What just happened: Mixed data, fresh trade talks

The US and China have held additional telephone conversations as part of their attempts to reach a trade agreement following the Trump-Xi Summit in late June. More importantly, the world’s largest economies have announced the first face-to-face talks next week ~ the first since early May. The news diminished demand for the safe-haven yen.

US data has been somewhat mixed. Existing and new home sales both missed expectations. However, Durable Goods Orders for June beat expectations on most figures and came on top of upward revisions for May’s numbers. The leap of 1.9% in non-defense ex-air orders – the “core of the core” – has been encouraging. Nevertheless, the expected positive contribution to GDP growth from these investment data was somewhat undermined by a growing trade deficit.

Geopolitical tensions were of interest but remained contained. Drone incidents in the Persian Gulf and North Korean missile tests were dismissed by the US which seems unwilling to enter a full confrontation with both regimes.

In Japan, the Tokyo inflation figures marginally beat expectations with ex-fresh food prices registering an annual increase of 0.9%. Nevertheless, core inflation remains far from the Bank of Japan’s 2% target.

Fed Preview – a one-off or more?

The Federal Reserve is most likely to cut its interest rate by 25 basis points. The bank has been preparing markets for such a move since June. There are two main reasons for the first rate reduction since the crisis. The first is weak inflation. The Fed has changed its stance that weak price development in the first quarter was only “transitory” and is now concerned about reaching its 2% target. The second reason is global trade tensions, which dim the outlook.

Markets have been pricing in a series of rate cuts beginning from this meeting, while some Fed officials have been far more cautious. James Bullard, President of the Saint Louis branch of the Federal Reserve has stressed that he sees July’s cut as an “insurance” move – a one-off reduction and nothing else. Bullard is known as a dove that rejected the last rate hike in December, and his words poured cold water on expectations. Moreover, recent data has been satisfactory, and trade talks have resumed – raising the chances for a “one and done” move – at least for now.

Despite falling expectations, markets still expect the Fed to reduce the Federal Funds Rate twice this year and twice again next year. Some analysts even see the Fed slashing rates by no less than 50 basis points this time.

Here are four scenarios for the Fed decision and the USD reaction:

An insurance cut may send the greenback higher across the board with limited gains against the yen while an open door to further moves may push it lower and the safe-haven yen may be limited in its fall as well. The extreme scenarios of a 50bp cut or no reduction at all cannot be ruled out.

For all the details, see Fed Preview: The currencies to trade in each of these four scenarios

US events: NFP stands out

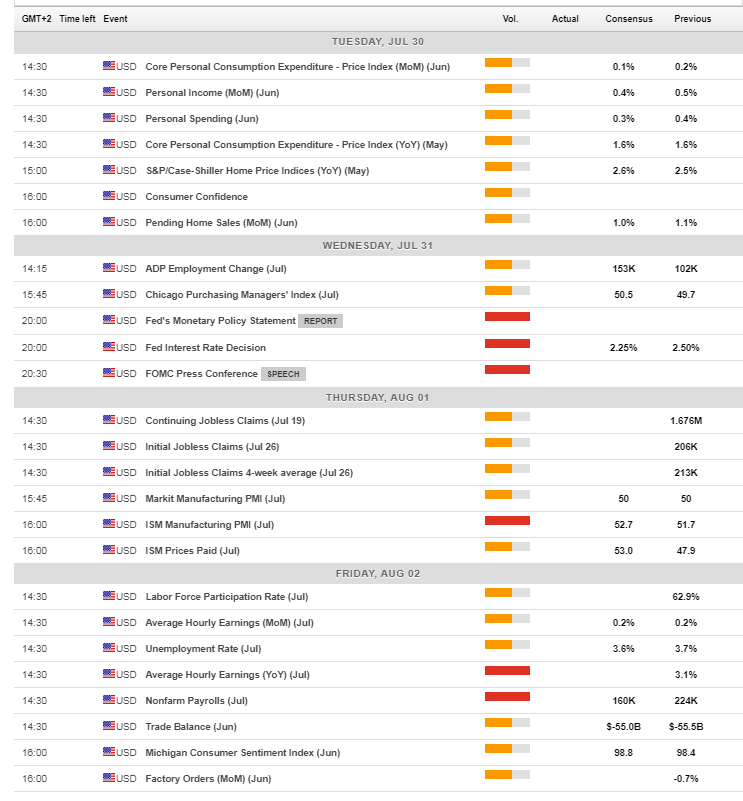

The week kicks off with the Federal Reserve’s preferred measure of inflation – Core Personal Consumption Expenditure (Core PCE) which is projected to remain unchanged at 1.6% – below the Fed’s 2% target. The release lags the Consumer Price Index (CPI), and only a significant surprise may move the USD.

