The Australian dollar was soft against most of its major rivals today. The construction index, released over the trading session, logged an increase, but that hardly helped Australia’s currency. The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index was at 43.0 in June, up from 40.4 in May. Being below the 50.0 level, the index was still indicating contraction of the sector, but at least with slower pace. … “Aussie Soft During Friday’s Trading”

Month: July 2019

Euro Falls on Weak German Data, Extends Losses on Upbeat US NFP

The euro today broke out of its 3-day consolidative range and fell drastically against the US dollar following the release of weak German factory data. The EUR/USD currency pair later extended its losses following the release of the upbeat US non-farm payrolls data in the early American session. The EUR/USD currency pair today fell from an opening high of 1.1286 to a low of 1.1206 after the release of the US jobs data and was near these … “Euro Falls on Weak German Data, Extends Losses on Upbeat US NFP”

Yen Soft After Macro Releases, Comments from BoJ Official

The Japanese yen was soft versus the majority of its most-traded peers today. Domestic macroeconomic data was mixed and Bank of Japan officials were sending somewhat confusing signals about monetary policy in the future. The Statistics Bureau of Japan reported that household spending increased 4.0% in May over the year. Market participants were expecting about the same rate of growth as in April (1.3%). Meanwhile, Japan’s Cabinet Office reported that … “Yen Soft After Macro Releases, Comments from BoJ Official”

Canadian Dollar Firm After Surprising Bad Economic Data

The Canadian dollar was firm today even as domestic macroeconomic data was surprisingly poor. While the loonie fell versus its US counterpart, which itself got boost from positive domestic data, the Canadian currency was firm against other major rivals. Statistics Canada reported that the net number of jobs fell by 2,200 in June. That is instead of rising by 10,000 as analysts had predicted ahead of the report. … “Canadian Dollar Firm After Surprising Bad Economic Data”

US Dollar Surges on Strong June Jobs Report

The US dollar is surging at the end of the holiday-shortened trading week, buoyed by a stellar June jobs report that defied market expectations and showcased employment gains in nearly every sector of the economy. But equities kicked off the trading session in the red because job creation dampened hopes of a cut to interest rates by the US central bank. According to the Bureau of Labor Statistics (BLS), the US economy added 224,000 new jobs last month, … “US Dollar Surges on Strong June Jobs Report”

NFP Preview: 3 scenarios for EUR/USD

US Non-Farm Payrolls for June are critical for the upcoming Fed rate cut. Markets will want to see if May’s dismal data was only a one-off. The US dollar’s next significant move heavily depends on the headline more than the wage numbers. EUR/USD is set to slide in two out of three scenarios. Will the … “NFP Preview: 3 scenarios for EUR/USD”

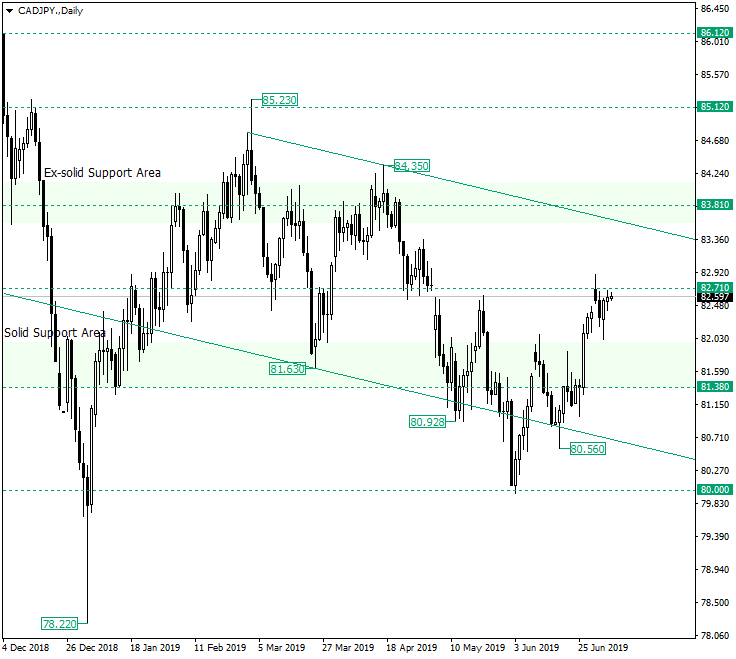

CAD/JPY at an Interesting Possible Obstacle

The Canadian dollar versus the Japanese yen currency pair came back above and confirmed the solid support area of 81.38, and thus fueled the bullish optimism. The question is where will the bulls mark their profits? Long-term perspective Since the high of 85.23, the price has been in what can be called a descending trend, the latest low of which confirmed as support the 80.00 psychological level. But the confirmation of 80.00 came after the break … “CAD/JPY at an Interesting Possible Obstacle”

Euro Falls on Weak Eurozone Retail Sales Amid Thin Holiday Trading

The euro today fell against the US dollar following the release of weak retail sales data for the euro area amid a subdued market environment. The EUR/USD currency pair traded in a tight range for most of today’s session as US markets remained closed for the Independence Day celebrations. The EUR/USD currency pair today fell … “Euro Falls on Weak Eurozone Retail Sales Amid Thin Holiday Trading”

Chinese Yuan Gains on Deregulation to Boost Foreign Investment

The Chinese yuan is strengthening against several major currencies on Thursday as the federal government announced it would be deregulating a whole host of industries to encourage foreign investment. This is part of Beijingâs efforts to open its market to the rest of the world and curb the growing number of companies fleeing the worldâs second-largest economy amid the trade war. Speaking at the World Economic Forum in China, otherwise known as the Summer Davos, Premier Li Keqiang … “Chinese Yuan Gains on Deregulation to Boost Foreign Investment”

Swiss Franc Strong After Inflation Beats Expectations

The Swiss franc was strong during today’s subdued trading. Domestic inflation data released over the trading session was supportive to the currency. Switzerland’s Federal Statistical Office reported that the consumer price index was stable in June compared with the previous month after rising 0.3% in the previous month. Despite the slowdown, the actual reading was better than a drop by 0.1% predicted by analysts. Year-over-year, the index rose 0.6%. USD/CHF … “Swiss Franc Strong After Inflation Beats Expectations”