The euro today fell against the US dollar despite pro-EU parties securing majority of the Parliamentary seats in the recently concluded election. The EUR/USD currency pair today fell from its Asian session highs and dropped to daily lows where it traded sideways for the rest of the day. The EUR/USD currency pair today fell from … “Euro Drops Despite Pro-EU Parties Retaining Majority in EU Elections”

Month: May 2019

BOC: USD/CAD set to move on 3 factors

The Bank of Canada is set to leave interest rates unchanged at 1.75%. Investors will look for hints for the next change in interest rates. The bank’s opinions on interest rates, the recent jobs report, and comments on trade will play a key role. Trading the Canadian dollar has not been easy of late as … “BOC: USD/CAD set to move on 3 factors”

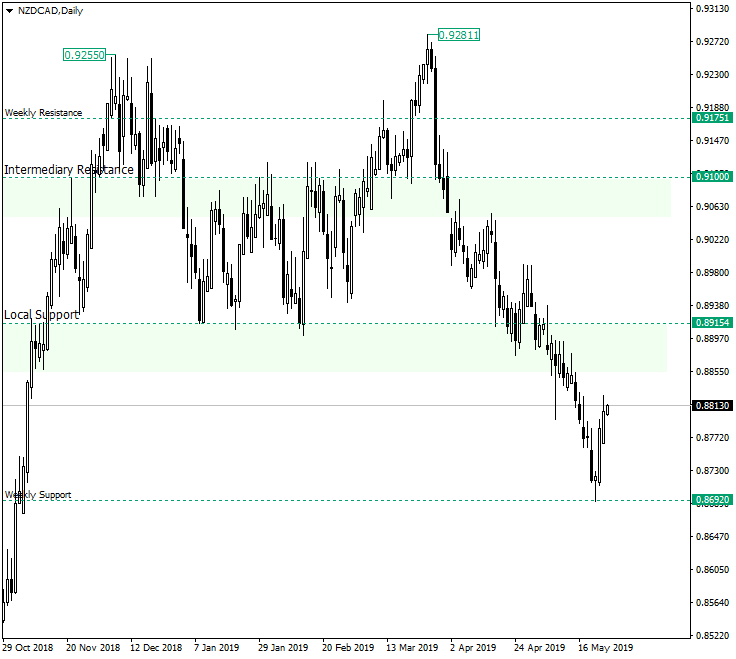

Bulls Back in the Loop on NZD/CAD

The New Zealand dollar versus the Canadian dollar appreciated after confirming the important weekly 0.8692 support. Long-term perspective After the drop from 0.9811, that began as the bulls were not able to keep the gains above 0.9175, the price reached the 0.8692 important support area, an area that on the weekly chart shows its strength by keeping in check most of the bearish endeavors of driving the prices under it. Given the will of the bulls to keep … “Bulls Back in the Loop on NZD/CAD”

US Dollar Ends Week Second Weakest After Great Britain Pound

The US dollar was one of the weakest currencies during the past trading week due to escalation of the trade war between the United States and China. While the greenback usually thrives in the environment of risk aversion, that was not the case this time. The weakest currency was the Great Britain pound, though. The trade war escalated after Chinese trade giant Huawei was banned from using Google services. The resulting risk aversion … “US Dollar Ends Week Second Weakest After Great Britain Pound”

Pound Falls As Theresa May Set to Resign on June 7, Later Recovers

The British pound today fell from daily highs after the British Prime Minister Theresa May announced that she would step down on June 7 from her post as party leader. Her decision took investors by surprise given that she had stood her ground before in the face of fierce opposition from within her party and the opposition for a long time. The GBP/USD currency pair today fell … “Pound Falls As Theresa May Set to Resign on June 7, Later Recovers”

US Dollar Strengthens on Initial Jobless Claims, Fed Minutes

The US dollar is strengthening against a few currencies at the end of the trading week, buoyed by another decline in initial jobless claims and a central bank that is unlikely to do anything on interest rates. But disappointing housing numbers put a cap on the buckâs ascent. According to the Bureau of Labor Statistics … “US Dollar Strengthens on Initial Jobless Claims, Fed Minutes”

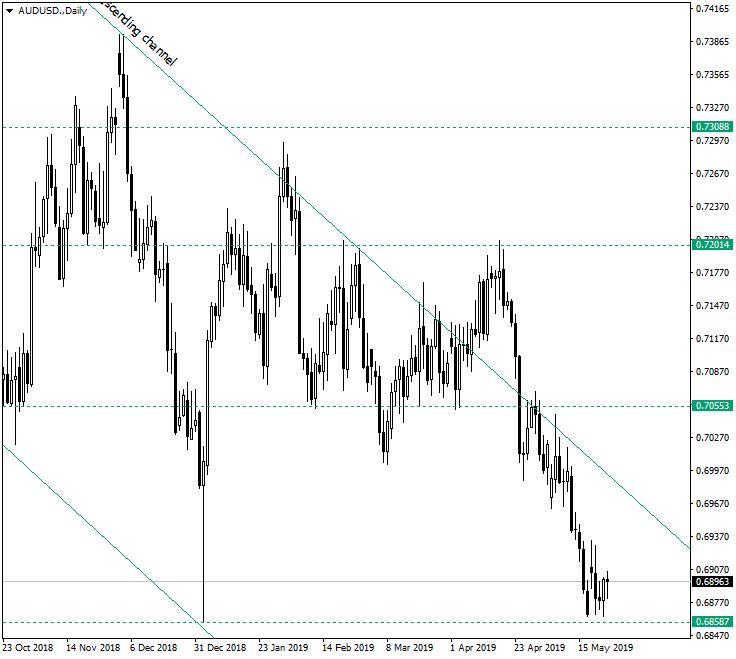

AUD/USD at the Important 0.6858 Historical Level

The Australian dollar versus the US dollar currency pair consolidates just above the major support represented by 0.6858. So, what will happen here decides the fate of the pair for quite some while from now on. Long-term perspective The price is contained in the descending channel that started on January 2018, and the last depreciation brought the price at 0.6858. The importance of this level is backed by two factors. The first one is that … “AUD/USD at the Important 0.6858 Historical Level”

GBP: Market Focus Already Turning To What Happens After PM May – MUFG

The pound dropped quite a lot as a result of political turmoil and the and the specter of seeing Boris Johnson in No. 10. What’s next? Here is their view, courtesy of eFXdata: MUFG Research discusses GBP outlook in light of the latest Brexit developments. “The pound continues to remain under heavy selling pressure in … “GBP: Market Focus Already Turning To What Happens After PM May – MUFG”

Yen Strong as Trade Wars Continue to Hurt Market Sentiment

The Japanese yen climbed against most major currencies today as the trade war between the United States and China continued to cause risk aversion on markets. Japan’s macroeconomic data was disappointing, but as it often happens, the currency paid little attention to domestic economic reports. China yet again blamed the USA for the failure of trade negotiations as Ministry of Commerce spokesperson Gao Feng said today: If the US would like to keep … “Yen Strong as Trade Wars Continue to Hurt Market Sentiment”

Canadian Dollar Weakens as US-China Trade War Overshadows Upbeat Data

The Canadian dollar is weakening against several major currency rivals as investor fears over the escalation in the US-China trade war overshadowed upbeat economic data. Despite the disappointing performance midway through the second quarter, the loonie is still in positive territory on the year. On the sales front, it was expansion across the board. According to Statistics Canada, retail sales rose 1.1% in March, up from 1% in February. March automobile sales … “Canadian Dollar Weakens as US-China Trade War Overshadows Upbeat Data”