Tuesday’s housing figures and the Conference Board’s Consumer Confidence gauge may also of interest on Tuesday and will likely remain stable.

Hours ahead of the Federal Reserve’s decision, ADP’s Non-Farm Payrolls report for the private sector provides a crucial hint towards Friday’s official NFP and may have a temporary influence on the greenback. A pick up in job growth is on the cards after two disappointing months.

Thursday’s ISM Manufacturing Purchasing Managers’ Index is the first post-Fed economic indicator and expectations are cautiously optimistic. Forward-looking figures data have fallen short of expectations of late. The headline figure and the accompanying employment component both serve as additional hints towards Friday’s jobs report.

And finally, the all-important NFP is projected to show moderation in job growth in July after a sharp increase of 224,000 jobs in June. After poor figures in February and May, investors want to see that the labor market is entirely back on track. The unemployment rate is expected to decline from an already low level of 3.7% while wage growth carries expectations for another mediocre increase of 0.2%. The dust from the Fed will likely have settled by the NFP publication – allowing for a robust reaction.

Here are the top US events as they appear on the forex calendar:

Japan: Bank of Japan decision

The Japanese yen continues playing its role as the ultimate safe-haven currency that may draw funds and outperform other currencies if the Fed paints a gloomy picture and if geopolitical tensions rise. North Korea and Iran remain in the limelight. Investors tend to sell off the yen when stock markets rise.

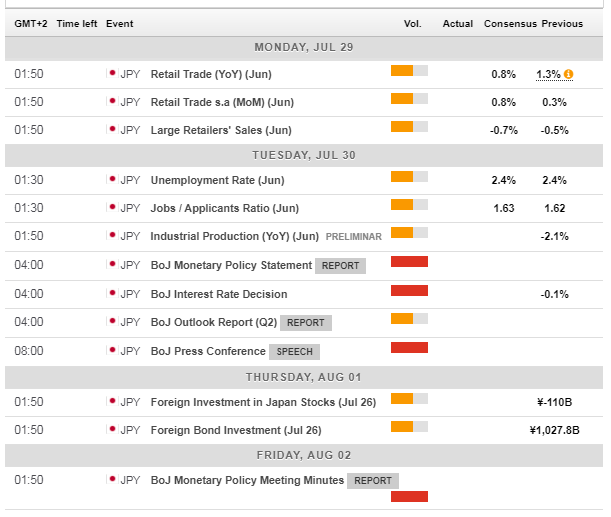

In Japan, the week kicks off with retail trade, industrial output, and the unemployment rate – which is expected to remain at the lows of 2.4%.

The Bank of Japan’s decision stands out on Tuesday. Governor Haruhiko Kuroda and his colleagues are set to leave their policies unchanged – a negative interest rate of -0.10% and massive bond-buying. The BOJ would like to add stimulus to match its global peers. However, divisions within the Tokyo-based institution and a limited set of remaining tools may limit any action now. A lack of novelties may push the yen higher while a pledge to do more in the next meetings could weigh on the currency.

The BOJ will have another opportunity to move markets late in the week – after the Fed decision. The bank releases its meeting minutes from the previous decision, and it may reiterate its commitment to push through stimulus until the 2% core inflation target is reached.

Here are the events lined up in Japan:

