- GBP/USD has been suffering from the Brexit impasse and USD strength.

- The Bank of England’s “Super Thursday” stands out.

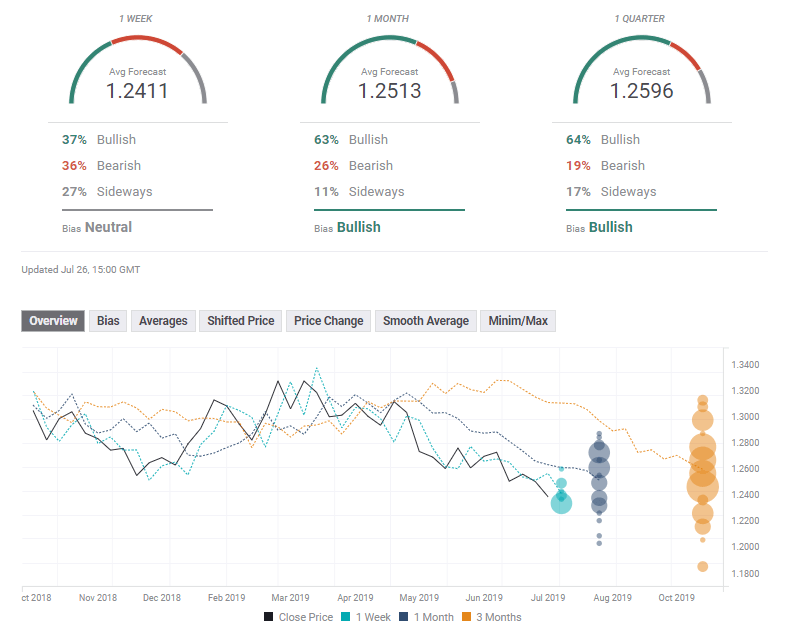

- Late July’s daily chart points to further falls.

- Experts are neutral in the short term and bullish afterward.

What just happened: PM Boris Johnson meets reality

Boris Johnson, PM – a headline that many had waited for in both hope and fear – has become a reality. The former foreign secretary won the Conservative Party’s leadership contest and entered Downing Street. His first actions in office were to get rid of his predecessor’s allies and to pack the cabinet with pro-Brexit ministers.

The choice of Dominic Raab as foreign secretary and Jacob Rees-Mogg as leader of the House have caused concern in markets. Johnson also maintained his pro-Brexit rhetoric, calling for abandoning the backstop, threatening to withhold the UK’s divorce bill, and demanding the reopening of the Brexit bill. His words and actions triggered angry responses from the EU that reiterated that no changes could be made and called Johnson’s approach “combative.”

On this background, the pound has been on the back foot.

The fresh friction comes as the UK found itself asking the EU for help in the Persian Gulf after Iran seized a British oil tanker in response to similar retention of an Iranian ship near Gibraltar.

The pound’s fall was somewhat limited by some signs that the colorful PM may be preparing for an election. The deadlock in parliament – that his predecessor suffered from so bitterly – has not changed. Moreover, Johnson has appointed Dominic Cummings – the controversial mastermind of the Vote Leave campaign – as a senior advisor. Political analysts see Johnson’s moves as campaign ones.

In the US, economic data was mostly upbeat, supporting the dollar. The US economy grew by 2.1% annualized in the second quarter – better than had been expected – and enjoying robust consumption. The greenback has also received support from the US-Sino announcement about fresh face-to-face talks next week.

BOE Preview: Dovish bias?

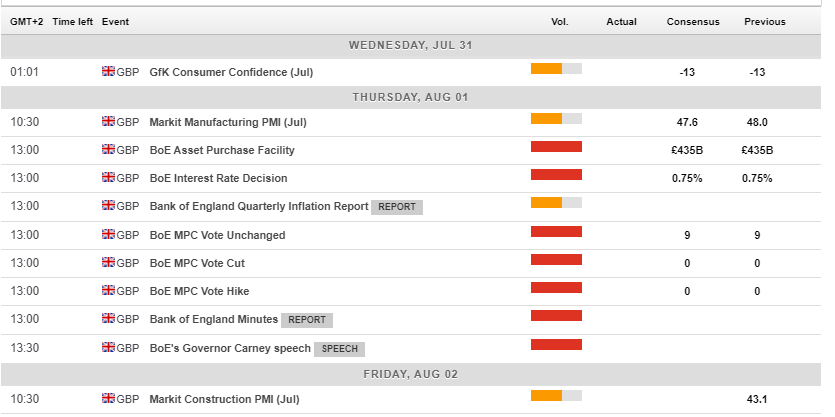

The Bank of England convenes for the first time under PM Johnson and with three months to go until the Brexit deadline of October 31st. In this meeting, the Bank of England not only publishes its rate decision and meeting minutes but also releases the Quarterly Inflation Report – a “Super Thursday.”

The bank is unlikely to leave the interest rate unchanged at 0.75% and maintaining the current size of the Quantitative Easing program at 435 billion pounds.

The significant change may come from the BOE’s future intentions. The “Old Lady” has expressed its desire to raise rates assuming a smooth Brexit. While Carney and co. will likely refrain from changing their Brexit assessment, they may still drop their hawkish bias. The BOE may signal it plans to leave rates unchanged and point to global headwinds – similar to other central banks.

Carney has already referred to a “sea change” in the global economy, hinting such a move is on the cards. The BOE’s decision is due out less than 24 hours after the US Federal Reserve is set to cut rates for the first time since the crisis. A downgrade of the outlook is, therefore even more likely. The move will likely be accompanied by downward revisions for growth and inflation forecasts – which come just before the GDP figures are set to show weakness in the second quarter.

