The Federal Reserve has countered its rate cut with a confident message. Fed Chair Jerome Powell has extended the dollar gains with three critical comments. EUR/USD has fallen to the lowest in two years and eyes critical levels below. The confident message in the Fed statement – expressing confidence on inflation, employment and the two … “EUR/USD levels to watch after Powell’s powerful performance”

Month: July 2019

3 reasons why the USD can continue higher after the hawkish Fed cut

The Federal Reserve has cut its interest rates for the first time in a decade as expected. The Fed also signaled it is unlikely to reduced rates anytime soon. The USD has been advancing ahead of the release and the move may further extend. The Fed finally did it – cutting rates for the first … “3 reasons why the USD can continue higher after the hawkish Fed cut”

EUR/USD may retreat ahead of the Fed with EZ inflation and GDP figures

Euro-zone July inflation and second-quarter GDP are set to show a slowdown. The European Central Bank will be using this data to construct its monetary stimulus package. The figures due out hours before the critical Fed meeting may weaken the euro. “The economic outlook is getting worse and worse” – said Mario Draghi, President of … “EUR/USD may retreat ahead of the Fed with EZ inflation and GDP figures”

Chinese Yuan Weakens As Trade Talk Hopes Fade

The Chinese yuan is weakening against several major currency rivals to kick off the trading week, driven by investors not expecting much to come out of the renewed US-China trade negotiations this week. Tradersâ hopes were dashed after one prominent White House official conceded he âwouldnât expect any grand dealâ as the worldâs two largest economies hold talks. Larry Kudlow, the director of the National Economic Council, … “Chinese Yuan Weakens As Trade Talk Hopes Fade”

Sterling Suffers from Rising Chances of No-Deal Brexit

The Great Britain pound slumped against all other most-traded currencies today amid concerns that chances for a no-deal Brexit increase. And a hard Brexit can deal a serious blow to Britain’s economy. The currency was trading at the lowest level in about two years. An official spokesman of Britain’s Prime Minister Boris Johnson said that the PM will not meet leaders of the European Union to discuss a trade deal until they drop … “Sterling Suffers from Rising Chances of No-Deal Brexit”

5 scenarios for GBP/USD on the BOE’s Super Thursday

The Bank of England is set to hold its rates but publish new projections on “Super Thursday.” The darkening clouds around the global economy and Brexit may cause a rethink. There are five scenarios for the decision and pound reaction. The disconnect between the Bank of England’s upbeat assessment and markets’ dim views is unlikely … “5 scenarios for GBP/USD on the BOE’s Super Thursday”

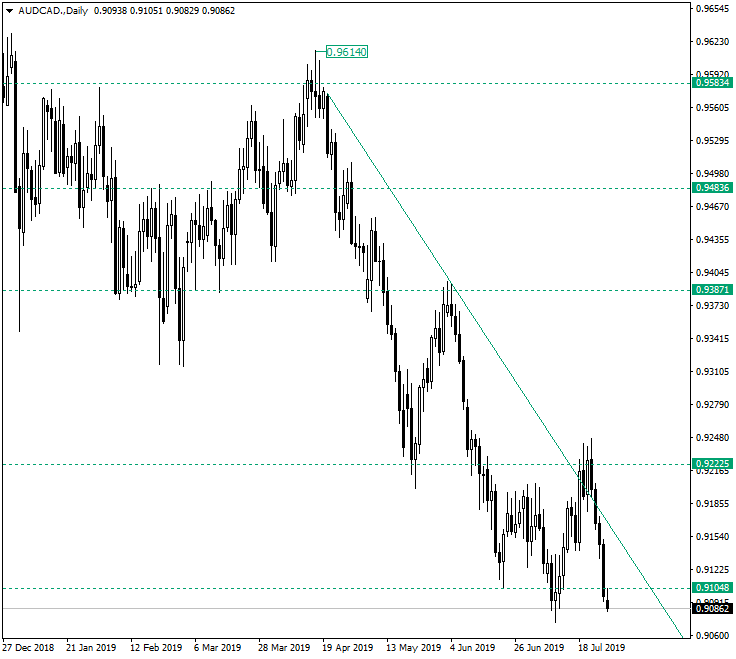

AUD/CAD Looking for 0.9000

The Australian dollar versus the Canadian dollar currency pair is under bearish dominance and the support of the 0.9100 psychological level seems to give way. Long-term perspective From the 0.9614 high the price entered a descending move which confirmed rigorously key resistance areas — like 0.9483, 0.9387, and 0.9225. In such a bearish driven environment the last support, 0.9104, seems to have little to do in order to withstand the downwards pressure. If the previous low … “AUD/CAD Looking for 0.9000”

After the plunge, these GBP/USD levels are eyed

GBP/USD has hit 1.2247 – the lowest in two years on fears of a hard Brexit. PM Boris Johnson has rejected the claim that the government is assuming no-deal. GBP/USD may challenge levels last seen in late 2016 / early 2017. How low can the pound go? The pound’s plummet has turned into an avalanche as the new … “After the plunge, these GBP/USD levels are eyed”

Japanese Yen Mixed as Traders Wait for Fed, Other Events

The Japanese yen was mixed today amid mild risk aversion on the Forex market. Traders were reluctant to open new positions at the start of the week full of important events. There will be many important macroeconomic releases this week, including US nonfarm payrolls. But the highlight of the week should be the monetary policy meeting of the Federal Reserve, which is expected to result in an interest rate cut. Market participants will … “Japanese Yen Mixed as Traders Wait for Fed, Other Events”

US Dollar Ends Week Strongest Despite Outlook for Fed Easing

The US dollar was surprisingly strong during the past trading week, rising against all other most-traded currencies. That is despite the outlook for monetary easing from the Federal Reserve next week. The greenback got a boost by the end of the week from a better-than-expected GDP print. But that did not change the outlook for a 100% chance of an interest rate cut from the Fed next week. It is possible that the cut … “US Dollar Ends Week Strongest Despite Outlook for Fed Easing”