The Australian dollar sank today after the central bank signaled that it may cut interest rates at its next monetary policy meeting. While market participants were already expecting a rate cut in the near future, the confirmation of the dovish outlook still hurt the currency. The Reserve Bank of Australia released today minutes of the monetary policy meeting that happened two weeks ago. While no change to monetary policy was … “Aussie Tanks, Driven Down by Prospects for Interest Rate Cut”

Month: May 2019

May’s deal may not be enough and GBP/USD could fall back down

PM May will present a new Brexit deal her cabinet has discussed. Sterling jumped on hopes that this time it can pass. The past shows that parliament is not keen on approving an accord. GBP/USD seemed to have ended its losing streak. After hitting a new four-month low at 1.2685, cable is currently trading closer to … “May’s deal may not be enough and GBP/USD could fall back down”

Surprising Growth of Japanese GDP Doesn’t Help Yen

The performance of the Japanese yen was not impressive today despite a surprisingly good report about Japan’s economic growth. The currency fell versus the Swiss franc and was about flat against most other major rivals. Japan’s gross domestic product rose 0.5% in the first quarter of this year from the previous three months. That is compared to the forecast decline by 0.1%. Yet diving deeper into the report reveals that … “Surprising Growth of Japanese GDP Doesn’t Help Yen”

Australian Dollar Fails to Keep Rally Caused by Election Surprise

The Australian dollar opened sharply higher on Monday after the unexpected outcome of the election held over the weekend. But analysts were unconvinced by the rally, and indeed the Aussie has trimmed its gains by now, losing them outright against many rivals. While not all the votes have been counted yet, it seems that the conservative coalition led by Australian Prime Minister Scott Morrison won the Australian federal election. Furthermore, … “Australian Dollar Fails to Keep Rally Caused by Election Surprise”

Euro Rises Despite Trade Jitters As the Dollar Falls on Weak US Data

The euro today rallied higher against the US dollar in the European and American sessions reversing five consecutive losing sessions to trade slightly higher. The EUR/USD currency pair today reversed Asian session losses and rallied higher boosted by positive German data and the greenback’s weakness after hitting a key resistance zone. The EUR/USD currency pair today rallied from a low of 1.1148 in the Asian session to … “Euro Rises Despite Trade Jitters As the Dollar Falls on Weak US Data”

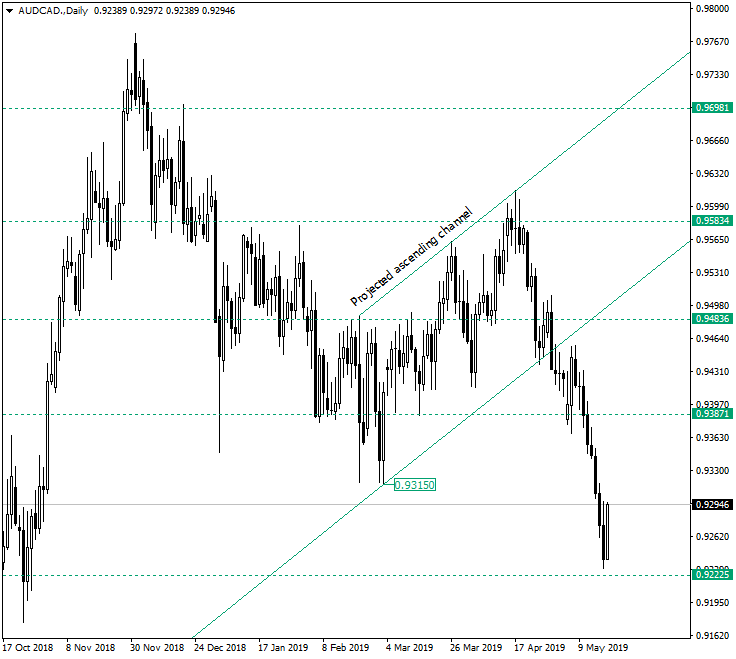

AUD/CAD at the Major Support of 0.9222

The Australian dollar versus the Canadian dollar currency pair declined sharply and the first signs of slowing down occurred only around the 0.9222 support level. Long-term perspective The price started an ascending move from the 0.9315 low on March 1, 2019, that was stalled by the resistance at 0.9583. From there the price descended and tried to confirm 0.9483 as support, but it did not manage to and pierced the support trendline of the ascending channel. One … “AUD/CAD at the Major Support of 0.9222”

USD/CAD: Reversion & Seasonals Point To USD/CAD Upside Risk Through 1.36 – BofAML

USD/CAD has mixed forces pulling it to all directions. What are the levels to watch? Here is their view, courtesy of eFXdata: Bank of America Merrill Lynch Global Research discusses USD/CAD outlook and maintains a bullish bias, on the back of unsustainable Fed vs. BoC policy pricing and bullish seasonals. “Since early last year, there have … “USD/CAD: Reversion & Seasonals Point To USD/CAD Upside Risk Through 1.36 – BofAML”

USD/JPY recovery capped as trade wars escalate

USD/JPY has managed to stabilize despite further blows in the trade war. The Fed meeting minutes, durable goods orders will join the trade concerns in moving markets. The technical outlook remains bearish for the currency pair and experts are bearish in the short term. What just happened: Chinese retaliation, Huawei Another week, another escalation in … “USD/JPY recovery capped as trade wars escalate”

GBP/USD may extend its falls as PM Johnson is feared

GBP/USD dropped sharply as PM May is getting closer to leaving. Apart from Brexit, US-Sino trade relations, and UK inflation stand out. The technical outlook is now fully bearish for the currency pair. Experts are mostly bullish after the fall. What just happened: The beginning of June is the end of May UK PM Theresa … “GBP/USD may extend its falls as PM Johnson is feared”

Chinese Yuan Slumps As FDI Slips, Housing Prices Lower Than Expected

The Chinese yuan is slumping against many major currencies at the end of the trading week. The yuan, which has plummeted in the wake of the escalation in the US-China trade war, rebounded on bullish economic data midweek but has since retreated on disappointing numbers. According to the Ministry of Commerce, foreign direct investment (FDI) advanced 6.2% in April, down from 6.5% in March. So far this year, China has recorded FDI gains in every … “Chinese Yuan Slumps As FDI Slips, Housing Prices Lower Than Expected”