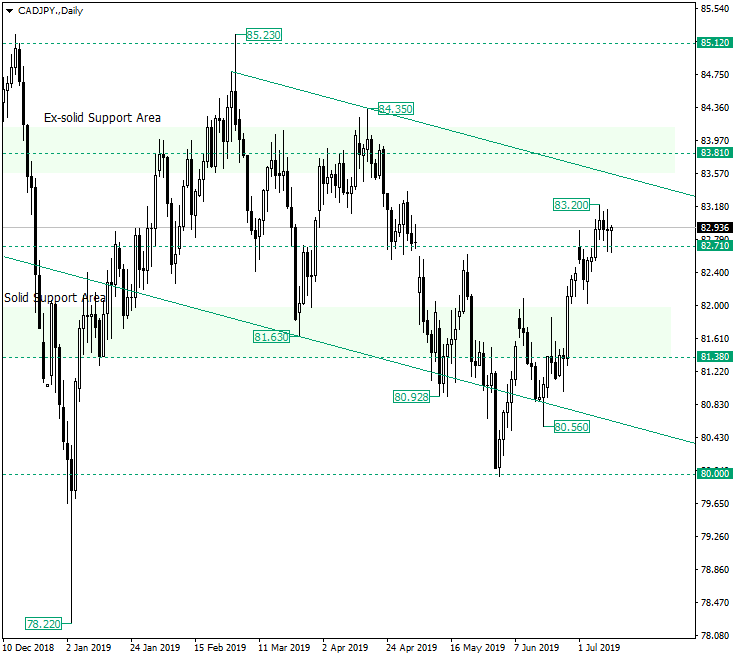

The Canadian dollar versus the Japanese yen currency pair managed to get even closer to the resistance line that dates back to the beginning of March 2019, and this brings even more possibilities for the bulls.

Long-term perspective

Since March 1, 2019, the price is in a downwards move. The support line of the descending channel was pierced, but the price found support at the 80.00 level. It bounced off this level, getting back into the descending channel (i.e. above the support line of the channel) and over he solid support area marked by 81.38.

Being so optimistic for their comeback, the bulls pulled all their forces and caused a rally that brought the price above the 82.71 intermediary level. Interestingly to note is that the almost doji-like candle of July 10, 2019, gives two distinct signs of bullish dominance. The first is that the high of it is a higher-high if compared with the previous candle and is well above the closing price of the bullish candle printed on July 8, 2019. The second is that the price was repelled from the 82.71 level. In other words, the bears, who tried to short the price as they always do when it is at highs, understood that this is not yet their moment.

In the current state of affairs, the price should continue the appreciation and test the double resistance made possible by the upper line of the descending channel and the ex-solid support area of 83.81. Only a return under 82.71, with the subsequent confirmation of it as a resistance, will postpone the visit to the aforementioned double resistance.

Short-term perspective

The price is in an ascending channel, concentrated around the resistance line. After confirming 83.22 as resistance, it came back under 82.94. This shows that, for the time being, the bulls are taking a short break, letting room for some consolidation.

The consolidation phase, if evolving above 82.43, will last a little longer, but has the potential to resume in a very aggressive manner, pointing directly to the double resistance discussed earlier. If the consolidation leads to a downwards move with the purpose of confirming the double support etched by the lower line of the ascending channel and the 81.77 level, the appreciation towards the daily target might extend over a longer period of time.

Levels to keep an eye on:

D1: 82.71 83.81

H4: 82.42 81.77

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.