The US dollar versus the Japanese yen currency pair seems to be left out of the bearish interest, as the price went above the important 108.00 support.

Long-term perspective

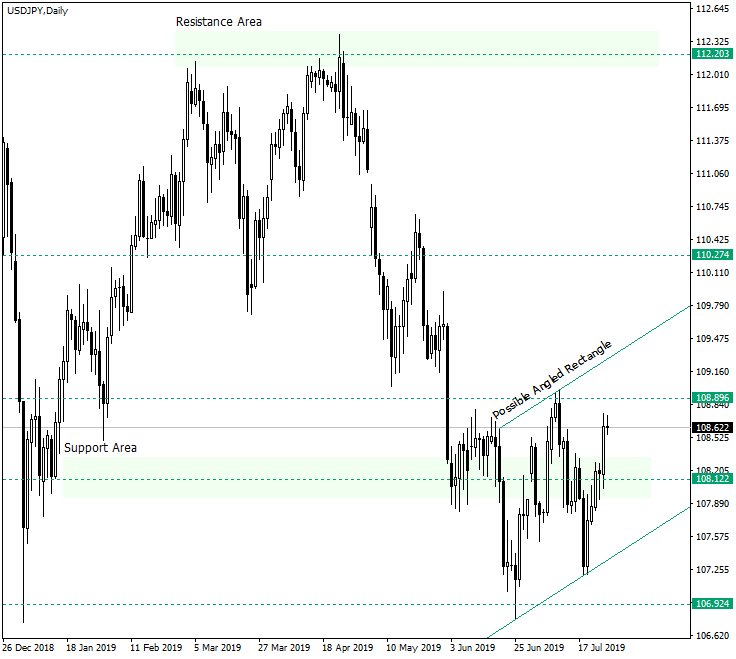

After reconfirming the important 112.20 resistance, the price entered in a bearish driven movement that brought the price under 108.12, a major support. As it retraced to confirm 108.12 as resistance, the bulls took action and dragged the price above the support area. The bears saw this as a new opportunity and, after confirming 108.89 as resistance on July 10, 2019, pushed lower only to make a higher high at the support line of what it looks to be an angled rectangle. The rally that followed drove the price, yet again, above 108.12, which of course is the technical correspondent of the 108.00 psychological level.

Angled rectangles are continuation patterns and since this one is preceded by a descent the expectations should be, at some point, for the bears to resume their role. But because the price is in this area, the bulls may very well see it as an chance to drive the price higher.

If the price, maybe after a small retracement, will resume climbing and establishes above 108.89, then the path to 110.27 is open. Aggressive sellers may want to short the highs, but in the current context such endeavors must be accompanied by lowering the risks.

Short-term perspective

The price rendered the piercing of 107.55 (and of the Fibonacci retracement level of 61.8) as a false one. It then pierced the resistance of 108.49. If it manages to confirm this level (and the 23.6 retracement projection) as support, then further advancement is to be seen, targeting 109.12.

But even if the price falls beneath 108.49, any Fibonacci retracement level could serve as support for the bullish expectations — as discussed for the daily chart — to drive the prices higher.

Levels to keep an eye on:

D1: 108.12 108.89 110.27

H4: 108.49 109.12

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.