The British pound today rallied to new weekly highs against the US dollar following Boris Johnson‘s launch of his campaign to become the next Conservative Party leader. The GBP/USD currency pair later fell as the US dollar recovered and investor sentiment shifted away from the pound amid the leadership uncertainty occasioned by Theresa May‘s impending … “British Pound Rallies on Johnson Campaign Launch, Later Retreats”

Month: June 2019

3 pound-positive things in Boris Johnson’s launch speech

Boris Johnson has launched his campaign to lead the country by pledging to leave the EU. He has also provided three positive comments that balance the picture. GBP/USD has room to rise if Johnson indeed moderates once in office. Former foreign secretary Boris Johnson has let his opponents sweat and has finally launched his campaign … “3 pound-positive things in Boris Johnson’s launch speech”

Japanese Yen Gains as Risk Appetite Wanes, Domestic Data Supports

The Japanese yen gained today as risk appetite of investors was waning, making them more interested in buying safer currencies, like the yen. Domestic macroeconomic data was also supportive for the Japanese currency. Japan’s Cabinet Office reported that core machinery orders rose by 5.2% in April from the previous month after rising 3.8% in March. That is instead of falling 0.8% as analysts had predicted. The Bank of Japan reported … “Japanese Yen Gains as Risk Appetite Wanes, Domestic Data Supports”

Australian Dollar Remains Soft After Domestic, China’s Data

The Australian dollar continued to demonstrate weakness as risk appetite was slowly coming off markets. Domestic macroeconomic data was weighing on the currency further as the consumer sentiment deteriorated sharply. And while China’s consumer inflation was accelerating, painting a positive picture of the economic health of Australia’s biggest trading partner, that led to concerns that Beijing may withdraw stimulus if prices continue to rise at a fast pace. The Westpac-Melbourne Institute Index … “Australian Dollar Remains Soft After Domestic, China’s Data”

US inflation may send the USD down

The US Consumer Price Index report due on June 12th is a critical input for next week’s Fed decision. The FXStreet Surprise Index has correctly predicted the Non-Farm Payrolls report. The Index points to weak CPI and that could be detrimental for the USD. The previous piece analyzing the FXStreet Surprise Index about the Non-Farm Payrolls has correctly predicted the bitter … “US inflation may send the USD down”

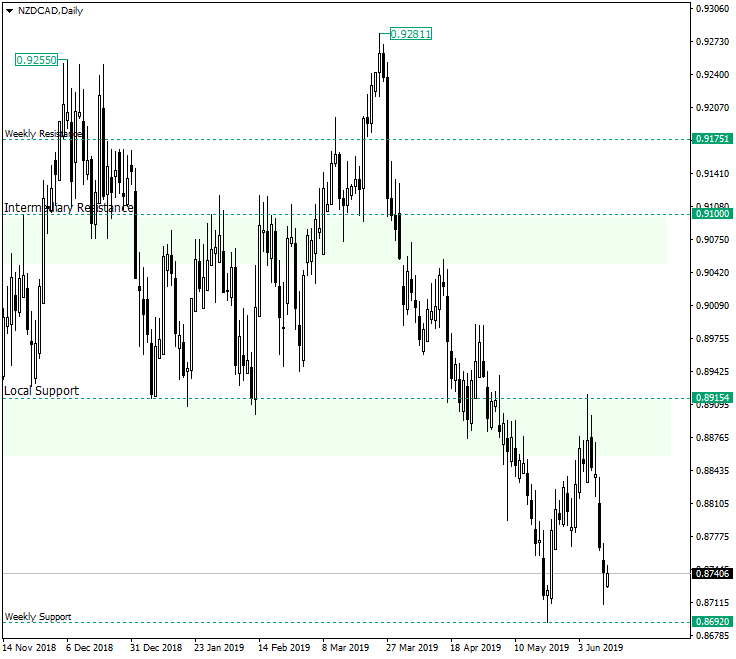

NZD/CAD to Test the Important 0.8692 Weekly Level

NZD/CAD to Test the Important 0.8692 Weekly Level The pair could have a place to recover from, but the current context might just favor the continuation of the descent. Long-term perspective The New Zealand dollar versus the Canadian dollar currency pair looks as if it does not have enough steam to initiate and fuel a rally. Since the high at 0.9281, after which it came beneath two important levels that could have … “NZD/CAD to Test the Important 0.8692 Weekly Level”

Pound Rallies on Upbeat Jobs Data Amid Leadership Concerns

The British pound today rallied higher following the release of upbeat UK jobs data in the early London session despite the political uncertainty in the country. The GBP/USD currency pair’s rally was limited by investor fears that a pro-Brexit leader could succeed Theresa May as Prime Minister and push for a hard Brexit. The GBP/USD … “Pound Rallies on Upbeat Jobs Data Amid Leadership Concerns”

Canadian Dollar Unable to Keep Momentum From Strong Data

The Canadian dollar is weakening on mixed data on Tuesday. The loonie has been unable to keep the momentum from last weekâs stellar economic data, gradually paring its gains against the greenback on the year. The Canadian buck could further weaken over the summer as the central bank is unlikely to put forward an aggressive normalization strategy until at least after the federal election. On the data front, according to the Canada Mortgage and Housing Corporation (CMHC), … “Canadian Dollar Unable to Keep Momentum From Strong Data”

US Dollar Flat Following Release of US PPI

The US Dollar index was flat today as the greenback was somewhat directionless during the trading session. Overall though, fundamentals looked really negative for the US currency, meaning that it has room for downside. The US Bureau of Labor Statistics reported that the seasonally adjusted Producer Price Index rose 0.1% in May. While the reading was within market expectations, it was a slowdown from the April’s 0.2% growth. In fact, … “US Dollar Flat Following Release of US PPI”

Euro Firm After Slump of Eurozone Investor Confidence

The euro was relatively firm today following the release of unexpectedly poor eurozone investor confidence print. While the shared 19-nation currency fell versus some of stronger rivals, like the Great Britain pound, it managed to gain on many other most-traded counterparts. The Sentix investor confidence for the eurozone slumped from 5.3 to -3.3 in June. Analysts were expecting a far better figure of 2.3. The report blamed the resumption of trade wars for the slump: … “Euro Firm After Slump of Eurozone Investor Confidence”