion”

Month: May 2019

US Dollar Sideways on Renewed Tariffs on China

The US dollar is trading sideways against several major currencies, suggesting that investors are waiting to see the fallout from an announcement that the White House is raising tariffs on $200 billion on Chinese imports by the end of the week. With data light on the calendar in the coming days, traders are focused primarily … “US Dollar Sideways on Renewed Tariffs on China”

Euro Range-Bound Despite the Release of Upbeat Eurozone Data

The euro today traded in a tight range against the US dollar despite the release of upbeat services PMI data from across the euro area by IHS Markit. The EUR/USD currency pair was weighed down by the risk-off market sentiment triggered by President Donald Trump‘s threat of additional tariffs on Chinese imports over the weekend. … “Euro Range-Bound Despite the Release of Upbeat Eurozone Data”

Can Retail and Institutional Trading Co-exist on the Same Platform?

Traditionally, FX broking and trading companies have kept their retail and institutional clients separate. Sometimes, this has extended to the establishment of individual trading and sales desks for the different types of client. And, more often than not, the deal flow of each type of customer was managed by different IT systems. But is this … “Can Retail and Institutional Trading Co-exist on the Same Platform?”

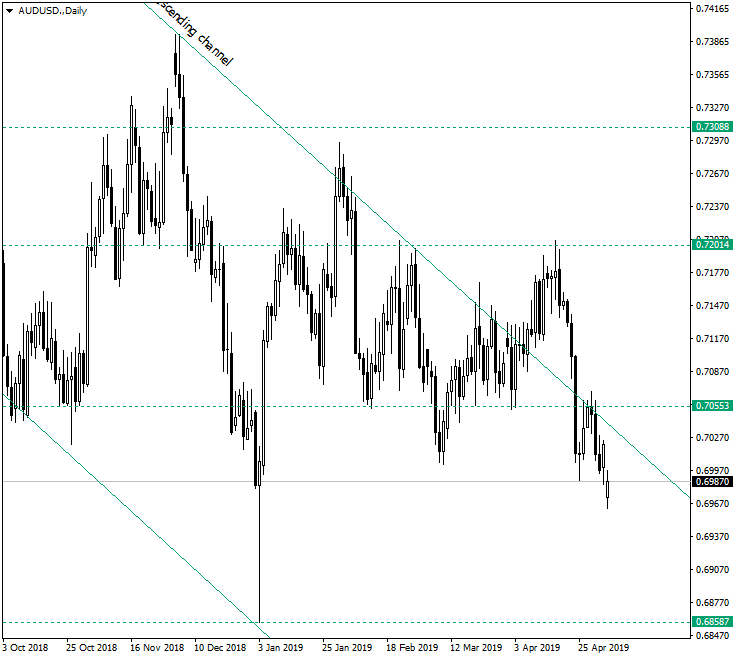

Possibilities After Confluence Confirmation on AUD/USD

The failure of the Australian dollar versus the US dollar currency pair to gain more ground after the rally to 0.7200 resulted in a drop that sent the price back into the descending channel. But still, the bulls could be more motivated than ever. Long-term perspective The resistance line of the descending channel that can be drawn by uniting the highs of January 31, 2018, and December 4, 2018, was finally pierced on April 8, … “Possibilities After Confluence Confirmation on AUD/USD”

Accelerating Consumer Inflation Fails to Bolster Euro

While the euro managed to rebound against the US dollar today, the shared 19-nation currency remained soft against other most-traded rivals. Consumer inflation beat expectations, but that failed to bolster the currency. One of the possible reasons for the euro’s weakness was the unexpected decline of producer prices. Eurostat reported that eurozone annual consumer inflation was expected to be at 1.7% in April. That is compared to the analysts’ median forecast of 1.6% … “Accelerating Consumer Inflation Fails to Bolster Euro”

Pound Drops on Brexit News, Rallies on Weak US Services PMI

The Sterling pound today fell to its daily lows in the early London session after it emerged that the UK government had made little progress in cross-party Brexit talks. The GBP/USD currency pair later rallied higher in the American session following the release of weak US non-manufacturing/services PMI and ignored the upbeat US jobs data. The GBP/USD currency pair today rallied from a low of 1.2987 to a high of 1.3110 in the American session and was … “Pound Drops on Brexit News, Rallies on Weak US Services PMI”

US Dollar Surges on Strong April Jobs Report

The US dollar is surging to finish the trading week, buoyed by an incredible April jobs report and other data that suggests the economic slowdown worries may be unfounded after all, even with some weak pockets. The greenback is making solid gains against multiple currencies on Friday. According to the Bureau of Labor Statistics (BLS), the US economy added 263,000 new jobs, driving the unemployment rate to a 49-year low of 3.6%, … “US Dollar Surges on Strong April Jobs Report”

Swiss Franc Soft as Consumer Sentiment Deteriorates

The Swiss franc managed to gain on the euro today but was generally soft against other currencies. The deteriorating consumer sentiment was not helping the Swissie at all. The State Secretariat for Economic Affairs reported that the consumer sentiment index fell to -6 in April from -4 in March. Analysts were expecting a slight improvement to -3. The Federal Statistical Office reported that the Consumer Price Index rose 0.2% in April from the previous … “Swiss Franc Soft as Consumer Sentiment Deteriorates”

NFP opens the door to further USD gains

US Non-Farm Payrolls are more than good enough. The Fed’s unwillingness to cut interest rates has been vindicated. In currency markets, the greenback has more room to rise. America is hiring: 263K jobs were gained in April, above 185K expected but closer to the ADP NFPprivate sector number of 275K. Wages came out at a tad … “NFP opens the door to further USD gains”