The Australian dollar was under pressure today from the wage inflation miss. News from China did not do the currency any favors either. The Australian Bureau of Statistics reported that the Wage Price Index rose 0.5% in the March quarter from the previous three months, the same as in the December quarter. Economists had promised a bit bigger inflation of 0.6%. The Westpac-Melbourne Institute Index of Consumer Sentiment rose 0.6% in May. That … “Aussie Under Pressure from Wage Inflation Miss, Chinese News”

Month: May 2019

Euro Hits New Weekly Lows on Mixed Eurozone Q1 GDP Data

The euro today fell to new lows against the US dollar following the release of disappointing German and eurozone GDP growth data in the early European session. The EUR/USD currency pair failed to rally higher following the release of weak US retail sales data in the early American session as investor risk appetite remained subdued. … “Euro Hits New Weekly Lows on Mixed Eurozone Q1 GDP Data”

Chinese Yuan Suffers from Poor Data, Sino-US Trade Quarrel

The Chinese yuan declined against the US dollar today after almost all Chinese macroeconomic indicators released today missed expectations. The developments in the US-China trade negotiations were not good for the currency as well. The National Bureau of Statistics of China reported that fixed asset investment rose 6.1% in the first four months of this year. That is compared to the 6.3% increase logged in the previous reporting period and 6.4% predicted by analysts. Industrial … “Chinese Yuan Suffers from Poor Data, Sino-US Trade Quarrel”

Could the FED Change Interest Rates in 2019?

On March 20th, the FOMC (Federal Open Market Committee) decided to keep the key interest at the same 2.25-2.5% levels. The move was in line with the market’s expectations, and the US central bank also announced that there won’t be any additional rate hikes this year, due to weakening economic conditions. QT ending in September … “Could the FED Change Interest Rates in 2019?”

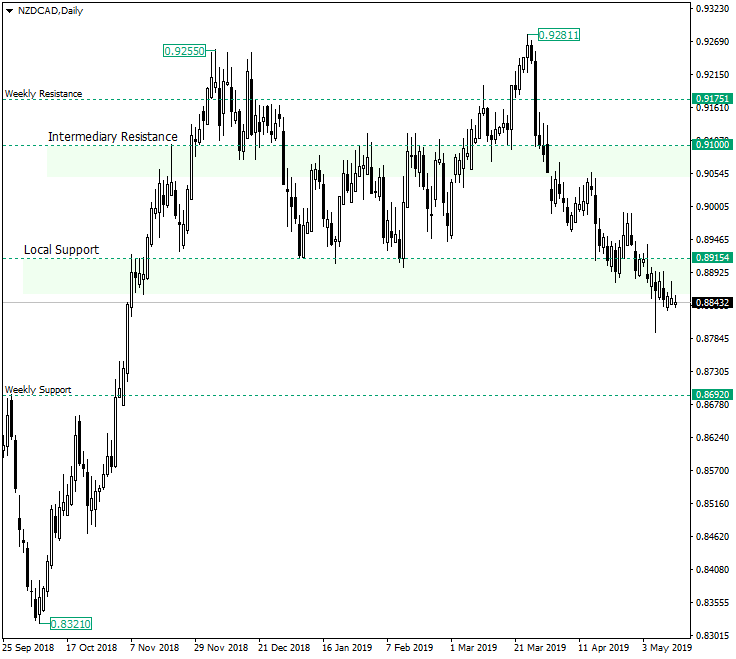

Bulls Vanquished on NZD/CAD

In font of a big chance, the bulls were not able to manage the situation on the New Zealand dollar versus the Canadian dollar and missed out the opportunity to direct the price towards the previous high, at 0.9281. Long-term perspective As the pair advanced from the 0.8321 low, the price formed a consolidation structure with the local support at 0.8915. It then tried to gain ground above the 0.9175 weekly resistance, but after making a high at 0.9281 the price was … “Bulls Vanquished on NZD/CAD”

Euro Fails to Rally amid US-China Trade Spat, Macroeconomic Data Doesn’t Help

The euro attempted to rally today but reversed movement against most of its rivals later, erasing gains against some of them outright. Traders remained cautious about the ongoing US-China trade conflict, while mixed macroeconomic data was not helping the currency either. The day started with a positive data in Germany as Destatis reported that the consumer price index rose 1.0% in April from the previous month — the same as in March … “Euro Fails to Rally amid US-China Trade Spat, Macroeconomic Data Doesn’t Help”

Pound Soft After Mixed Employment Data

The Great Britain pound was generally soft today, dragged down mostly by the market sentiment. Domestic employment data was mixed, providing both positive and negative surprises, and therefore giving no help for the currency in finding direction. The Office for National Statistics reported that the unemployment rate fell to 3.8% in the three months through March from 3.9% in the previous reporting period. That was the lowest level of unemployment since October-December 1974. … “Pound Soft After Mixed Employment Data”

US Dollar Rebounds As Markets Recover From Trade War Fallout

The US dollar is rebounding on Tuesday as global financial markets recover from the latest development in the US-China trade war. Despite trade war fears dampening the US economy, experts say that America holds the upper hand because of how strong it is performing. Investors are also combing through recent trade pricing data. International equities were rocked on Monday after Beijing confirmed it was retaliating … “US Dollar Rebounds As Markets Recover From Trade War Fallout”

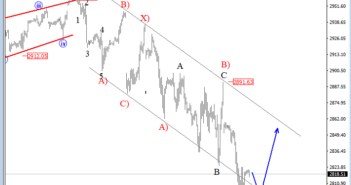

Elliott wave Analysis: DAX, The S&P500 and XXX/JPY Pairs Having a Great Connection; A Bullish Reversal in View

Stocks are lower, still in search of support. We see German Dax reaching a very interesting area around 11800 where bears may slow down as second zigzag seems very similar in a distance of the first zigzag. Ideally, there will be a strong bounce from that area, but it should be in impulsive fashion to … “Elliott wave Analysis: DAX, The S&P500 and XXX/JPY Pairs Having a Great Connection; A Bullish Reversal in View”

Pound Declines on Market Sentiment, Brexit Uncertainties

As many other currencies, the Great Britain pound declined on Monday. While the negative market sentiment was the major reason for the decline, domestic news was not good as well. The mood of market participants was gloomy today due to the trade spat between the United States and China. While the sterling is usually less susceptible to bad news from China as Britain does not have strong trading ties with the Asian nation, … “Pound Declines on Market Sentiment, Brexit Uncertainties”