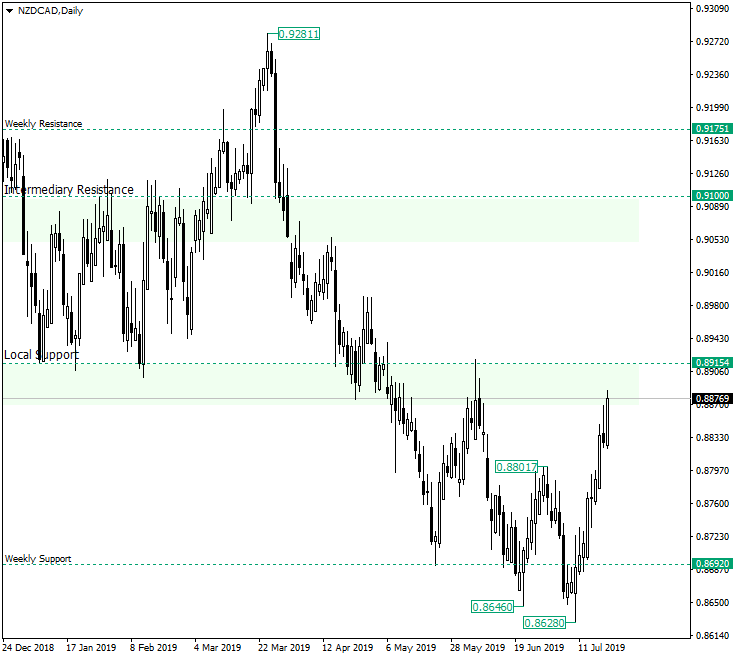

The New Zealand dollar versus the Canadian dollar currency pair is in a very aggressive ascending phase, and orchestrated by other factors it might be able to pierce the 0.8900 psychological level and turn it into a support.

Long-term perspective

The price breached the 0.8692 weekly support twice. What is interesting to note, besides the fact that both piercings were false, is that the second one — at 0.8628 — was a lower low and, even so, the price managed to came back above the weekly support and make a new — yet without an etched peak — higher high with respect to 0.8801. The combination of these factors give reasons to the bears to stay aside for now.

Approaching the local support of the previous consolidation phase, the bulls might be a little cautions in order not to overextend themselves, which could result in an exhaustive ascending move that will quickly be invalidated by a strong retracement. As an effect, it is possible for the price to calm its pace as it approaches this area, but that should take the form of a consolidation or a small retracement. Any strong bearish pattern could send the price into a fall. Even it such a bearish pattern materializes, any short position would require a very strict money-management, in the form of a lower risk than usual.

Short-term perspective

From the 0.8628 the price is in an ascending move, with relatively small retracements and convinced upwards legs. So, as long as 0.8825 holds as support further advancement should be seen, with subsequent confirmations as support of 0.8895 and 0.8928.

Even a break of 0.8825 would require the piercing of 0.8782 to take place in order for a bearish takeover to be considered.

Levels to keep an eye on:

D1: 0.8915 0.9100

H4: 0.8825 0.8895 0.8928 0.8782

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.