- The pound has been suffering from a poor GDP read for April.

- A bitter disappointment in the same month’s jobs report may be on the cards.

- GBP/USD may be unprepared for this outcome, potentially extending its falls.

UK economic output has already been hit from Brexit uncertainty – and the job market may suffer the same fate. UK GDP dropped by 0.4% in April, far worse than 0.1% that was expected. Manufacturing production was hit hardest with a plunge of 3.9% in April.

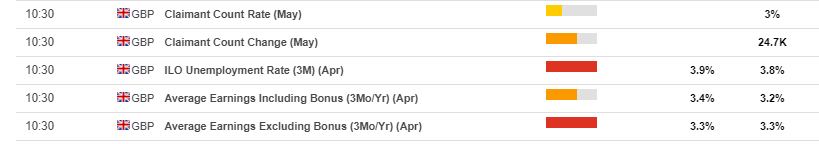

Economists expect the unemployment rate to rise from the historic low of 3.8% in March to 3.9% in April, but that may be too optimistic – as the drop in output may have already triggered a substantial loss of jobs.

And while trends in employment lag behind the economic activity, stockpiling towards Brexit – which was supposed to happen on March 29th – may have likely triggered a “payback effect” in April. The staff that was hired in March ahead may have been laid off as early as April.

Moreover, the claimant count change rose in April by 24,700 and this increase may affect the jobless rate. Unemployment benefits have been on the rise for many months while the jobless rate continued falling – this anomaly may now come to an end – perhaps worse than expected.

Expectations for wages also seem too high. Average earnings growth has decelerated to 3.2% in March and is now projected to rise back to 3.4% – the optimism seems unwarranted.

Overall, there is a higher chance of a disappointment than an upside surprise.

GBP/USD positioning

The pound has been unable to capitalize on the weakness of the US dollar – exposing its weakness. Other currencies such as the euro have been able to hold onto their gains against the greenback despite its own issues.

Sterling also looks vulnerable to recent political developments. The contest in the Conservative Party has kicked off with candidates competing to show who is tougher on Brexit – something that markets are not fond of. In addition, some insist that the EU may accept an accord without the thorny issue of the Irish backstop – also seemingly disconnected from reality.

Conclusion

Expectations for the UK jobs report seem too high after the weak GDP numbers. GBP/USD has exposed its vulnerability and may extend its falls on a disappointing outcome.

The UK jobs report is published on Tuesday, June 11th, at 8:30 GMT.

Get the 5 most predictable currency pairs