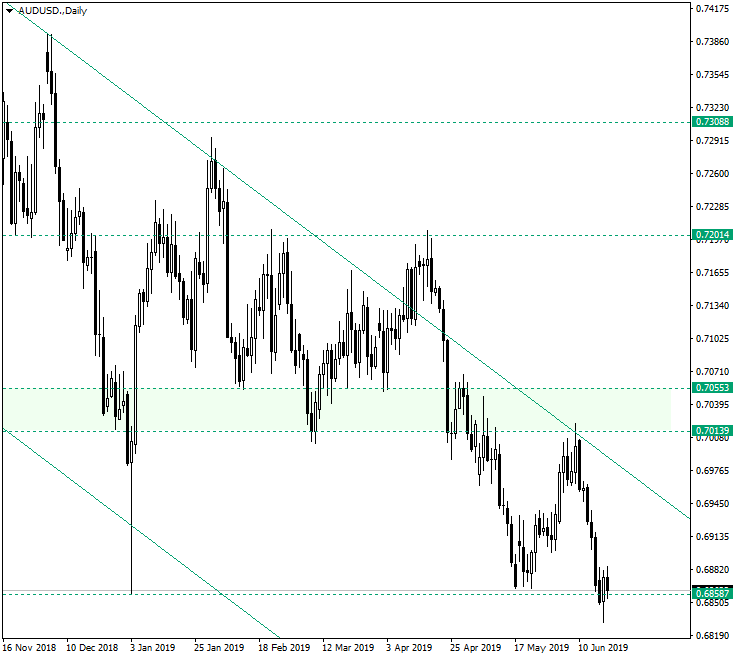

The Australian dollar versus the US dollar hits the first target, at 0.6858. The upcoming move could be very interesting.

Long-term perspective

The pair confirmed the important resistance made up by the zone limited in between 0.7055 and 0.7013 and the upper trendline of the descending channel. The confirmation resulted in a decline that reached the major support of 0.6858, which constitutes the first target for the current impulsive wave that the decline represents.

The price could print a minor correction, but it is better for the bears if it will be limited by the 0.6900 psychological level, as crossing that level results in an appreciation that could touch once more the upper line of the descending channel, thus prolonging the corrective period.

On the other hand, it is possible for a pennant or a flag to form, patterns that have the power to resume — in this context — the descent. The next target is represented by the 0.68 psychological level, while the second one could be very generous: 0.6700.

Short-term perspective

After the fall that started with the confirmation of 0.7003 as resistance, the price looks as if it is trying to confirm 0.6865 as support. If this happens, then a rally towards 0.6935 is likely to materialize.

A conservative approach is to eye 0.6935 for possible new descents, with a first target at 0.6865, followed by the previous low, at 0.6831.

Levels to keep an eye on:

D1: 0.6858 0.6800

H4: 0.6935 0.6865

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.