The Federal Reserve has been under growing pressure to cut interest rates. The Fed will likely leave rates unchanged, and markets will move in response to policy hints. Five critical factors will move markets and the USD. To cut interest rates or not to cut them? – this is the question – not for the June meeting, … “Five things to watch in the Fed decision”

Month: June 2019

Aussie Weakens on Poor China’s Data, Market Sentiment

The Australian dollar was soft today as the market sentiment remained negative following yesterday’s news about an attack on oil tankers in Middle East. Mixed macroeconomic data in China, Australia’s biggest trading partner, added to downside pressure on the currency. While some of the indicators were good, the arguably more important ones were surprisingly bad, suggesting that the Chinese economy struggles to maintain its impressive growth. The National Bureau of Statistics of China … “Aussie Weakens on Poor China’s Data, Market Sentiment”

NZ Dollar Drops as Manufacturing Slows

The New Zealand dollar dropped against other most-traded currencies today as nation’s manufacturing sector almost stopped expanding last month. The general negative market sentiment wasn’t helping the currency either. The BusinessNZ Performance of Manufacturing Index dropped from 52.7 in April to 50.2 in May. The indicator was getting dangerously close to the 50.0 level of no-growth. Furthermore, it was the lowest reading since December 2012. BNZ Senior Economist Doug … “NZ Dollar Drops as Manufacturing Slows”

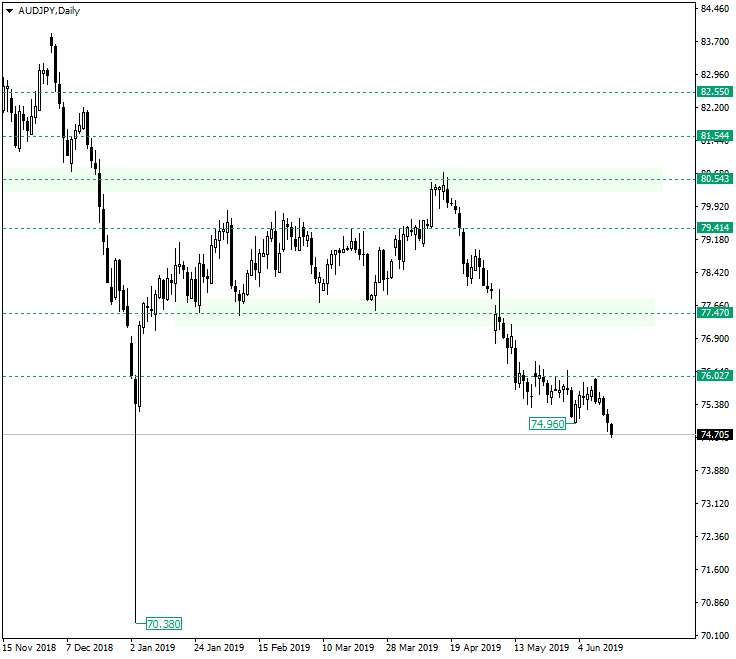

Next Move for AUD/JPY After Revisiting 74.96

By confirming 76.00 as resistance and revisiting 74.96 the price opens the door to very interesting possibilities. Long-term perspective The Australian dollar versus the Japanese yen currency pair managed to print on June 10, 2019, a bearish engulfing pattern in a very sensitive area: the 76.00 psychological level. This pattern came after a consolidation phase that formed, of course, under the level. In other words, it was the trigger that the bears were searching for. … “Next Move for AUD/JPY After Revisiting 74.96”

Sterling Rallies As Johnson Floors Rivals in 1st Round, Later Falls

The Sterling pound today rallied against the US dollar in the mid-London session as Boris Johnson floored his opponents in the first round of voting within the Conservative Party. The GBP/USD currency pair had fallen earlier today as markets reacted to yesterday’s defeat of a motion to eliminate the possibility of a hard Brexit. The GBP/USD currency pair today fell … “Sterling Rallies As Johnson Floors Rivals in 1st Round, Later Falls”

Chinese Yuan Weakens on Falling Auto Sales, Sluggish US Investment

The Chinese yuan is weakening against major currency rivals on Thursday after new data painted a grim picture of the worldâs second-largest economy. The trade war, which appears to be at a standstill, is seeping to a whole host of areas in Beijing, impacting economic growth and causing officials to hit the panic button. In the backdrop of the chaos is the yuan nearing toward the 7 threshold against the buck. According to the Ministry of Commerce, foreign direct investment (FDI) … “Chinese Yuan Weakens on Falling Auto Sales, Sluggish US Investment”

Swiss Franc Rallies on Risk Aversion, Ignores SNB

The Swiss franc rallied today on the back of risk aversion on the Forex market. The currency largely ignored the monetary policy meeting of the Swiss National Bank and somewhat disappointing domestic macroeconomic data. As was widely expected, the SNB left its monetary policy unchanged, keeping interest rates in the negative territory. The central bank announced a new benchmark rate to replace the target range for the three-month Libor: The Swiss National Bank is today introducing the SNB … “Swiss Franc Rallies on Risk Aversion, Ignores SNB”

Australian Dollar Weak After Release of Employment Data

The Australian dollar was weak today, falling for the seventh consecutive trading session against the euro, following the release of employment data in Australia. While the report was not entirely bad, the market preferred to focus on the bad part. The Australian Bureau of Statistics reported that the number of employed people in Australia rose by 42,300 in May from April. That is a far bigger figure than 16,000 predicted by experts. The increase was registered in both … “Australian Dollar Weak After Release of Employment Data”

Yen Rallies After Attack on Two Oil Tankers in Gulf of Oman

The Japanese yen rallied today after two oil tankers were supposedly attacked in the Gulf of Oman, leading to a surge of risk aversion on markets. Currently, the currency has trimmed its gains. According to reports, the ships were supposedly attacked with “some sort of shell”. Japan’s Ministry of Economy, Trade and Industry said that both tankers were carrying “Japan-related cargo”. Iran’s Foreign Minister Mohammad Javad Zarif said “suspicious … “Yen Rallies After Attack on Two Oil Tankers in Gulf of Oman”

US Dollar Mixed on Lower-Than-Expected Inflation Data

The US dollar is mixed against several major currency rivals midweek after new lower-than-expected inflation data was released. Prices have proven to be major drivers of the greenback this week, mainly because there have been little updates to the US-China trade dispute and the brief US-Mexico trade spat concluded. On monetary policy, it will likely be speculation until the next Federal Reserve meeting. According to the Bureau … “US Dollar Mixed on Lower-Than-Expected Inflation Data”