The euro today rallied to 10-week highs against the US dollar following the release of disappointing US non-farm payrolls report in the early American session. The EUR/USD currency pair had traded sideways for most of today’s session following the release of weak German data in the early European session before the spike higher. The EUR/USD currency pair today rallied from a session low of 1.1251 to a multi-week high of 1.1340 after the release of the non-farm payrolls report … “Euro Falls on Weak German Data, Rallies to 10-Week High on US NFP”

Month: June 2019

US Dollar Slumps on Disappointing May Jobs Report

The US dollar slumped at the end of the trading week, driven by a weaker-than-expected May jobs report and stagnant wage growth that signaled a slowing economy. Should the trend continue, then it might prompt the Federal Reserve to cut interest rates to spur economic growth, which the market is already betting will happen as … “US Dollar Slumps on Disappointing May Jobs Report”

Japanese Yen Soft, Domestic Data Doesn’t Help

The Japanese yen was largely soft today as market participants felt no need for safety provided by the currency. Domestic macroeconomic data did nothing to help the currency. Average cash earnings fell 0.1% in April, year-on-year. While not a good reading by itself, it was still a better result than a drop by 0.7% predicted by analysts and the 1.3% decline registered in March (though it itself got a positive revision from the 1.9% … “Japanese Yen Soft, Domestic Data Doesn’t Help”

Aussie Mixed After Poor Domestic Macroeconomic Data

The Australian dollar was mixed today, falling against some currencies, staying flat against others, but also managing to gain on the Swiss franc. Domestic macroeconomic reports released over the trading session were detrimental to the currency. The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index dropped to 40.4 in May (seasonally adjusted) from 42.6 in April. The figure below the neutral 50.0 levels indicates that the sector was … “Aussie Mixed After Poor Domestic Macroeconomic Data”

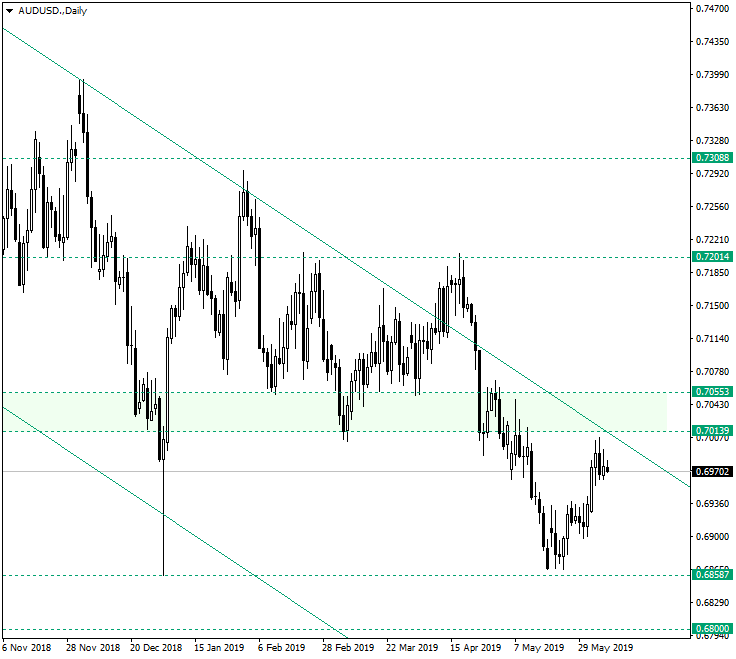

AUD/USD Might Prepare for a New Descent

The Australian dollar versus the US dollar is just in the right spot for the bears to begin a new descent. Long-term perspective It seems like the price is in a well defined resistance zone and in a well suited shape for a move to the south to occur. The resistance zone is etched by the trendline projected after uniting the highs of February 16, 2018, and December 3, 2018, respectively, and by the area confined to 0.7055 and 0.7013. To this, a bearish pattern adds — a bearish … “AUD/USD Might Prepare for a New Descent”

