The Australian dollar fell intraday but has recovered by now as markets were waiting for US nonfarm payrolls. Meanwhile, macroeconomic data in Australia was not good, which can explain the initial fall of the currency. The Australian Bureau of Statistics reported that the seasonally adjusted number of building approvals slumped by 15.5% in March from the previous month after climbing 19.1% in February. That is compared to the forecast drop of 12.5%. The Australian Industry … “Australian Dollar Recovers After Falling on Poor Data”

Month: May 2019

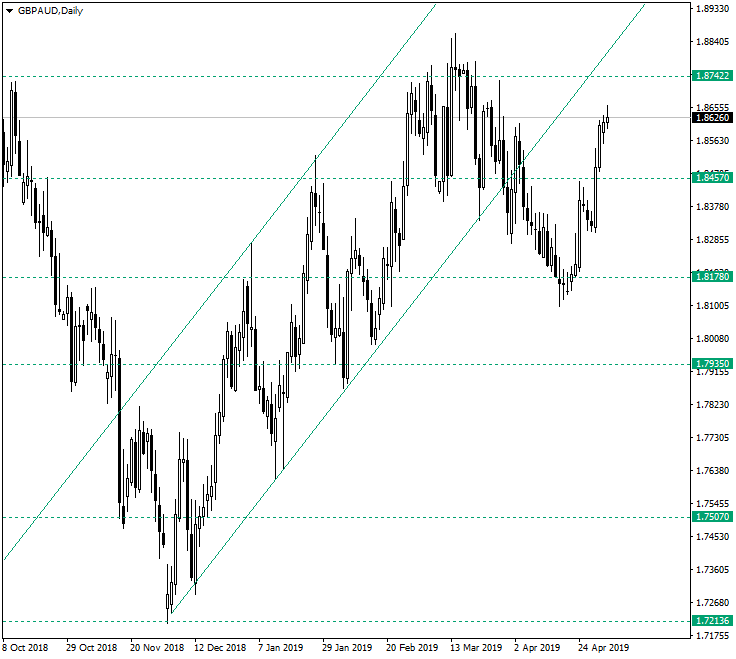

The Bulls Are Still in Charge on GBP/AUD

Last month, the Great Britain pound vs. the Australian dollar looked as if it was poised for a drop, but now it seems that the bulls are the ones who manage things. Long-term perspective After piercing the support of the trend that started at 1.7213 and the 1.8457 support level (an important confluence area), the price began on April 4, 2019, a decline that could make anyone think that the bears took control. … “The Bulls Are Still in Charge on GBP/AUD”

Mexican Peso Weakens As Economy Contracts In Q1, AMLO Dismisses Concerns

The Mexican peso weakened against a basket of currencies towards the end of the trading week after the economy contracted in the first quarter. Despite the deceleration across the country, the peso is still one of the best performing currencies so far this year. Could it hold up after a plethora of forecasts suggest the Mexican economy is in store for a rough period? In the first quarter, the gross domestic product (GDP) fell 0.2% as services activity slipped, … “Mexican Peso Weakens As Economy Contracts In Q1, AMLO Dismisses Concerns”

Euro Falls to New 3-Day Lows Against a Resurgent Dollar

The euro today fell to new 3-day lows against the resurgent US dollar as investors bought the world’s reserve currency with positive expectations. The EUR/USD currency pair extended yesterday’s fall, which was triggered by the FOMC‘s positive outlook for the US economy. The EUR/USD currency pair today fell from a high of 1.1219 in the early European session to a low of 1.1171 in the … “Euro Falls to New 3-Day Lows Against a Resurgent Dollar”

British Pound Drops Despite Balanced BoE Interest Rate Decision

The British pound today fell against the US dollar after the Bank of England left its monetary policy unchanged and exhibited confidence in Britain’s economy. The GBP/USD currency pair had rallied higher earlier today amid rumors that Theresa May was willing to relax her tough stand on a customs union with the EU in order … “British Pound Drops Despite Balanced BoE Interest Rate Decision”

Swiss Franc Soft After Disappointing Macroeconomic Releases

The Swiss franc was soft today following the release of disappointing macroeconomic data in Switzerland. The Swiss Federal Statistical Office reported that retail sales dropped 0.7% in March compared with the previous year. That was a bigger drop than experts had predicted — 0.5%. On a positive side, the February reading was revised from a drop by 0.2% to no change. The manufacturing Purchasing Managers’ Index dropped to 48.5 in April from 50.3 … “Swiss Franc Soft After Disappointing Macroeconomic Releases”

Australian Dollar Recovers After China’s Disappointing Data

The Australian dollar demonstrated the same performance as its New Zealand counterpart — rising a bit today after yesterday’s big slump. Unlike the kiwi though, the Aussie did not have negative domestic economic data to explain the decline. Perhaps, the currency continued to fall after disappointing macroeconomic releases in China on Tuesday. Update: currently, the Aussie has lost its gains. Released on April 30, China’s official manufacturing Purchasing Managers’ Index … “Australian Dollar Recovers After China’s Disappointing Data”

GBP/USD is back to focusing on Brexit

The BOE has left its policy unchanged in a unanimous vote, as expected. They strike a balance between positives and negative, seeming keen not to rock any boat. GBP/USD is back to focusing on Brexit, with cross-party talks in the limelight. Does the Bank of England want to stay in the shadows? This is the … “GBP/USD is back to focusing on Brexit”

NZ Dollar Edges Higher After Wednesday’s Slump

The New Zealand dollar edged higher today following yesterday’s huge slump even though macroeconomic data released during today’s trading session was negative. The plunge during the previous session was caused by worse-than-expected jobs data. Statistics New Zealand released a report on building consents, showing a drop by 6.9% in March on a seasonally adjusted basis. The drop followed the increase by 1.7% in February. Released yesterday, the employment report showed that … “NZ Dollar Edges Higher After Wednesday’s Slump”

5 positive dollar drivers from Powell, and why it can continue

Powell triggered a massive turnaround in the USD with his upbeat comments. There are five reasons why it happened and three to justify another drive higher. The Fed has fired up markets, but and they continue burning. After the FOMC statement had been balanced and consisted of a technical cut to the IOER, Fed Chair … “5 positive dollar drivers from Powell, and why it can continue”