Carney may take one step further and shoot a warning about the consequences of a hard Brexit in his press conference. He has been criticized in the past for scaremongering ahead of the referendum. Nevertheless, the governor ends his tenure by year-end and may feel freer to speak his mind.

Other UK events:

Markit/CIPS’s forward-looking purchasing managers’ indicators are also of interest, and the manufacturing PMI comes just before the BOE’s decision. It has been below 50 points in recent months – indicating a contraction in the sector. Another drop is likely after May’s score of 48 points. The data for the construction sector is due out on Friday and may remain depressed as well.

In addition to economic indicators, it is essential to follow Johnson’s statements. If he maintains his tough stance on Brexit, it may signal he is prepping up an election – and that may be positive for the pound. In an election, the pro-Remain Liberal Democrats seem to have an equal chance to Labour which also leans toward a soft Brexit, and to the hardline Brexit party. The race is wide open.

If he begins setting the ground for a climbdown on Brexit, he may face opposition within his party, but markets will likely cheer it – at least in the short term. Johnson has arguably made substantial turnarounds in the past.

Here are the events lined up in the UK on the forex calendar:

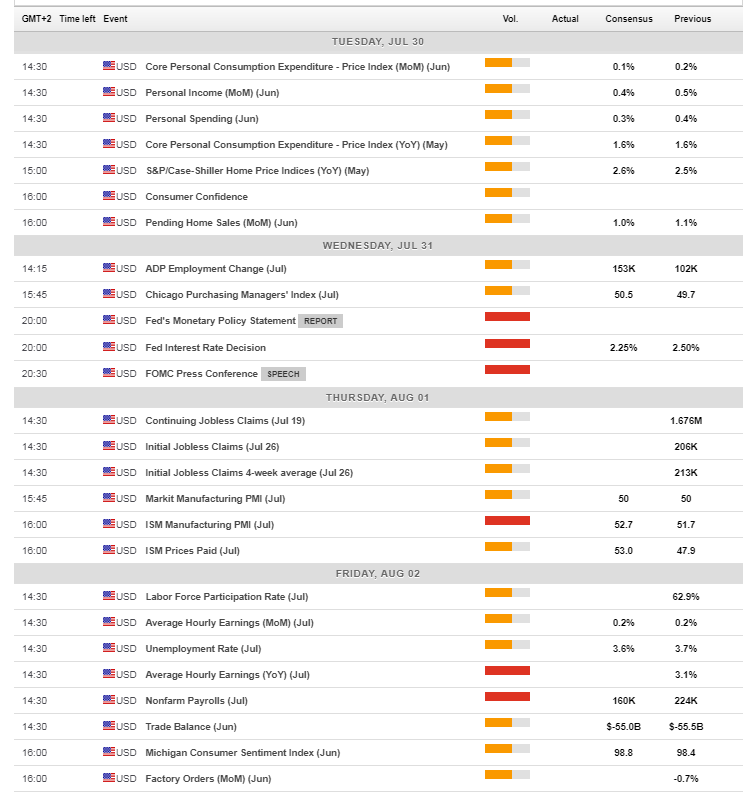

US events: All eyes on the Fed, and then on the NFP

The Federal Reserve’s decision is left, right, and center. The world’s most powerful central bank is set to cut rates for the first time since the crisis amid weak inflation and trade tensions. However, it may signal that this cut is only a measure of “insurance” and not the beginning of a long series of reductions – thus sending the dollar higher. Recent economic figures are incompatible with emergency steps. Nevertheless, the high level of uncertainty means volatility will likely be elevated.

See Fed Preview – the currencies to trade in each of these four scenarios

The central bank will learn about its preferred measure of inflation – the Core PCE Price Index on Tuesday. It is expected to remain stable at 1.6% – below the Fed’s target of 2%.

On Wednesday and apart from the Fed, markets will be following the ADP Non-Farm Payrolls jobs report for the private sector. The firms’ numbers have fallen short of expectations in the past two months, and economists forecast a rebound this time. The data feeds into the official jobs report expectations.

Thursday’s ISM Manufacturing PMI provides a forward-looking view into the small yet critical sector and also provides insights into the NFP. Industrial activity has been moderating of late.

And finally, Friday’s NFP for July will rock markets despite modest expectations of only 160K, jobs gained after a leap of 224K in June’s report. Forecasts are low also for wages, which are projected to increase by only 0.2% monthly.

Apart from the data, headlines from the US-Sino trade talks will also be of interest. So far, the world’s largest economies have been vague when talking to the press.

Here are the scheduled events in the US:

GBP/USD Technical Analysis

GBP/USD has been trading below a downtrend resistance line that has been depressing it since late June when it peaked at 1.2780. A relief seems nowhere in sight as the pair is trading below the 50, 100, and 200 Simple Moving Average. Moreover, momentum is to the downside, and the Relative Strength Index (RSI) is leaning lower but staying shy of the 30 levels – thus not implying oversold conditions.

Overall, the trend is down.

Significant support is at 1.2380, which was seen last week and is the lowest level since 2017. Below, 1.2360 was a low point in April 2017, 1.2300 capped it in March that year, and 1.2100 was a swing low around the same time.

Looking up, 1.2440 was a double bottom that was touched in January, and in July this year. It is followed by 1.2520 which was a low point in June and capped Sterling in late July. Further up, 1.2580 was a high point earlier this month, and 1.2660 provided support in late June.

GBP/USD Sentiment

The FXStreet Poll shows that experts have adapted to the recent fall but see it as viable only for the upcoming week – the targets for the next month and next quarter are bullish. The downgrades have affected short-term objectives more than long-term ones.

Get the 5 most predictable currency pairs