The Sterling pound today fell to new 4-moth lows against the US dollar as cross-party Brexit talks collapsed ahead of Theresa May’s impending resignation. The Labour Party officially called off the talks saying that there was no need to negotiate with a government that was about to collapse. The GBP/USD currency pair today fell from … “Pound Crashes to 4-Month Lows As Brexit Talks End Without a Deal”

Month: May 2019

Boris Johnson may do a De-Gaulle on Brexit

UK PM May is set to step down and Boris Johnson is the leading candidate to replace her. The erratic former Foreign Secretary may increase GBP/USD volatility. Despite his Brexit credentials, he could still lift the pound. After a tear-provoking meeting with her backbenchers, UK PM Theresa May pledged to set a date for her … “Boris Johnson may do a De-Gaulle on Brexit”

NZ Dollar Fails to Hold Ground in Face of Risk Aversion

While the New Zealand dollar was attempting to rally earlier today despite risk aversion prevailing on the market, currently the kiwi has retreated, trading below the opening level against many of its most-traded rivals. Domestic macroeconomic data did nothing to help the currency of New Zealand. Statistics New Zealand reported that the Producer Price Index input fell 0.9% in the March quarter after rising 1.6% in the previous three months. … “NZ Dollar Fails to Hold Ground in Face of Risk Aversion”

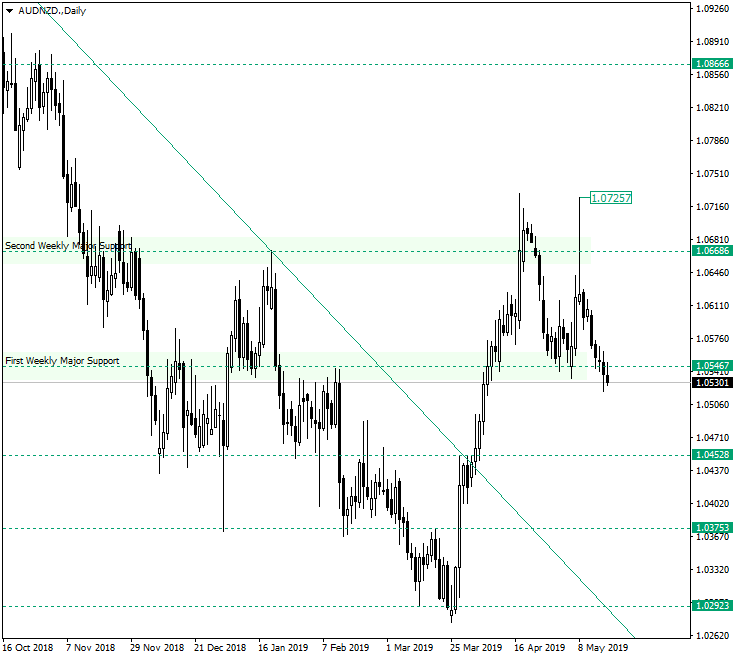

AUD/NZD Looks Bearish

The Australian dollar vs. New Zealand dollar looks to be poised for a bearish move, even if the descending trend told a different story. Long-term perspective The descended trend, that began at 1.10000 end extended until 1.0292, ended after the piercing of the double resistance area consolidated by the resistance trendline of the descending trend and the 1.0452 level. The price made a very bullish move, reaching 1.0668 with no corrections. But this, in itself, … “AUD/NZD Looks Bearish”

Euro Falls to 9-Day Lows on Trade Concerns and Positive US Data

The euro today fell to 9-day lows against the US dollar in the American session following the release of upbeat US data and a rally in US equity markets. The EUR/USD currency pair attempted to rally earlier today following upbeat trade headlines regarding the eurozone, but the rally quickly fizzled out. The EUR/USD currency pair today … “Euro Falls to 9-Day Lows on Trade Concerns and Positive US Data”

Mexican Peso Weakens Despite Nearing Repeal of US Steel Tariffs

The Mexican peso is weakening against several major currencies toward the end of the trading week. Despite senior officials claiming that they are close to striking a deal that would see the US repeal its tariffs on steel and aluminum from Mexico, the peso was unable to take advantage. This could show that traders are … “Mexican Peso Weakens Despite Nearing Repeal of US Steel Tariffs”

Australian Dollar Falls After Unemployment Rate Rises

The Australian dollar fell today following the release of employment data. While the report had both positive and negative parts, markets preferred to focus on the negative ones. Additionally, the monetary policy outlook worsened. The Australian Bureau of Statistics reported that the number of employed people rose by 28,400 in April, which exceeded the consensus forecast of a 15,200 increase. But the growth was due to part-time jobs, while the number of full-time jobs decreased. The participation rate … “Australian Dollar Falls After Unemployment Rate Rises”

Loonie Dips Intraday on Inflation Data, Recovers to Settle Higher

The Canadian dollar declined intraday as some of Canada’s inflation indicators missed expectations. But the currency rebounded later, ending the Wednesday’s trading session above the opening level. Statistics Canada reported that the Consumer Price Index rose 0.4% in April from the previous month and 2.0% from a year ago, without adjustments for seasonal variations. That was within expectations. But some of the Bank of Canada preferred measures of core inflation missed … “Loonie Dips Intraday on Inflation Data, Recovers to Settle Higher”

Swiss Franc Retreats From Safe-Haven Bolster As Foreign Investment Declines

The Swiss franc is sliding against some of its major currency rivals midweek. For the last week, the franc has been advancing as investors seek out safe-haven assets during the escalation in the US-China trade spat. The franc has ostensibly come back down to earth on recent economic data. Switzerland has witnessed foreign direct investment slump in the last year, says a new report. According to the 2019 AT Kearney Foreign Direct Investment … “Swiss Franc Retreats From Safe-Haven Bolster As Foreign Investment Declines”

Yen Rallies Against the Dollar on Weak US Retail Sales, Later Drops

The Japanese yen today rallied against the US dollar driven by the risk-off sentiment, which dominated markets from the early European session. The USD/JPY currency pair extended its losses in the early American session following the release of disappointing US retail sales report. The USD/JPY currency pair today fell from a high of 109.69 in … “Yen Rallies Against the Dollar on Weak US Retail Sales, Later Drops”