Euro Rallies to New Highs After ECB Rate Decision and TLTRO Terms

The euro today rallied to new multi-week highs when the European Central Bank announced the terms of its TLTRO III facility, which were better than expected. The EUR/USD currency pair had traded lower following the ECB rate decision but spiked higher after Mario Draghi‘s speech. The EUR/USD currency pair today rallied from a session low of 1.1200 to a high of 1.1308 after the TLTRO III … “Euro Rallies to New Highs After ECB Rate Decision and TLTRO Terms”

Canadian Dollar Rises on Crude Rebound, Boost in Labor Productivity

The Canadian dollar is strengthening on Thursday, driven by the rebound in crude oil prices and an increase in quarterly labor productivity. Manufacturing and trade data were also published, contributing to the near-term direction of the loonie. Despite the disappointing numbers as of late, Canadians are less pessimistic about the economy, especially after the US recently lifted tariffs. On Wednesday, crude slipped into a bear market as oil prices cratered to a six-month low. But prices are beginning … “Canadian Dollar Rises on Crude Rebound, Boost in Labor Productivity”

Chinese Yuan Mixed on Poor Economic Data

The Chinese yuan is mixed midweek on poor economic data. But the biggest development for the yuan is that it is nearing the 7 mark against the US dollar. The federal government has hinted that it will take action to prevent the yuan from reaching that threshold. The last time the yuan crossed 7 was in December 2016. On the data front, the Caixin Composite Purchasing Managersâ Index (PMI) came in at 51.5 … “Chinese Yuan Mixed on Poor Economic Data”

Euro Drops From Post-US ADP Highs on Upbeat US Services PMI

The euro today fell from almost 7-week highs against the greenback triggered by weak US employment data following the release of upbeat US services PMI data. The EUR/USD currency pair rallied to the new highs driven by upbeat market sentiment and disappointing US ADP employment change report before falling to new lows. The EUR/USD currency pair rallied to a high of 1.1306 but fell shortly afterward to hit a new daily … “Euro Drops From Post-US ADP Highs on Upbeat US Services PMI”

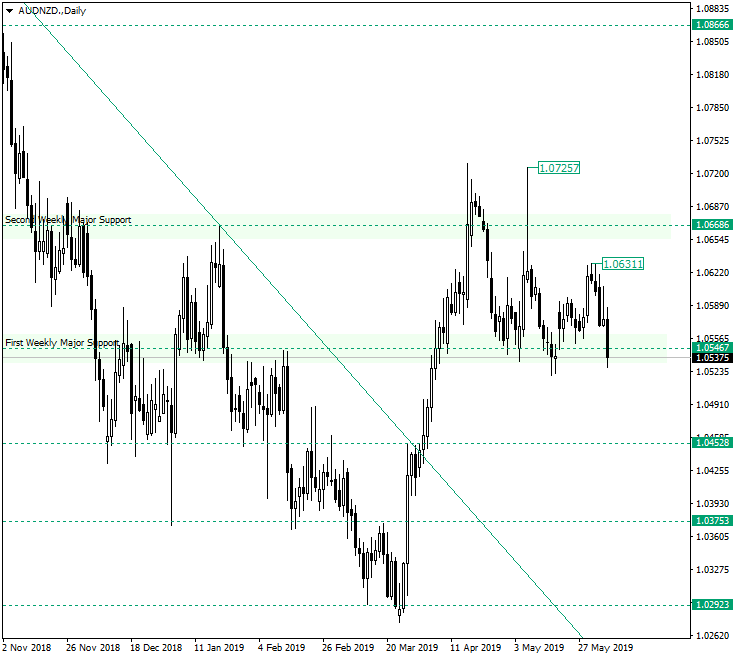

AUD/NZD Facing a Dilemma at the Important 1.0546 Support

The Australian dollar versus the New Zealand dollar currency pair is caught in between the bullish and bearish plans, with both parties being of equal strength right now. Long-term perspective After confirming the 1.0292 support and ending the descending trend, the price got stuck between two important areas from which — actually — both serve as support: 1.0668 and 1.0546. The latter is an important weekly support, while the first plays the role … “AUD/NZD Facing a Dilemma at the Important 1.0546 Support”