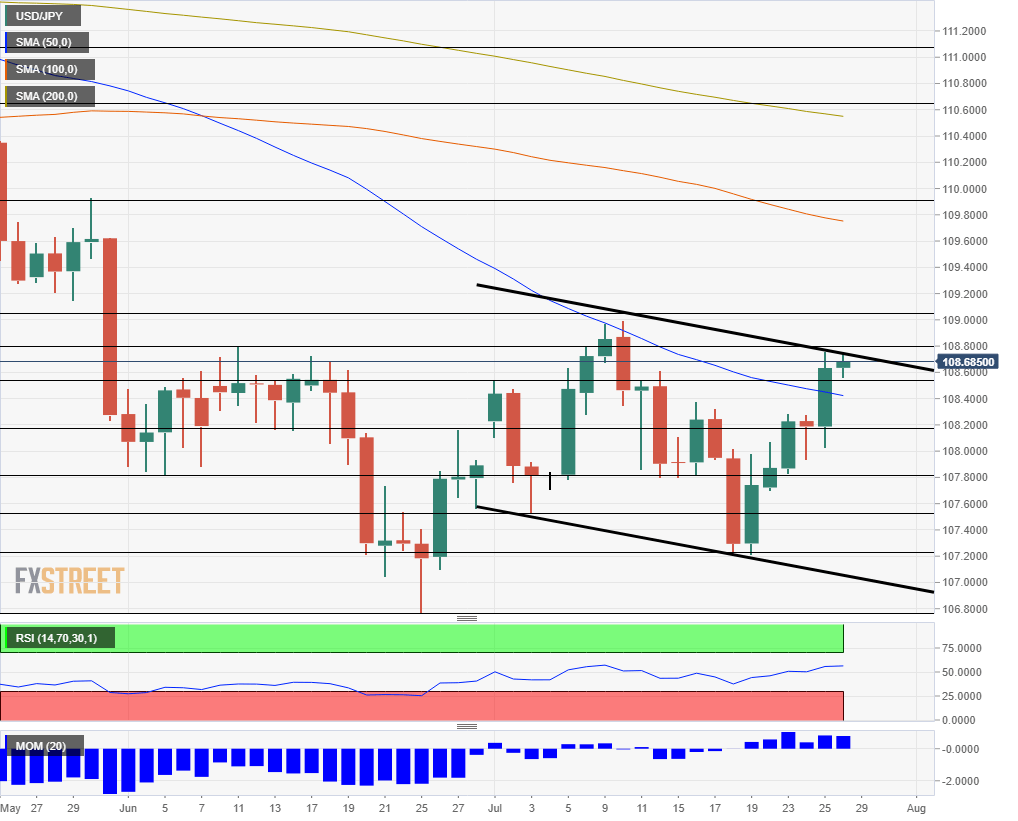

USD/JPY Technical Analysis

Dollar/yen is trading within a moderate downtrend channel after forming it with the recent upside move. On its way up, it has topped the 50-day Simple Moving Average and it also enjoys upside momentum. Overall, the indicators are mixed.

Immediate resistance awaits at the recent peak of 108.80. It is followed by 109.00 which is a round number and also held the currency pair down in early July. Further up, 109.90 was a line of resistance in late May, and 110.65 served as support earlier in the spring.

Some support awaits at 108.20 which was a peak in late June. 107.80 is more substantial after stubbornly supporting USD/JPY in mid-July. It is followed by 107.60 which was a swing low early in the month, then by 107.20 that form part of the downtrend support line, and finally by the late-June trough of 106.80.

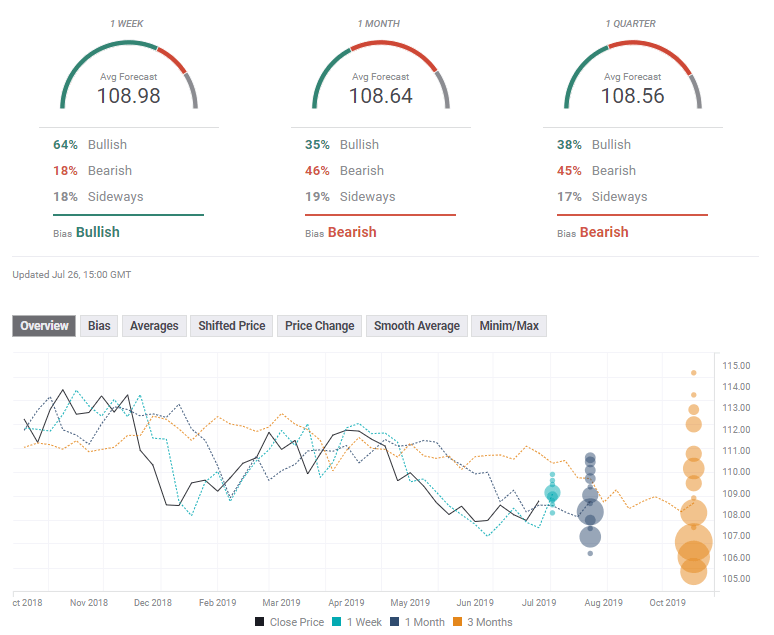

USD/JPY Sentiment

The FXStreet Poll shows that experts see limited short-term rises before prices are expected to fall. Nevertheless, the gap between the short-term and the long-term stands at 42 pips, reflecting limited volatility is here to stay.

Get the 5 most predictable currency pairs

USD/JPY set to rock on the explosive mix of the Fed and the NFP