The Australian dollar versus the US dollar is just in the right spot for the bears to begin a new descent.

Long-term perspective

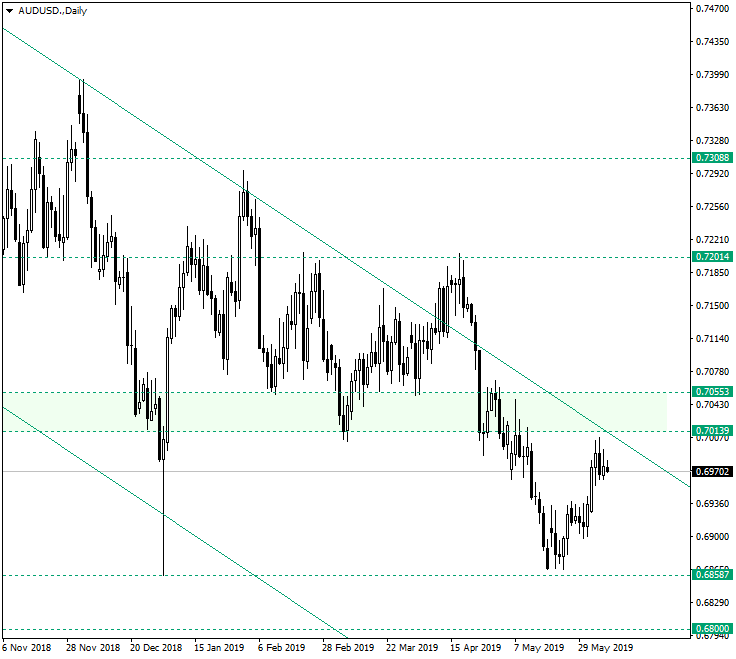

It seems like the price is in a well defined resistance zone and in a well suited shape for a move to the south to occur. The resistance zone is etched by the trendline projected after uniting the highs of February 16, 2018, and December 3, 2018, respectively, and by the area confined to 0.7055 and 0.7013. To this, a bearish pattern adds — a bearish engulfing on 5 June.

So, the price is in the right place and shape, but the time could or could not be, as major economical news will come out later today: the Non-Farm Employment Change.

Given this variables, the first target for a descend is 0.6858, followed by 0.6800 psychological level. This scenario could play out as a continuation of the current descent or after a failed attempt to pierce the resistance. In the event of the bulls managing to confirm 0.7055 as support, 0.7200 will become a prime target.

Shot-term perspective

The ascending channel that started after the confirmation of 0.6865 as support extended until the 0.7003 resistance. The upper line of the channel has been pierced, as price extended to the aforementioned resistance, only for the price to fall under and confirm it as a resistance on June 6. This points to the fact that a correction phase is underway.

The support line of the current correction phase starts from the low of 0.6955. As long as it holds, upwards movements are favored, scoping 0.7047. If it gives way, then the correction may progress towards the lower line of the channel and the 0.6935 support level. If the price crosses this area, then further decline towards 0.6865 is to be expected.

Levels to keep an eye on:

D1: 0.7055 0.7013 0.6858 0.6800

H4: 0.7003 0.6935 0.6865

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.