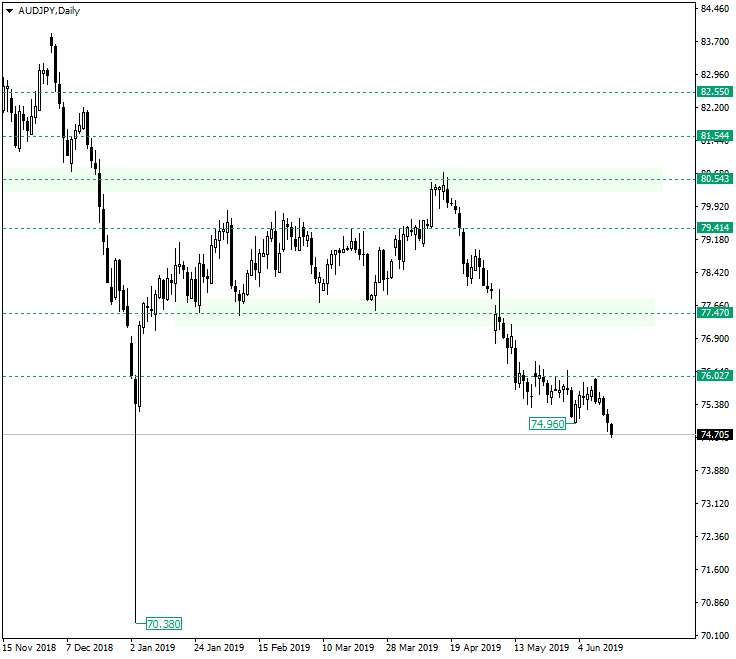

By confirming 76.00 as resistance and revisiting 74.96 the price opens the door to very interesting possibilities.

Long-term perspective

The Australian dollar versus the Japanese yen currency pair managed to print on June 10, 2019, a bearish engulfing pattern in a very sensitive area: the 76.00 psychological level. This pattern came after a consolidation phase that formed, of course, under the level. In other words, it was the trigger that the bears were searching for.

The descent had no obstacles as it passed beyond the previous low at 74.96 and, by doing so, erased the bullish hopes for a reversal pattern. The move — and the bearish profile — will remain valid as long as the price does not cross back above the 74.96 low, which corresponds to a psychological level: 75.00. The next targets are represented by subsequent psychological levels.

If the price manages to consolidate above the 75.00 level, then the situation will turn to neutral, as a break of the 76.02 resistance or the support around 74.60 is to decide the direction.

Short-term perspective

The price is in a downwards move and limited by a support trendline. Further move to the south could be limited by this line and lead to a consolidation phase.

As long as the price sits beneath 94.96 — or falsely pierces it — further decline is to be expected. Like in the case of the long-term perspective, subsequent targets are represented by psychological levels.

Levels to keep an eye on:

D1: 75.00 76.02

H4: 74.96 75.33 75.62

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.