What just happened: Trade wars continue

USD/JPY has been torn by two opposing forces. The US dollar has been downed by weak US core inflation – 2.0% against 2.1% in May – raising the chances of a rate cut by the Federal Reserve. The data undermines the Fed’s assertion that slow inflation in the first quarter was only transitory.

Late in the week, US retail sales beat expectations with the control group rising by 0.5% in May. Moreover, April’s data was revised to the upside with changes of 0.4% or 0.5% to all measures.

On the other hand, the safe-haven Japanese yen has gained ground on as trade wars have intensified once again. President Donald Trump has said that there is no deadline for imposing tariffs on China and that it is all in his head. He has also threatened to slap duties if Chinese President Xi Jinping does not meet him at the G-20 summit at the end of the month. Chinese officials have also been on the offensive – saying they will “fight until the end.”

Outside the main US-Sino trade front, the US has reached an agreement with Mexico that would stem migrant inflows to the US and thus removed the menace of levies on its southern neighbor. However, the administration is unhappy with Germany’s plan to move forward with the controversial Nord Stream 2 pipeline – increasing the dependency on Russia – and tariffs are on the cards for Europe as well.

The yen attracted flows also due to other adverse developments. The clash between the nations has spilled over to Hong Kong – which has seen massive protests against a law that would allow extradition to China. The fight over values of the city-state has been tied to the broader US-Sino tensions. A Japanese oil tanker has been attacked in the Persian Gulf while Japanese PM Shinzo Abe was visiting Iran – and sent oil prices higher.

In Japan, revised data now shows that the economy grew by 0.6% in the first quarter, above 0.4% originally reported. Machinery orders and stock investments also beat expectations.

Fed Preview

A Fed rate cut? It is not a question of if, but rather a question of when and how many. Markets have been pricing in two rate cuts – with the first coming in July. Lower expectations originate from weak data such as dismal job gains and weak inflation. Markets are also pessimistic about trade relations – something Fed Chair Jerome Powell has addressed in a recent speech. Powell has already opened the door to cutting rates by saying he will “act as appropriate.”

Markets will first look at the Fed’s outlook for interest rates, dubbed the “dot plot.” If the bank signals more than one cut this year, the greenback has room to fall. If they stick to no cuts or only one, the dollar may rise.

The accompanying statement will also be scrutinized carefully. Investors will analyze the tone – optimistic or pessimistic before making their judgment.

See the full preview Five factors that will rock USD in a critical decision

For USD/JPY, it may be a lose-lose situation. If the Fed is dovish, safe-haven flows may move away from the yen but these could be mitigated by the falling USD.

And if the Fed is hawkish, the greenback may gain across the board but perhaps not against the yen – as the Japanese currency may attract safe-haven flows and USD/JPY may fall alongside stocks.

All in all, it may be a lose-lose situation for the currency pair as markets are more gloomy in general.

Other US events

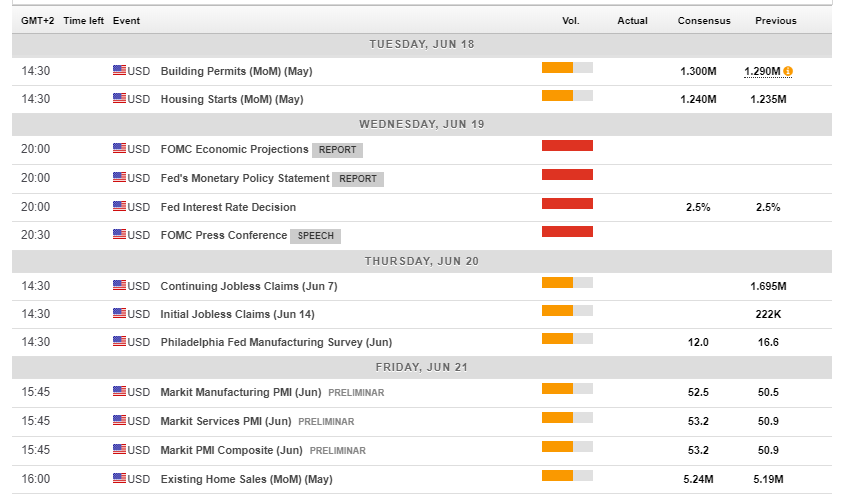

Housing starts and building permits kick off the week. If they both surprise in the same direction – either both down or both up – they may move the greenback despite growing tensions toward the Fed decision.

After the Fed, the fresh Philly Fed Manufacturing Index for June will shed some light on the manufacturing sector, but markets will probably be digesting the previous night’s event.

Markit’s forward-looking purchasing managers indices – which have both dropped dangerously close to the 50-point threshold separating expansion and contraction – may already have a greater say on the dollar’s moves. Existing home sales close the week.

Here are the top US events as they appear on the forex calendar:

Japan: BOJ in the spotlight

The Japanese yen maintains its position as the top safe-haven – rising when the mood deteriorates. That is the main driver of the currency.

