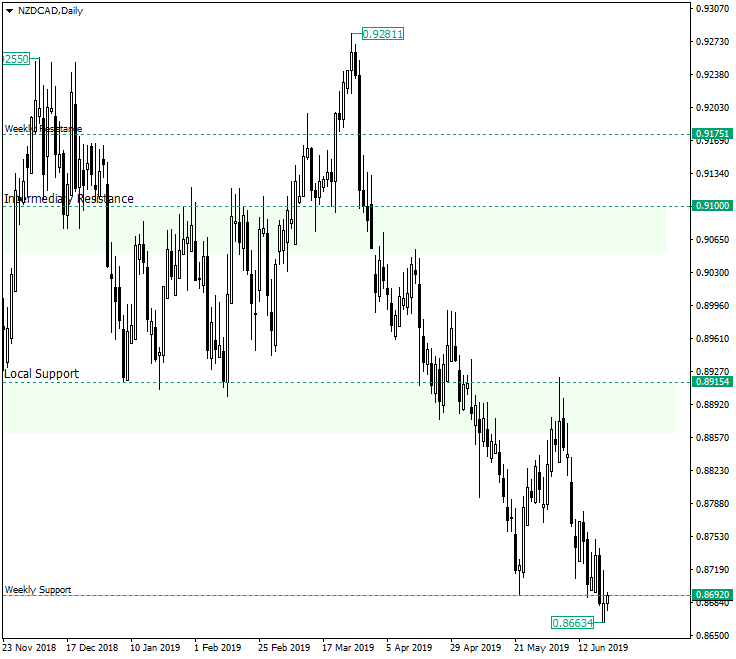

The New Zealand dollar versus the Canadian dollar currency pair pierced a major support in the context of a well established bearish profile.

Long-term perspective

The price, after confirming the ex local support area at 0.8915 as resistance — which, pertaining to a consolidative phase following the rally that began on October 8, 2018, canceled the prospects of one in the near future — began a descent that tried to find support at 0.8692, but failed to.

The flop in confirming the level as support was a two-step process. The first step was printing, on June 17, 2019, a candle that resembled an inverted hammer, but failed to actually be one because of having the upper tail less than twice the length of the body. So, not being an inverted hammer, the slim bullish message that this candle offers was not able to make the market think about the possibility of an appreciation. But there was a savior: the bullish engulfing printed on the second day. But the candle on June 19, 2019, engulfed it, thus invalidating the bullish signal.

So, as long as the price is under 0.8692, the message is that the bears are in charge. But if they manage to bring the price above 0.8692, then the candles printed on 18 and 19 June could be considered to be a last engulfing bottom pattern, which — if it is not itself invalidated — points to an appreciation, targeting 0.8915. On the other hand, if such a recovery fails to take place, then the door to 0.8600 is open.

Short-term perspective

The price returned in the descending channel and under the 0.8716 resistance. To add to the bearish profile, a symmetrical consolidation forms between the 0.8773 high and the 0.8663 low, a behavior which usually leads to continuation, in this case of the descent. The next target would be the next psychological level: 0.8600.

But if price manages to pierce and confirm 0.8716 as support, a rally towards 0.8792 is to be expected, with a possible continuation to 0.8825.

Levels to keep an eye on:

D1: 0.8692 0.8600

H4: 0.8716

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.