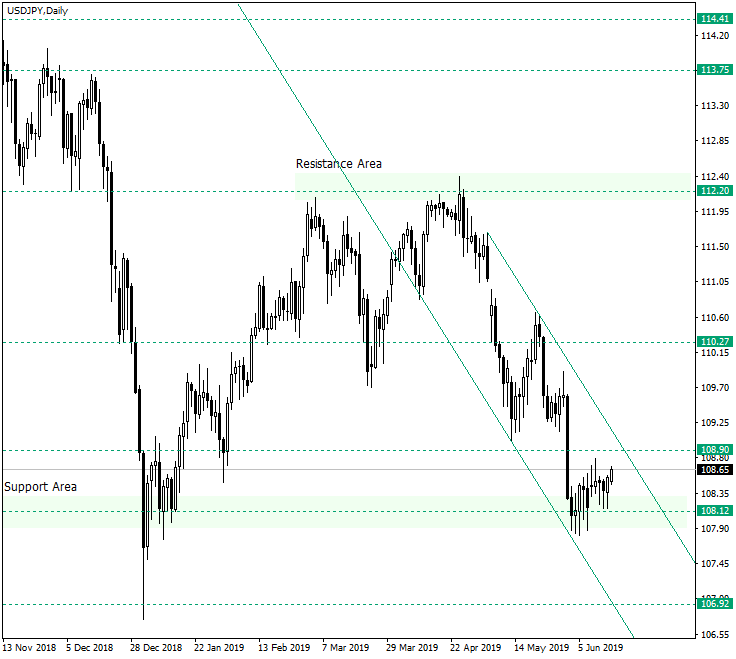

The price is above an important support area, but it does not seem to be willing any appreciation. The descending channel might give the explanation.

Long-term perspective

After confirming the 112.20 resistance area on April 25, 2019, the US dollar versus the Japanese yen currency pair began a very determined downwards move. On its way, the price confirmed as resistances 110.27 and 109.70 (not drawn on the chart) and then stopped at the important support area of 108.12.

From 108.12, the bulls should have been very determined to make a rally, but instead they were pleased to print small retracements. The main reason for this is the trend, which points downwards. In such a context, the bears will expect the price to confirm or falsely pierce the double resistance etched by the upper trendline of the channel and the 108.90 level, and then continue the decline to 106.92.

For the bulls to have a chance, the price must conquer 108.90 and confirm it as a support. This will bring the price out of the descending trend and open the door to 110.27.

Short-term perspective

The price is in a consolidative phase limited by 108.01 as support and 108.77 as resistance. Because it follows a descent and it represents a preparation for continuation, it would be reasonable to expect yet another fall.

The confirmation of 108.50 as resistance will further give credit to the bears, who will target 108.01 first and then 107.56.

Levels to keep an eye on:

D1: 108.90 108.12 106.92

H4: 109.12 108.77 108.50 108.01 107.56

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.