The Norwegian krone surged today after the nation’s central bank announced an interest rate hike and signaled about probability of additional hikes in the future. The Norges Bank announced today that it raises its main interest rate by 0.25 percentage point to 1.25 percent. The bank commented on the decision: Growth in the Norwegian economy is solid, and capacity utilisation is estimated to be somewhat above a normal level. Underlying inflation is a little … “Norwegian Krone Soars After Norges Bank Hikes Interest Rate”

Month: June 2019

BOE may join the gang and go dovish, weighing on the pound

The BOE has been holding up its intention to raise interest rates. Uncertainty about Brexit and global headwinds may push the pound back to neutral. GBP/USD is vulnerable ahead of the decision. The world’s most prominent central banks have turned dovish – and it may the Bank of England’s turn now. The BOE has been forecasting rate … “BOE may join the gang and go dovish, weighing on the pound”

Euro Soft as Domestic Data Hurts

The euro was soft today. While the currency managed to gain on the US dollar thanks to the dovish Federal Reserve, unfavorable domestic macroeconomic data prevented the euro from rising against other most-traded rivals. The German Producer Price Index fell 0.1% in May from the previous month. That is compared to the median forecast of a 0.2% increase and the 0.5% gain registered in April. The eurozone current account surplus shrank to â¬21 billion in April … “Euro Soft as Domestic Data Hurts”

Canadian Dollar Rises Sharply as Consumer Inflation Beats Expectations

The Canadian dollar was firm today after nation’s consumer inflation accelerated and beat analysts’ expectations. The rally of crude oil prices likely also helped the currency. Statistics Canada reported that the Consumer Price Index rose 2.4% in May, year-over-year, after rising 2.0% in April. The gains were broad-based, including higher prices for food and durable goods, while prices for gasoline declined. Month-on-month, the index was up 0.4%, without … “Canadian Dollar Rises Sharply as Consumer Inflation Beats Expectations”

US Dollar Mixed on Dovish, Optimistic Federal Reserve

The US dollar was mixed against its major rivals midweek as analysts and investors are trying to make heads and tails of the Federal Reserve‘s latest policy announcement. The US central bank left interest rates unchanged, but it confirmed that it will “closely monitor” the numbers to determine if rates need to be lowered. Despite the dovish signals, Fed officials are still optimistic about the US economy, sticking … “US Dollar Mixed on Dovish, Optimistic Federal Reserve”

3 reasons why the USD can recover after the Fed’s blow

The Federal Reserve has left rates unchanged but downgraded its language. There are three reasons why the USD retreated on the news. But there are also three factors that could send it back up. The Federal Reserve has left the interest rates unchanged as broadly expected but has also made significant changes that open the door to … “3 reasons why the USD can recover after the Fed’s blow”

Pound Rallies After UK Inflation Meets Consensus Estimates

The British pound today rallied higher in the early London session following the release of the latest UK inflation data, which was in line with consensus estimates. The GBP/USD currency pair extended yesterday’s gains and rallied into the American session to print new weekly highs driven by positive investor sentiment. The GBP/USD currency pair today rallied from a low of 1.2541 in the early London session … “Pound Rallies After UK Inflation Meets Consensus Estimates”

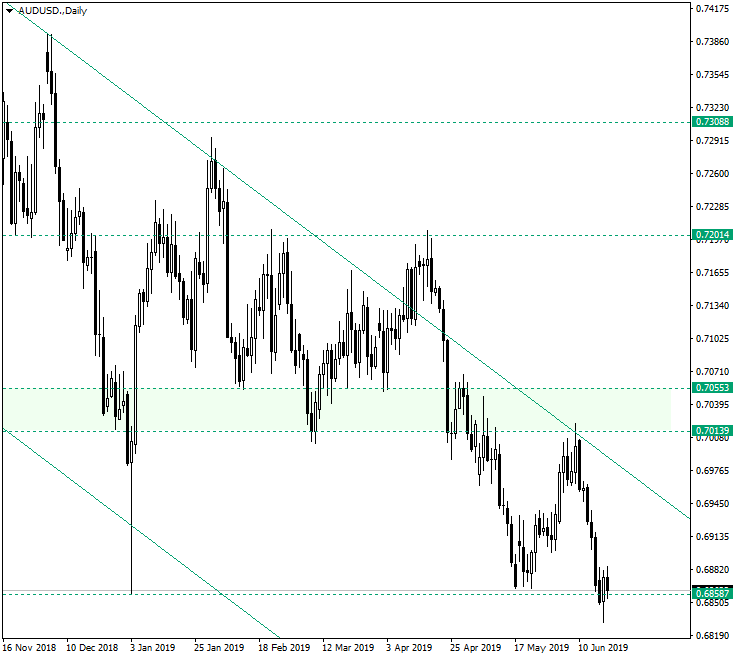

AUD/USD After Reaching 0.6858

The Australian dollar versus the US dollar hits the first target, at 0.6858. The upcoming move could be very interesting. Long-term perspective The pair confirmed the important resistance made up by the zone limited in between 0.7055 and 0.7013 and the upper trendline of the descending channel. The confirmation resulted in a decline that reached the major support of 0.6858, which constitutes the first target for the current impulsive wave that the decline represents. The price could print a minor correction, … “AUD/USD After Reaching 0.6858”

Aussie Mixed-to-Lower After Leading Index Continues to Decline

The Australian dollar was mixed today, falling against some rivals and staying flat versus others, after the country’s leading index continued to decline. According to the report released today: The six month annualised growth rate in the WestpacâMelbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, rose slightly from â0.49% in April to â0.45% in May. Westpac Senior … “Aussie Mixed-to-Lower After Leading Index Continues to Decline”

Yen Mostly Flat During Directionless Trading

The Japanese yen was flat against most major currencies today, though fell versus the Swiss franc. The trading was somewhat directionless on Wednesday as traders were waiting for a monetary policy announcement from the Federal Reserve. Japan’s Ministry of Finance reported that the trade balance deficit widened from ¥0.17 trillion in April to ¥0.61 trillion in May as exports fell, while imports increased. Still, it was a smaller gap … “Yen Mostly Flat During Directionless Trading”