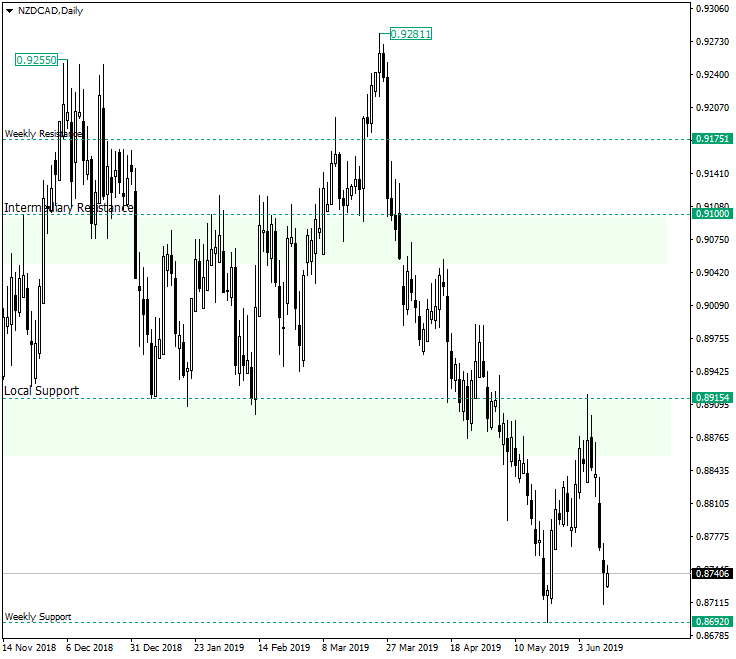

NZD/CAD to Test the Important 0.8692 Weekly Level

The pair could have a place to recover from, but the current context might just favor the continuation of the descent.

Long-term perspective

The New Zealand dollar versus the Canadian dollar currency pair looks as if it does not have enough steam to initiate and fuel a rally.

Since the high at 0.9281, after which it came beneath two important levels that could have been confirmed as supports — the weekly resistance of 0.9175 and the intermediary resistance of 0.9100 — the price was in a convinced downwards move. The only exception was the appreciation that started on May 22, 2019, when 0.8692 was confirmed.

Considering that 0.8692 is a weekly support, the appreciation should have been able to extend beyond an intermediary — or local — support, such as 0.8915. This fact, coupled with 0.9281 being a higher-high — with regards to the previous peak of 0.9255 — that the bullish message of which was invalidated by the missed opportunity of the descent to print a higher-low, point to the conclusion that the pair is not ready for a rally and that the piercing of 0.8692 is just a matter of time, with the first target at 0.8600.

Short-term perspective

After breaking the double support of the ascending move, constituted by the lower trendline and the 0.8825 support level, the price continued downwards, piercing the support of 0.8782 and reentering the main descending move, the resistance of which can be etched by uniting the highs of April 1, 2019, and April 16, 2019.

As long as the price is contained within the descending move and under 0.8782, moves to the south are to be expected, with a fist target at 0.8691, followed by 0.8600.

Levels to keep an eye on:

D1: 0.8692

H4: 0.8716 0.8782

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.