The New Zealand dollar was strong today even as, unlike its Australian peer, it had no support from macroeconomic data. Reports released over the trading session both in New Zealand and its biggest trading partner, China, were rather poor. The ANZ World Commodity Price Index fell 3.9% in June, month-on-month, demonstrating the first decrease this year. The index rose marginally by 0.1% in the previous month. … “Poor Economic Data Doesn’t Prevent Kiwi from Rallying”

Month: July 2019

Aussie Gains, Propelled by Positive Domestic Data

The Australian dollar was broadly strong today, rising against all of its most-traded rivals. Australia’s macroeconomic data released over the trading session was good for the large part, and that could explain the good performance of the Australian currency. The Australian Bureau of Statistics reported that the seasonally adjusted number of building approvals rose 0.7% in May, whereas analysts had predicted no change. The April reading got a positive revision from … “Aussie Gains, Propelled by Positive Domestic Data”

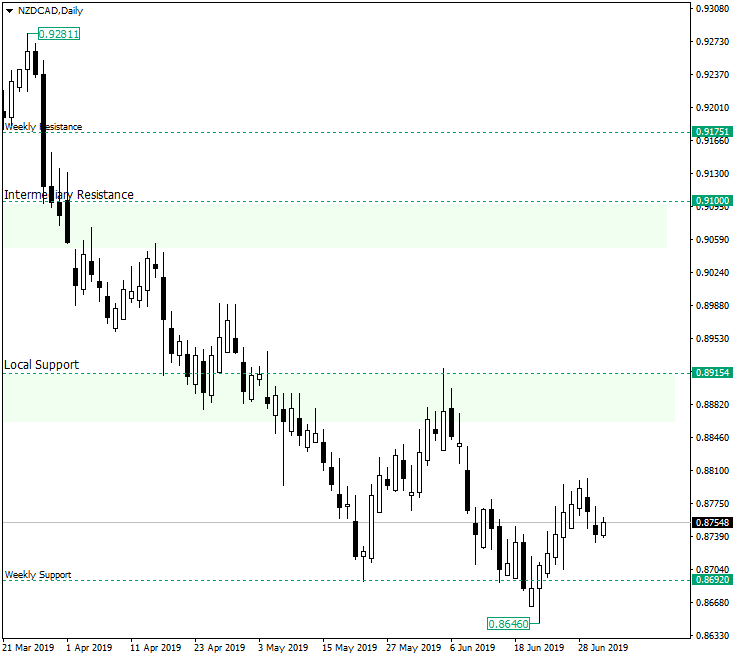

First Target on NZD/CAD: The 0.8900 Psychological Level

The New Zealand dollar versus the Canadian dollar currency pair did not manage to validate the piercing of the 0.8692 support level, sending the price above it and opening the path to 0.8915. Long-term perspective The descent from 0.9281, which brought the price under the weekly resistance of 0.9175 that was finally pierced just days before, gave the bears the necessary confidence to break all the subsequent important levels. Being so effective at piercing … “First Target on NZD/CAD: The 0.8900 Psychological Level”

Pound Soft on Contracting Construction, Carney’s Comments

The Great Britain pound was one of the weakest currencies on the Forex market during Tuesday’s trading session. The likely reasons for that were poor domestic macroeconomic data and comments from the central bank’s chief. The seasonally adjusted IHS Markit/CIPS UK Construction PMI fell sharply from 48.6 in May to 43.1 in June, whereas experts had promised an increase to 49.4. Being already below the neutral 50.0 level of no change, the index … “Pound Soft on Contracting Construction, Carney’s Comments”

Swiss Franc Strong Despite Comments from Zurbruegg

The Swiss franc gained on most major currencies today even after the central bank’s officials continued to signal that extremely loose monetary policy will remain in place in the foreseeable future. SNB Deputy Chairman Fritz Zurbruegg said today that the central bank will stick to its accommodative policy, which is aimed at keeping the franc weak: We are boring and are sticking to our expansionary monetary stance. We … “Swiss Franc Strong Despite Comments from Zurbruegg”

Euro Rallies on ECB Rumors, Later Falls Against Strong US Dollar

The euro today rallied against the US dollar earlier in the session despite the release of mostly week eurozone data following rumors about a rate cut delay by the European Central Bank. The EUR/USD currency pair rose to its daily highs in the early European session before falling as the US dollar recovered amid a subdued market environment. The EUR/USD currency pair today rallied from an Asian session low of 1.1273 to a high of 1.1321 in the early … “Euro Rallies on ECB Rumors, Later Falls Against Strong US Dollar”

US Dollar Slides on Disappointing Data

The US dollar is losing ground against a basket of currencies on Tuesday after a flurry of data was released and disappointed the market. The one positive this week has been the rise in housing prices, which have been running on a treadmill for more than a year. With the US-China trade war taking a breather, investors may be finding short-term direction on data instead of geopolitical events. The Institute of Supply Management (ISM)âs manufacturing purchasing … “US Dollar Slides on Disappointing Data”

EUR/USD may fall under ECB President Christine Lagarde

European leaders have been struggling to divvy up the top jobs. IMF Chief Christine Lagarde is emerging as a potential candidate to lead the ECB. Her views are dovish and may push EUR/USD to new lows. European leaders have usually been able to reach compromises – or “euro-fudges” – after long nights in Brussels. This … “EUR/USD may fall under ECB President Christine Lagarde”

NZ Dollar Falls with Business Confidence

The New Zealand dollar was weak across the board today, though managed to trim losses against some of its rivals by now. One of the possible reasons for the currency’s poor performance was the deteriorating business confidence. The New Zealand Institute of Economic Research reported today: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows business confidence fell to its lowest level since March 2009, with a net 31 … “NZ Dollar Falls with Business Confidence”

Aussie Rallies After RBA Cuts Interest Rates

The Reserve Bank of Australia cut interest rates today. Yet the Australian dollar did not react to the news in the expected manner, rising after the event, not falling. The RBA cut its main interest rate by 25 basis points to 1%. Such decision was largely priced in by markets. Furthermore, the central bank signaled that more cuts are possible: The Board will continue to monitor developments in the labour market closely and adjust … “Aussie Rallies After RBA Cuts Interest Rates”