The euro today rallied to new 3-wek highs earlier in the session driven by improved risk sentiment and broad US dollar weakness before retreating later in the session. The EUR/USD currency pair fell from its highs as the European session progressed driven by the greenback’s resurgence and the disappointing eurozone employment and inflation data. The … “Euro Falls From 3-Week Highs, Later Recovers to Trade Flat”

Month: June 2019

Japanese Yen Weakens Despite Better Q1 GDP Amid Higher Business Spending

The Japanese yen is weakening against several major currencies on Tuesday, despite upbeat economic data and positive news that should strengthen the safe-haven currency. So far this year, the yen has made commendable gains against a basket of rivals, attracting investors fleeing from geopolitical tensions and trade strife. Domestic business spending surged in the first quarter, shows the latest Ministry of Finance (MOF) data. According to the Japanese government, … “Japanese Yen Weakens Despite Better Q1 GDP Amid Higher Business Spending”

Euro Rallies on Weak US Manufacturing Data and Inverted US Yields

The euro today rallied against the US dollar following the release of disappointing US manufacturing PMI in the American session. The EUR/USD currency pair kept up it bullish momentum from Friday as markets remained worried about the inverted US yield curves and the possibility of a Fed rate cut. The EUR/USD currency pair today rallied from … “Euro Rallies on Weak US Manufacturing Data and Inverted US Yields”

US Dollar Mixed on Weak Data, Recession Fears

The US dollar is mixed to kick off the trading week as investors comb through disappointing economic data amid fears of a global recession. As the trade strife escalates after higher US tariffs on Chinese and Mexican goods, markets are worried that this could lead to additional cooling in the sluggish global economy. US manufacturing … “US Dollar Mixed on Weak Data, Recession Fears”

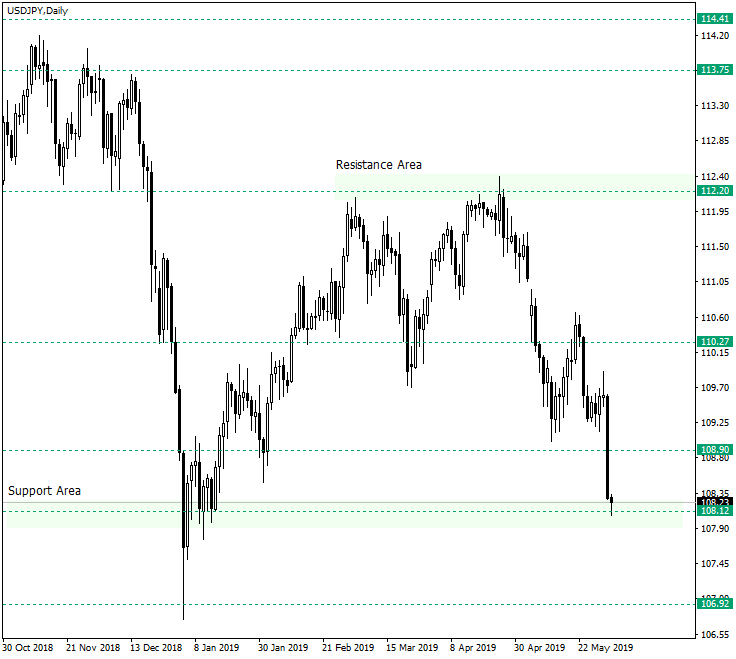

Support Level of 108.00 on USD/JPY Might Give Way

The descent on the US dollar versus the Japanese yen reached the important target of 108.12, a level that represents a weekly support area. But certain factors point to the fact that, this time, the support might would not hold its ground. Long-term perspective After the confirmation of the 112.20 resistance area, on April 25, 2019, the price began a steep decent, that stopped at 108.90, throwed-back to confirm 110.27 as resistance, and continued downwards to pierce … “Support Level of 108.00 on USD/JPY Might Give Way”

US Dollar Gains vs. Riskier Currencies, Falls vs. Safer Ones During Week of Risk Aversion

Trade wars and the resulting risk aversion on markets were the main themes during the past trading week. The US dollar reacted in an expected manner, rising versus riskier currencies but underperforming against safer ones. The week actually started on a positive note as the European parliamentary elections resulted in a victory of pro-EU forces. The Great Britain pound was not thrilled, though, as Britain’s two major parties lost the elections, showing that Britons … “US Dollar Gains vs. Riskier Currencies, Falls vs. Safer Ones During Week of Risk Aversion”