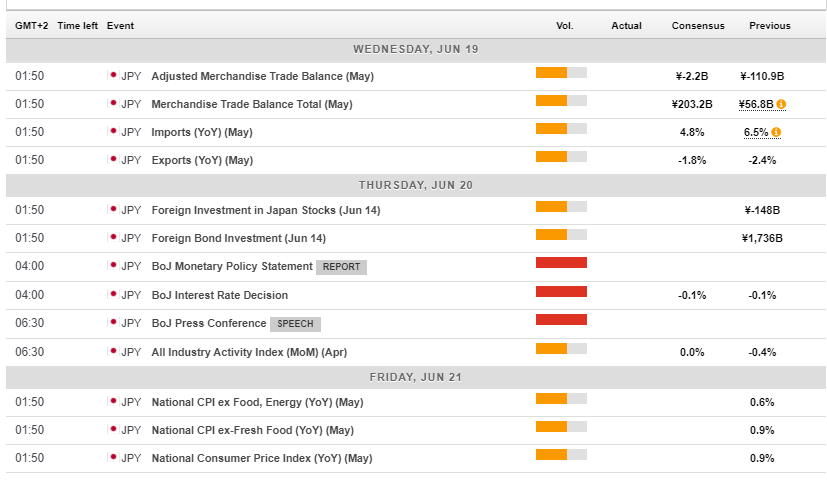

Trade data is due early in the week and another fall in exports will be of worry. The main event of the week is the Bank of Japan’s rate decision early on Thursday. The Tokyo-based institution will make its announcement less than 12 hours after the Fed, and if the Fed goes dovish – the BOJ may do more.

Inflation remains far from the elusive 2% target for core inflation but the BOJ is expected to leave its negative interest rate unchanged at -0.1% and continue with buying bonds as much as needed. What else can Governor Haruhiko Kuroda and his colleagues do? The BOJ may hint it is ready to buy more bonds and expand its shopping basket – even though the central bank has bought a substantial chunk of Japanese debt and has also moved into Exchange Traded Funds (ETFs).

Overall, the BOJ will probably have to provide radical new measures or an alarming message to push the yen lower.

After the central bank’s decision, markets will receive a reminder about low inflation. The national consumer price index for May will likely be in line with the early data from the Tokyo region.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

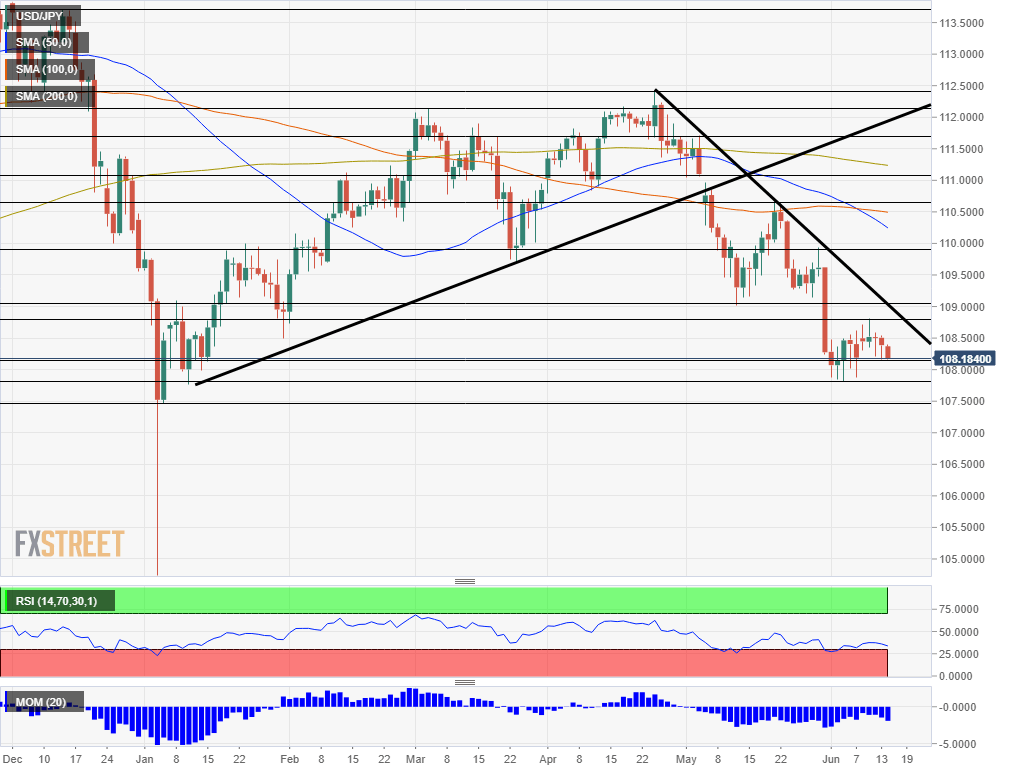

The daily chart points to further falls. The Relative Strength Index is leaning lower but holds up above 30 – not reflecting oversold conditions just yet. Momentum remains to the downside and USD/JPY is trading below the downtrend resistance line as well as the 50, 100, and 200-day Simple Moving Averages.

Overall, the bears are in control.

Some support awaits at 108.10, which was a cushion in mid-June. The recent stubborn support of 107.80 is next. It was seen in early June. 107.50 was a low point in January. 106.80 and 106.00 are noteworthy on the way down, but the most significant support line is the 2019 low of 104.75.

Looking up, 108.70 provides resistance after capping USD/JPY in mid-June. The round level of 109.00 provided support in May and now works as resistance. Further up, 109.90 was a swing high in late May, and it is followed by 110.65 that held it down earlier last month.

USD/JPY Sentiment

As mentioned earlier, the Fed decision may be a lose-lose event for USD/JPY and the BOJ has few tools to counter substantial market forces. The only wildcard that may push it higher is Trump – if he surprises with a gesture toward China – and that is highly unlikely.

The FXStreet Poll shows a bearish sentiment with substantial falls in the short term but a significant bounce later on. The short-term target has been downgraded while the medium-term and long-term targets have been upgraded. Perhaps experts expect a dovish Fed decision and a recovery afterward.

Get the 5 most predictable currency pairs

USD/JPY may lose on any Fed decision